The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

XTO Energy Inc. retained EnergyNet Indigo for the sale of a South Texas Eagle Ford and Austin Chalk asset through a sealed-bid offering closing May 28.

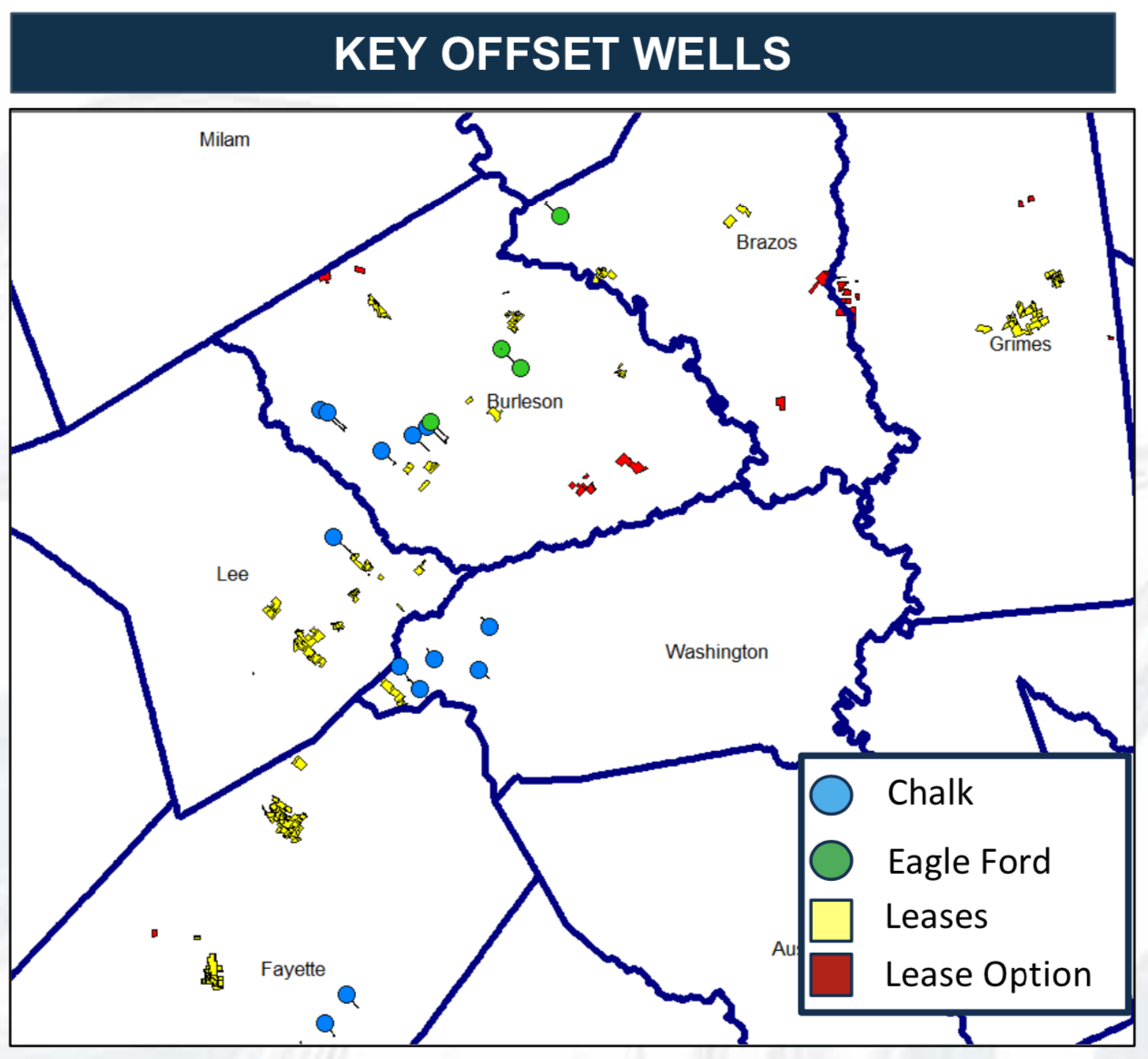

The package comprises 87 wells in Brazos, Burleson, Fayette, Grimes, Lee and Washington counties, Texas, and includes operations, nonoperated working interest, royalty interest and overriding royalty interest (ORRI) plus leasehold and option-to-lease mineral rights.

EnergyNet Indigo is exclusive transaction and technical adviser to XTO Energy, an affiliate of Exxon Mobil Corp., for the sale.

Highlights:

South Texas Eagle Ford / Austin Chalk Opportunity

87-Well Package (Operations, Nonoperated Working Interest, Royalty Interest and ORRI) plus Leasehold and Option-To-Lease Mineral Rights

- Brazos, Burleson, Fayette, Grimes, Lee and Washington Counties, Texas

- XTO Energy Inc.

- 21,513.98 Gross (10,491.28 Net) Leasehold Acres

- Additional Option to Lease Mineral Rights

Operations in Nine Producing Wells:

- 100.00% to 17.453863% Working Interest / 80.00% to 12.9804% Net Revenue Interest

- An Additional ORRI in Three Wells

- An Additional Royalty Interest in the Laura 1 Well

Nonoperated Working Interest in 47 Wells:

- 50.00% to 5.07803% Working Interest / 41.458632% to 4.094164% Net Revenue Interest (After Payout)

- An Additional ORRI in Six Wells

- 37 Producing Wells | Three Non-Producing Wells

- Four Wells First-quarter IP | Three AFE Proposals

- Select Operators include Chesapeake Operating LLC. Hawkwood Energy Operating and Magnolia Oil & Gas Operating LLC

ORRI in 31 Wells:

- 17.50% to 0.8681% ORRI

- 29 Producing Wells | Two Non-Producing Wells

- Select Operators include Chesapeake Operating LLC and

- Magnolia Oil & Gas Operating LLC

Trailing 12-Month Average Net Production: about 55 bbl/d of Oil and 360,000 cubic feet per day of Gas

Trailing Proved Developed Producing Annual Cash Flow: about $431,400

- Four First-quarter Wells Pending IP will add Significant Cash Flow

Sealed-bids are due by 4 p.m. CT May 28.

The XTO Energy package is listed on EnergyNet’s new platform, EnergyNet Indigo, which is tailor-made for higher valued assets. The platform features asset deals valued from $20 million to more than $250 million, according to the A&D advisory firm.

For complete due diligence information visit indigo.energynet.com or email Cody Felton, vice president of business development, at Cody.Felton@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

SM Energy Adds Brookman to Board, Promotes Lebeck to Executive VP

2024-02-23 - Barton R. Brookman previously served as President and CEO of PDC Energy and James B. Lebeck served as senior vice president and general counsel since January 2023.

Greenbacker Names New CFO, Adds Heads of Infrastructure, Capital Markets

2024-02-02 - Christopher Smith will serve as Greenbacker’s new CFO, and the power and renewable energy asset manager also added positions to head its infrastructure and capital markets efforts.

Crescent Point Energy to Rebrand as Veren Inc.

2024-03-21 - The company will seek shareholder approval for the change at its upcoming annual and special meeting of shareholders on May 10.

enCore Energy Appoints Robert Willette as Chief Legal Officer

2024-02-01 - enCore Energy’s new chief legal officer Robert Willette has over 29 years of corporate legal experience.

SunPower Appoints Garzolini as Executive VP, Chief Revenue Officer

2024-03-14 - Tony Garzolini will oversee SunPower’s sales, including the direct, dealer and new homes channels, along with pricing and demand generation.