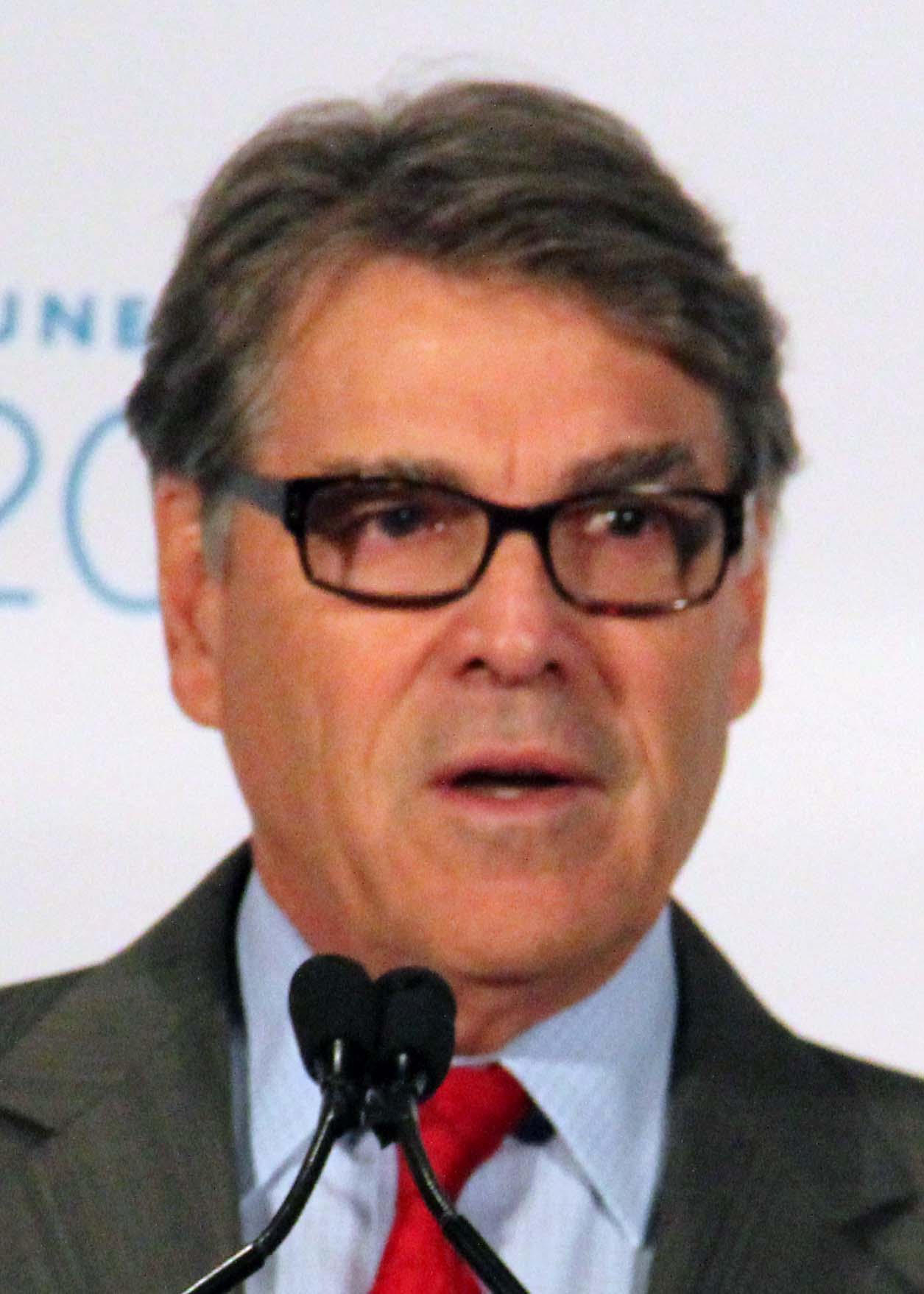

VIENNA—The oil market is resilient and will react positively to the attack on Saudi Arabia’s oil industry, U.S. Energy Secretary Rick Perry said on Sept 16, blaming the attack firmly on Iran.

An attack on Saudi Arabia that shut 5% of global crude output caused the biggest surge in oil prices since 1991, after U.S. officials blamed Iran and President Donald Trump said Washington was “locked and loaded” to retaliate.

“Despite Iran’s malign efforts we are very confident that the market is resilient and will respond positively,” Perry said in a speech to the International Atomic Energy Agency’s General Conference, an annual meeting of its member states.

He repeated his government’s position that it is prepared to tap its Strategic Petroleum Reserve, which holds about a month’s worth of U.S. oil consumption, but he did say how likely it was to do so.

“President (Donald) Trump has authorized the release of oil from the Strategic Petroleum Reserve if that is needed. And my department stands ready to respond,” he said.

“The United States wholeheartedly condemns Iran’s attack on Saudi Arabia and we call on other nations to do the same. This behavior is unacceptable. It’s unacceptable and they must be held responsible. Make no mistake about it. This was an attack on the global economy and the global energy market.”