Petroleo Brasileiro SA (Petrobras) redirected a well at its biggest oil discovery after encountering a pressure zone, underscoring the technical challenges facing the producer’s new management team, Bloomberg said Feb. 10.

The “drilling phase” of the well at the offshore Libra field hasn’t been halted because of the procedure, the Rio de Janeiro-based state-run company said in an emailed response to questions Feb. 10. A snag caused the company to halt drilling for more than a week, two people with knowledge of the matter said earlier, asking not to be named because the matter isn’t public. Libra is expected to start commercial output in 2020.

While Petrobras expanded output to a record in December at the so-called presalt region that holds Brazil’s largest deposits, it has also run into drilling disruptions in the past. In 2010, it abandoned the first well it started at Libra, citing mechanical issues. In 2011, it briefly halted production at the Sapinhoa Field in the same region after a pipe ruptured.

The snag shows that the challenges facing CEO Aldemir Bendine extend beyond finance and corruption as he chooses a new management team. The company is deploying the largest fleet of deepwater production vessels in the industry in an effort to boost output and pay down debt. All that as oil trades near six-year lows after an almost 50% drop.

The company will be more autonomous under new management and it has the world’s best technical staff, Bendine said in an interview broadcast on TV Globo.

Petrobras shares fell 3.9% to 8.92 reais in Sao Paulo, the lowest since Feb. 2. They’re 39% down from a year ago.

Bendine started the job Feb. 6 after former CEO Maria das Gracas Foster and five of her executive managers quit amid difficulties reporting graft-related writedowns.

Petrobras took a 40% stake in a 35-year concession for Libra, the largest discovery in Brazil’s history, in a government auction in October 2013. It was the first auction of subsea prospects, known as presalt, using a production-sharing model. Petrobras drilled the first well in 2010 on behalf of oil regulator ANP as part of a project to gather data on the region before offering the areas.

Total SA (NYSE: TOT) and Royal Dutch Shell Plc (NYSE: RDS-A, RDS-B) each hold a 20% stake of the concession while China National Petroleum Corp. and Beijing-based CNOOC Ltd. have 10% apiece.

Libra is estimated by Brazil to hold as much as 12 billion barrels of recoverable crude, or 50% more than the proven reserves of OPEC member Ecuador. Schahin Petroleo & Gas SA, the owner of the Cerrado drillship Petrobras hired last year to drill two wells at Libra, said in an email it can’t comment on the project because of confidentiality clauses.

Recommended Reading

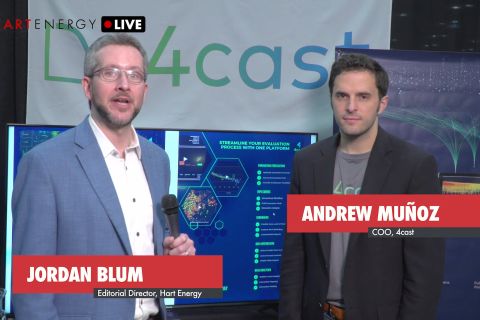

Exclusive: As AI Evolves, Energy Evolving With It

2024-02-22 - In this Hart Energy LIVE Exclusive interview, Hart Energy's Jordan Blum asks 4cast's COO Andrew Muñoz about how AI is changing the energy industry—especially in the oilfield.

Exclusive: Tenaris’ Zanotti: Pipes are a ‘Matter of National Security’

2024-04-12 - COVID-19 showed the world that long supply chains are not reliable, and that if oil is a matter of U.S. national security, then in turn, so is pipe, said Luca Zanotti, U.S. president for steel pipe manufacturer Tenaris at CERAWeek by S&P Global.

Chesapeake, Awaiting FTC's OK, Plots Southwestern Integration

2024-04-01 - While the Federal Trade Commission reviews Chesapeake Energy's $7.4 billion deal for Southwestern Energy, the two companies are already aligning organizational design, work practices and processes and data infrastructure while waiting for federal approvals, COO Josh Viets told Hart Energy.

Exclusive: Chevron New Energies' Bayou Bend Strengthens CCUS Growth

2024-02-21 - In this Hart Energy LIVE Exclusive interview, Chris Powers, Chevron New Energies' vice president of CCUS, gives an overview of the company's CCS/CCUS activity and talks about the potential and challenges of it onshore-offshore Bayou Bend project.

Exclusive: Sabine CEO says 'Anything's Possible' on Haynesville M&A

2024-04-09 - Sabine Oil & Gas CEO Carl Isaac said it will be interesting to see what transpires with Chevron’s 72,000-net-acre Haynesville property that the company may sell.