Noble Midstream Partners LP (NYSE: NBLX) March 25 announced it has secured a $200 million equity commitment (preferred equity) from Global Infrastructure Partners Capital Solutions Fund (GIP) to fund capital contributions to Dos Rios Crude Intermediate LLC, a newly-formed subsidiary holding Noble Midstream’s 30% equity interest in the EPIC Crude Pipeline.

Of the $200 million total commitment, $100 million will be funded during first-quarter 2019, with the remaining $100 million available for a one-year period, subject to certain conditions precedent. The preferred equity is perpetual and has a 6.5% annual dividend rate, payable quarterly in cash, with the ability to defer payment during the first two years following the closing. In addition, Noble Midstream can redeem the preferred equity in whole or in part at any time for cash at a predetermined redemption price. GIP can request redemption of the preferred equity following the later of the sixth anniversary of the preferred equity closing or the fifth anniversary of the EPIC Crude Pipeline completion date at a pre-determined base return.

Proceeds from the preferred equity will be used to repay a portion of outstanding borrowings under the partnership’s revolving credit facility, which were drawn to fund the partnership’s exercise of its option to invest in the EPIC Crude Pipeline.

Commenting on the announcement, John Bookout, CFO, said, “We look forward to having GIP as our partner given their extensive energy investing track record and believe this transaction is a further endorsement of our investment in the EPIC Crude Pipeline. This preferred equity provides an attractive funding source for the partnership, allowing us to maintain a prudent balance sheet without issuing common equity as the EPIC Crude Pipeline progresses. We are excited to capitalize on the growing demand for crude oil takeaway and export capability from the Permian Basin and look forward to adding a high-quality source of cash flow to our portfolio. The EPIC Crude Pipeline, together with our other recently announced joint ventures, is a crucial piece in building a leading Permian Basin midstream platform and delivering long-term value for our unitholders.”

The 30-inch EPIC Crude Pipeline is being designed with an initial capacity of 590,000 barrels per day (bbl/d) from the Permian Basin and Eagle Ford to the Gulf Coast. With the installation of additional pumps and storage, EPIC can increase the 30-inch capacity to approximately 900,000 bbl/d. Interim service remains on track for startup in third-quarter 2019 and permanent service is anticipated in January 2020.

Barclays Capital Inc. acted as financial advisor and Vinson & Elkins L.L.P. served as legal counsel to Noble Midstream. Bracewell LLP represented GIP.

Recommended Reading

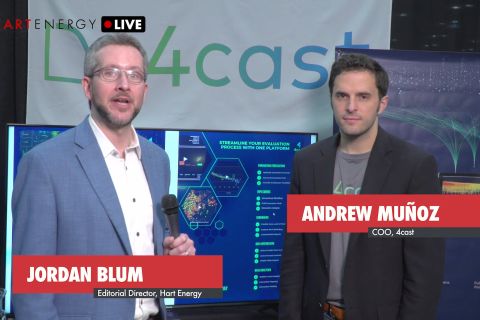

Exclusive: As AI Evolves, Energy Evolving With It

2024-02-22 - In this Hart Energy LIVE Exclusive interview, Hart Energy's Jordan Blum asks 4cast's COO Andrew Muñoz about how AI is changing the energy industry—especially in the oilfield.

Exclusive: Tenaris’ Zanotti: Pipes are a ‘Matter of National Security’

2024-04-12 - COVID-19 showed the world that long supply chains are not reliable, and that if oil is a matter of U.S. national security, then in turn, so is pipe, said Luca Zanotti, U.S. president for steel pipe manufacturer Tenaris at CERAWeek by S&P Global.

Chesapeake, Awaiting FTC's OK, Plots Southwestern Integration

2024-04-01 - While the Federal Trade Commission reviews Chesapeake Energy's $7.4 billion deal for Southwestern Energy, the two companies are already aligning organizational design, work practices and processes and data infrastructure while waiting for federal approvals, COO Josh Viets told Hart Energy.

Exclusive: Chevron New Energies' Bayou Bend Strengthens CCUS Growth

2024-02-21 - In this Hart Energy LIVE Exclusive interview, Chris Powers, Chevron New Energies' vice president of CCUS, gives an overview of the company's CCS/CCUS activity and talks about the potential and challenges of it onshore-offshore Bayou Bend project.

Exclusive: Sabine CEO says 'Anything's Possible' on Haynesville M&A

2024-04-09 - Sabine Oil & Gas CEO Carl Isaac said it will be interesting to see what transpires with Chevron’s 72,000-net-acre Haynesville property that the company may sell.