Phillips 66 Partners LP proposed raising tariff rates on its Gray Oak crude oil pipeline, which connects the Permian Basin to the U.S. Gulf Coast, according to a filing on May 19.

The company will increase all committed rates on the roughly 900,000 bbl/d line by 2% per year, the filing with the Federal Energy Regulatory Commission (FERC) said. Uncommitted rates would be assessed separately and would amount to increases of around 2%.

The uncommitted rates will be increased by the FERC index factor, while the committed rates have a contractual inflation adjustment factor.

The rates are set to take effect by July 1.

The Gray Oak pipeline is one of the biggest new pipelines connecting the Permian Basin, the nation's largest oil field, to the U.S. Gulf Coast.

It became fully operational last month after a segment was added in the Eagle Ford shale region, completing the project.

Recommended Reading

NAPE: In Basins Familiar to E&Ps, Lithium Rush Offers Little Gold

2024-02-07 - A quest for sources of lithium comes as the lucrative element is expected to play a part in global efforts to lower emissions, but in many areas the economics are challenging.

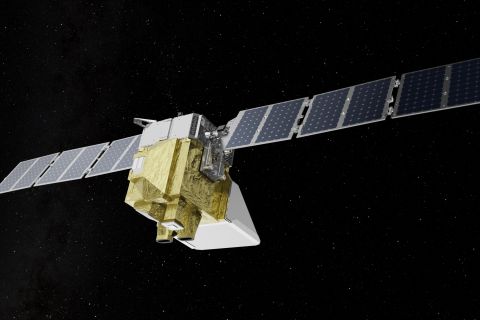

Markman: Is MethaneSAT Watching You? Yes.

2024-04-05 - EDF’s MethaneSAT is the first satellite devoted exclusively to methane and it is targeting the oil and gas space.

APA’s Permian to Pick up Production Slack Amid Overseas Headaches

2024-02-26 - With various overseas headaches, Houston-based APA Corp. aims to boost its Permian Basin volumes and integrate its Callon Petroleum acquisition when it closes in the second quarter.

Global Energy Watch: Corpus Christi Earns Designation as America's Top Energy Port

2024-02-06 - The Port of Corpus Christi began operations in 1926. Strategically located near major Texas oil and gas production, the port is now the U.S.’ largest energy export gateway, with the Permian Basin in particular a key beneficiary.

From Satellites to Regulators, Everyone is Snooping on Oil, Gas

2024-04-10 - From methane taxes to an environmental group’s satellite trained on oil and gas emissions, producers face intense scrutiny, even if the watchers aren’t necessarily interested in solving the problem.