Editor's note: This article was updated at 4:21 a.m. CDT on Sept. 16.

Oil prices surged on Sept 16, with Brent crude posting its biggest intra-day percentage gain since the start of the Gulf War in 1991, after an attack on Saudi Arabian oil facilities on Saturday shut in the equivalent of 5% of global supply.

Benchmark Brent crude futures rose by as much as 19.5% to $71.95 per barrel, the biggest intra-day jump since Jan. 14, 1991. The front-month contract was at $66.20 per barrel, up $5.98, or 9.9%, from their previous close, at by 0343 GMT.

U.S. West Texas Intermediate (WTI) futures climbed by as much as 15.5% to $63.34 a barrel, the biggest intra-day percentage gain since June 22, 1998. The front-month contract was at $59.73 a barrel, up $4.88, or 8.9%, at 0343 GMT.

RELATED:

- Global Spare Oil Capacity In US Hands After Saudi Outage

- Saudi Attacks Raise Spectre Of Oil At $100/bbl

Saudi Arabia is the world's biggest oil exporter and the attack on the state-owned producer Saudi Aramco's processing facilities at Abqaiq and Khurais has cut output by 5.7 million barrels per day. The company has not given a timeline for the resumption of full output.

"Abqaiq and Khurais are main processing centers for Saudi Arabia's Arab Extra Light and Arab Light crude oil,” said Wood Mackenzie research director Vima Jayabalan, in a released statement. "The impact and the next course of action will depend on the duration of the outage. Saudi Arabia has enough reserves to cover the shortfall over the next week, but if the outage extends, then filling the gap with the right type of crude quality could be a challenge. Moreover, OPEC+ output cut predominantly consists of medium and heavy sour crudes.

A source close to the matter told Reuters the return to full oil capacity could take "weeks, not days."

Saudi Arabia's oil exports will continue as normal this week as the kingdom taps into stocks from its large storage facilities, an industry source briefed on the developments told Reuters on Sunday.

"How the United States and Saudi Arabia deal with the situation will be closely watched," said Margaret Yang, market analyst at CMC Markets in Singapore.

"If higher oil prices are here to stay, Asia's oil reliant economies such as China, Japan, India, South Korea and the Philippines will start to feel the pain as higher energy and raw material prices add on the cost burden," Yang added.

President Donald Trump said he approved the release of oil from the U.S. Strategic Petroleum Reserve (SPR) if needed in a quantity to be determined due to the attack.

The attack on plants in the heartland of Saudi Arabia's oil industry, including the world's biggest petroleum-processing facility at Abqaiq, came from the direction of Iran, and cruise missiles may have been used, according to a senior U.S. official. Initial reports indicated the attack came from Yemen.

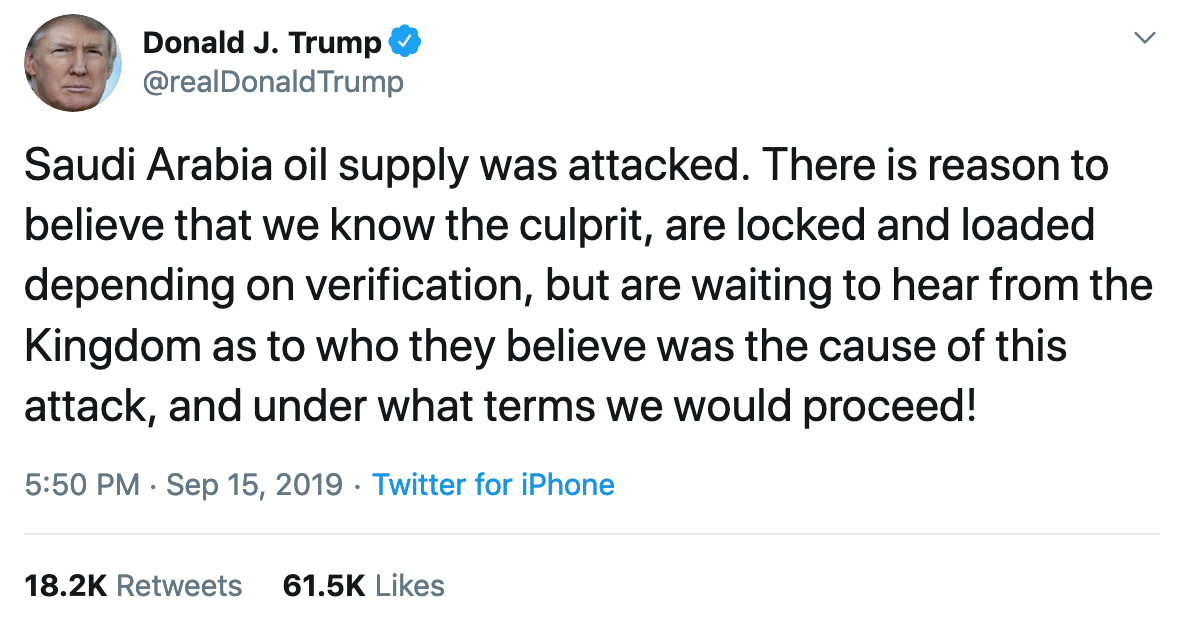

Trump also said the United States was "locked and loaded" for a potential response to the attack on Saudi Arabia's oil facilities.

Risk Premium

ANZ Research said in a note that the market would price in "a sizable global geopolitical risk premium.”

"Any expectation that the market had about the U.S. easing sanctions on Iran following President Trump's dismissal of John Bolton will quickly dissipate. This should see Brent crude test the $70 per barrel mark in the short term," ANZ Research said.

Saudi Arabia is set to become a significant buyer of refined products after the attacks, consultancy Energy Aspects said in a note.

Saudi Aramco will likely buy significant quantities of gasoline, diesel and possibly fuel oil while cutting liquefied petroleum gas exports.

U.S. gasoline futures rose as much 12.9%, while U.S. heating oil futures rose by as much as 10.8%. China's Shanghai crude oil futures rose to its trading limit, gaining 8% at the open.

Meanwhile, Saudi Aramco has told one Indian refinery there will be no immediate impact on oil supplies as it will deliver crude from other sources and has adequate inventory, a source with the refinery said.

Other Asian buyers such as Thailand have also said the attack would have no immediate impact on oil imports.

"China, South Korea, Japan and India are the biggest takers in Asia, with China and Japan leading the pack at an average of 900 – 1,100 kilo barrels per day each. India could be most exposed as its reserves are the least. China has SPR (Strategic Petroleum Reserve) and commercial crude storage, while Korea and Japan have IEA reserves to fall back on," WoodMac's Jayabalan said.

"Collectively, Asian demand for Saudi Arabian crude is around 5 million barrels per day; accounting for almost 72% of Saudi Arabia's crude exports. Asian consumption of Arab Extra Light and Arab Light grades alone from the affected facilities varies between 2.5 and 2.7 million barrels per day seasonally. The region's dependence has increased significantly over the last 1.5 years.

Stocks Affected

Dollar-denominated bonds issued by Saudi Arabia's government and state-oil firm Saudi Aramco tumbled to multi-week lows on Monday following a weekend attack on Saudi Arabia's oil facilities that shut about 5% of global supply.

Saudi Aramco's longer-dated bonds bore the brunt of the falls with the 2049 issue dropping nearly 3 cents in the dollar to touch their lowest since early August, data from Tradeweb showed.

The government sovereign bonds also came under pressure, with longer-dated issues falling between 1-2 cents.

"Markets had become too sanguine over the last few months about the geopolitical risks facing countries allied with the US against Iran, with Saudi Arabia particularly vulnerable," said Patrick Wacker at UOB Asset Management.

"While Saudi Arabia’s sovereign fundamentals are still firm, bond prices will need to factor in higher geopolitical risk going forward."

On Monday, Saudi stocks gained 0.5%, with analysts pointing to support from state institutions as well as higher oil prices supporting firms. Yet the gains only partly mitigated a 1% drop on Sunday, with the index down 0.4% since the start of the year.

Blue chip Saudi Basic Industries Corp (SABIC) gained 0.6% after tumbling nearly 3% on Sunday when the company said it had curtailed feedback supplies by about 49% following the attacks.

"The critical issues for Saudi Arabia and the global oil market are the extent of the damage and the time required to restore Aramco's oil and gas supply," said Monica Malik, chief economist at Abu Dhabi Commercial Bank, adding the short-term impact could be partly mitigated by the kingdom drawing down strategic oil reserves.

"We estimate that Saudi Arabia's fiscal deficit could widen by some 0.9-1.0% of GDP under the scenario mentioned above, though oil revenue would see some support from the higher oil price as production and exports gradually normalize.”

European shares fell on Monday after four straight sessions of gains as attacks on crude facilities in Saudi Arabia and weak Chinese data added to worries over global growth while boosting shares in unaffected oil producers.

The drone attacks on the weekend, which cut more than 5% of the global oil supply, sent crude prices soaring as much as 19% and pushed the oil & gas index 2.4% higher, driving roughly 3% gains for majors BP and Shell.

UK and Irish-based explorer Tullow Oil jumped 7%, to the top of Europe's STOXX 600, after the firm said it plans to drill three or more exploration wells in Guyana next year following its second oil discovery in the country.

Recommended Reading

TPH: Lower 48 to Shed Rigs Through 3Q Before Gas Plays Rebound

2024-03-13 - TPH&Co. analysis shows the Permian Basin will lose rigs near term, but as activity in gassy plays ticks up later this year, the Permian may be headed towards muted activity into 2025.

Comstock Continues Wildcatting, Drops Two Legacy Haynesville Rigs

2024-02-15 - The operator is dropping two of five rigs in its legacy East Texas and northwestern Louisiana play and continuing two north of Houston.

For Sale, Again: Oily Northern Midland’s HighPeak Energy

2024-03-08 - The E&P is looking to hitch a ride on heated, renewed Permian Basin M&A.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

Gibson, SOGDC to Develop Oil, Gas Facilities at Industrial Park in Malaysia

2024-02-14 - Sabah Oil & Gas Development Corp. says its collaboration with Gibson Shipbrokers will unlock energy availability for domestic and international markets.