Matador Resources Co. (NYSE: MTDR) revealed itself on Sept. 12 as the mystery top bidder of Permian acreage in the recent federal oil and gas lease sale in New Mexico that shattered old bidding records.

During the Bureau of Land Management (BLM) auction held Sept. 5-6, Matador said it successfully acquired 8,400 gross/net acres for about $387 million, or a weighted average cost of roughly $46,000 per net acre, in Lea and Eddy counties, N.M. Federal Abstract Co., a Santa Fe, N.M.-based company which offers a service to allow buyers to remain anonymous, made the purchases for Matador.

Matador noted the acquired leases provide an 87.5% net revenue interest (NRI) as compared to about 75% NRI on most fee leases today. As a result, the company will retain an additional 17% of the net production from each well drilled and completed on these properties.

Analysts with Capital One Securities said the favorable lease terms make the eye-catching average price Matador paid per acre more palatable.

“Matador has been upfront with its willingness to acquire additional Delaware acreage, but we're surprised to see Matador [a.k.a. Federal Abstract Co. per the BLM bidding] spend up to $95,000 per acre given its historical low entry cost in the Delaware Basin,” Capital One analysts said in a Sept. 13 research note adding that Matador’s 2017 average cost per acre was around $7,500.

“Nevertheless, attractive BLM terms of 10-year lease with a 12.5% royalty on undeveloped acreage help ease the initial sticker shock of the average price of about $46,000 per acre for properties in a solid neighborhood,” the analysts continued.

Joseph Wm. Foran, Matador’s chairman and CEO, said that each tract the company acquired was evaluated based on several characteristics including rock quality and reserves potential that resulted in the company’s ability to acquire each tract for less than the full valuation.

“Over the past several years, Matador has followed a strategy of primarily building its Delaware Basin land position on a ‘brick by brick’ basis, but we have always believed it is also important to capture unique value-creating opportunities on a select basis, like the recent BLM lease sale ... We will, of course, continue our ‘brick by brick’ strategy, which has worked well for us—and is continuing to work well for us—but we will also strive to be prepared in the future for special opportunities such as this one,” Foran said in a statement.

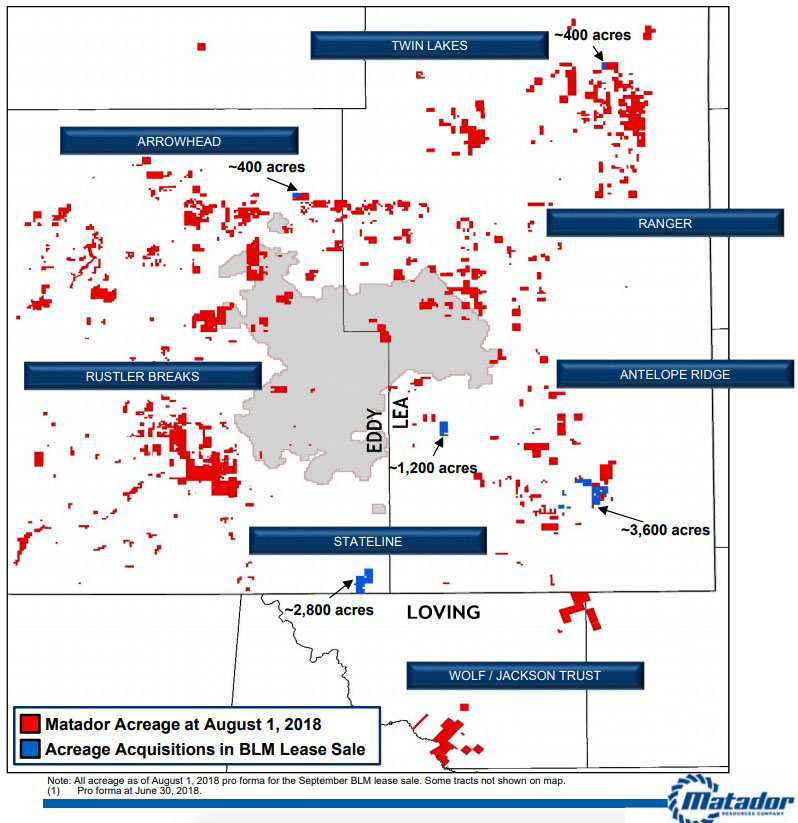

Matador expects the acquired federal leases to blend well with its existing properties, expanding and bolting on acreage in the Antelope Ridge asset area in Lea and establishing a foothold in the prolific Stateline area in Eddy. The acquired acreage includes about 2,800 gross/net acres in the Stateline area, 4,800 gross/net acres in the Antelope Ridge asset area, 400 gross/net acres in the Arrowhead asset area and 400 gross/net acres in the Twin Lakes asset area.

Along the Stateline area in Eddy, Matador paid an average $78,900 per acre for a total of $248 million. The company also purchased a parcel in the northern part of the county for more reserved $3,616 per acre. In Lea, the company was generally more reserved, with one parcel purchased at $87,500 per acre and the rest about $47,600 or less. Overall, Matador's acreage in Lea averaged $20,944 for about 6,590 acres.

As a result of the acreage acquired in the BLM lease sale, Matador’s leasehold and mineral position in the Delaware Basin will total 217,400 gross (123,800 net) acres, pro forma at Aug. 1.

Although all of the acquired acreage is undeveloped, Matador said most of the acreage is also prospective for multiple geologic targets and believed to be conducive to drilling longer laterals of up to two miles or more.

Matador estimates these properties should immediately add an incremental 16.3 million barrels of oil equivalent, or 10%, in proved undeveloped reserves with a PV-10 value of about $135 million to its total proved reserves base.

Matador plans to finance the acreage acquired during the BLM lease sale using cash on hand and borrowings under its undrawn $725 million credit facility. The company said it also could fund the purchase with proceeds from the sale of its Haynesville or Eagle Ford properties.

Foran said Matador has waited and managed its balance sheet carefully over time for this “special opportunity” and, as a result, the company’s financial position and liquidity remain strong.

“Additionally, we see further opportunities for Matador to unlock additional value across this quality acreage position, including midstream opportunities and the ability to add to our growing minerals and leasehold positions,” he said.

Recommended Reading

President: Financial Debt for Mexico's Pemex Totaled $106.8B End of 2023

2024-02-21 - President Andres Manuel Lopez Obrador revealed the debt data in a chart from a presentation on Pemex at a government press conference.

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.

M4E Lithium Closes Funding for Brazilian Lithium Exploration

2024-03-15 - M4E’s financing package includes an equity investment, a royalty purchase and an option for a strategic offtake agreement.

Laredo Oil Subsidiary, Erehwon Enter Into Drilling Agreement with Texakoma

2024-03-14 - The agreement with Lustre Oil and Erehwon Oil & Gas would allow Texakoma to participate in the development of 7,375 net acres of mineral rights in Valley County, Montana.