The following information is provided by UBS Securities LLC. All inquiries on the following listings should be directed to UBS. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

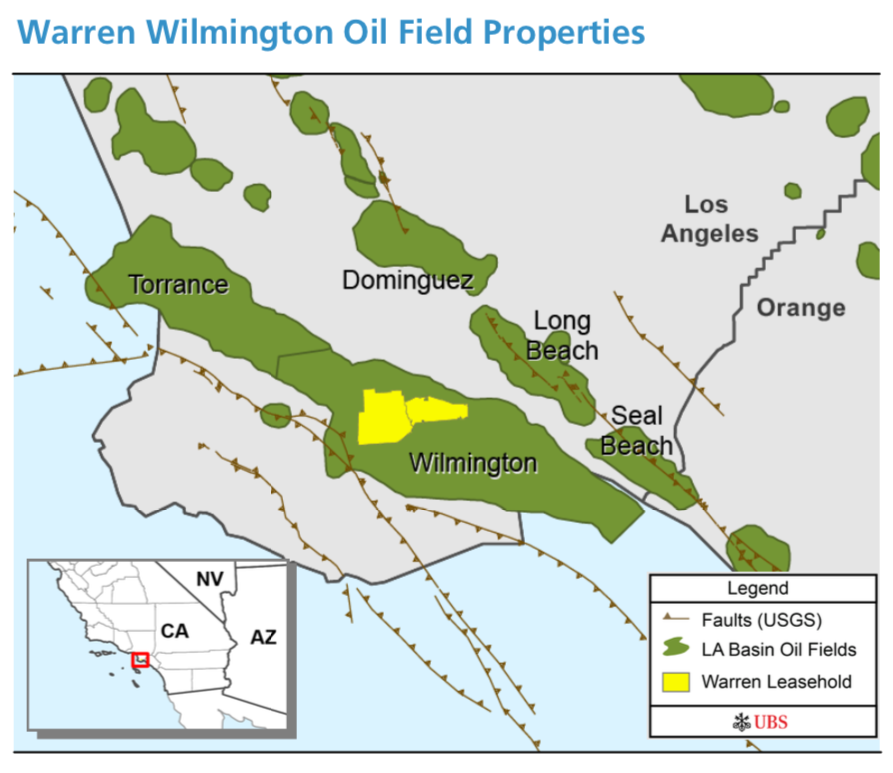

Warren Resources Inc. is offering for sale certain Los Angeles (LA) Basin Wilmington Oil Field assets located in Los Angeles County, Calif.

Warren’s preference is to sell the properties in a single cash transaction, according to UBS Securities LLC, which was retained as the company’s exclusive financial adviser for the transaction.

Bids will be due late August. Online virtual data room and UBS data room presentations are currently available. Contact UBS at Warren@ubs.com for further information.

Highlights:

- Opportunity to acquire a core position in the Wilmington Oil Field, which is the third largest oil field in the U.S.

- About 2,175 barrels of oil equivalent per day (boe/d) net (based on 2019 year-to-date average January-May); near term annual decline of 10%, producing from about 135 horizontal, deviated and vertical wells across more than eight high quality sandstone intervals

- Average 99% Working Interest (about 81% Net Revenue Interest, 18% burden) across 2,850 net acres; 100% HBP and operated

- Steady net cash flow of about $2.5 million /month (based on 2019 year-to-date average January-May)

- Surface land ownership significantly offsets

- Plugging and abandoning liability

- Large inventory of low-risk, high-interval rate of returns production enhancement opportunities (workovers, recompletions, acid stimulations and waterflood conformance) represent proven, easily executable upside program

- Significant new-drill potential across several benches; Warren executed a successful nine-well drilling program in 2018

- Fully developed infrastructure with takeaway optionality to multiple local refineries—direct pipelines to refineries

- State-of-the-art facilities and knowledgeable staff with an average tenure of over 12 years

Recommended Reading

Waha NatGas Prices Go Negative

2024-03-14 - An Enterprise Partners executive said conditions make for a strong LNG export market at an industry lunch on March 14.

Summit Midstream Launches Double E Pipeline Open Season

2024-04-02 - The Double E pipeline is set to deliver gas to the Waha Hub before the Matterhorn Express pipeline provides sorely needed takeaway capacity, an analyst said.

Pembina Pipeline Enters Ethane-Supply Agreement, Slow Walks LNG Project

2024-02-26 - Canadian midstream company Pembina Pipeline also said it would hold off on new LNG terminal decision in a fourth quarter earnings call.

EQT CEO: Biden's LNG Pause Mirrors Midstream ‘Playbook’ of Delay, Doubt

2024-02-06 - At a Congressional hearing, EQT CEO Toby Rice blasted the Biden administration and said the same tactics used to stifle pipeline construction—by introducing delays and uncertainty—appear to be behind President Joe Biden’s pause on LNG terminal permitting.

Energy Transfer Asks FERC to Weigh in on Williams Gas Project

2024-04-08 - Energy Transfer's filing continues the dispute over Williams’ development of the Louisiana Energy Gateway.