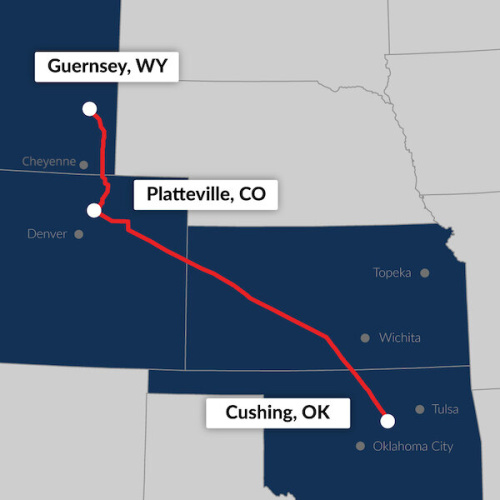

The 24-inch Liberty Pipeline will provide crude oil transportation service from the Rockies and Bakken production areas to Cushing, Okla., with service targeted to commence in first-half 2021. (Source: Phillips 66)

Phillips 66 Partners LP agreed to acquire a 50% stake in the Liberty Pipeline, a $1.6 billion project to transport Rockies and Bakken crude oil production to Oklahoma’s Cushing hub.

According to a Feb. 21 news release from the Houston-based company, Phillips 66 Partners will acquire the interest as part of a roughly $75 million dropdown agreement with Phillips 66 Co. The company said it plans to fund the transaction through a combination of cash on hand and its revolving credit facility.

Greg Garland, CEO of both Phillips 66 and its MLP, described Liberty Pipeline, which is underpinned with long-term volume commitments, as a great addition to the Phillips 66 Partners portfolio.

“It is a strong organic project and continues our strategy of growing [Phillips 66 Partners] with stable fee-based cash flows, supported by long-term volume commitments,” Garland said in a statement. “Phillips 66 Partners is well-positioned to execute this pipeline project on the heels of successfully starting up the Gray Oak Pipeline.”

Service on the 24-inch Liberty Pipeline is targeted to commence in first-half 2021. The cost of the pipeline is expected to be about $800 million net to Phillips 66 Partners. Bridger Pipeline LLC owns the remaining 50% interest in Liberty.

The purchase price for the dropdown reflects the reimbursement of project costs incurred by Phillips 66 prior to the March 1 effective date of the transaction, according to the release.

The transaction is expected to close March 2. The Phillips 66 Partners conflicts committee engaged Evercore to act as its financial adviser and Vinson & Elkins LLP as its legal counsel for the deal.

Recommended Reading

Waha NatGas Prices Go Negative

2024-03-14 - An Enterprise Partners executive said conditions make for a strong LNG export market at an industry lunch on March 14.

Summit Midstream Launches Double E Pipeline Open Season

2024-04-02 - The Double E pipeline is set to deliver gas to the Waha Hub before the Matterhorn Express pipeline provides sorely needed takeaway capacity, an analyst said.

Pembina Pipeline Enters Ethane-Supply Agreement, Slow Walks LNG Project

2024-02-26 - Canadian midstream company Pembina Pipeline also said it would hold off on new LNG terminal decision in a fourth quarter earnings call.

EQT CEO: Biden's LNG Pause Mirrors Midstream ‘Playbook’ of Delay, Doubt

2024-02-06 - At a Congressional hearing, EQT CEO Toby Rice blasted the Biden administration and said the same tactics used to stifle pipeline construction—by introducing delays and uncertainty—appear to be behind President Joe Biden’s pause on LNG terminal permitting.

Energy Transfer Asks FERC to Weigh in on Williams Gas Project

2024-04-08 - Energy Transfer's filing continues the dispute over Williams’ development of the Louisiana Energy Gateway.