The following information is provided by TenOaks Energy Advisors LLC. All inquiries on the following listings should be directed to TenOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

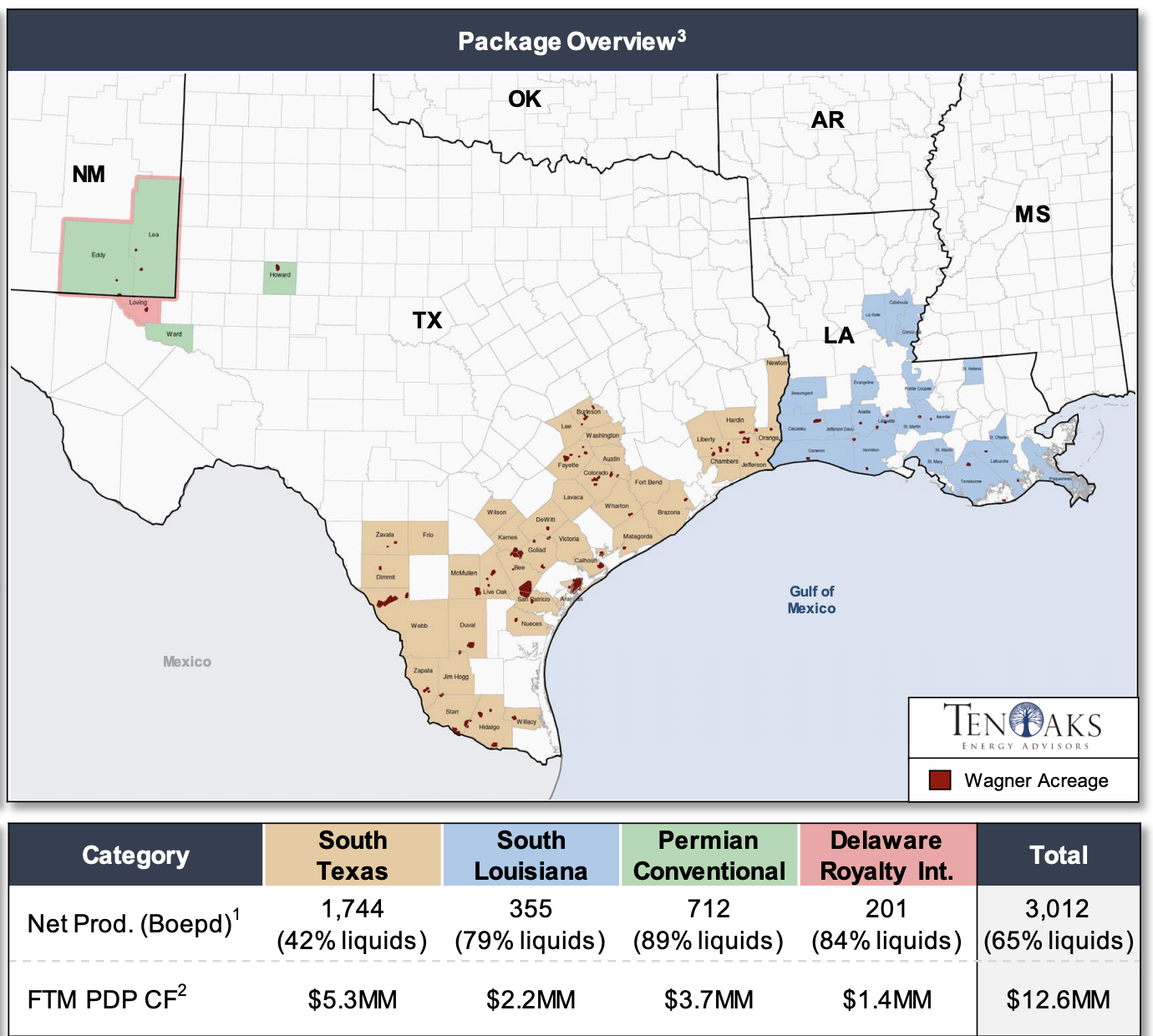

Wagner Oil Co. retained TenOaks Energy Advisors as the exclusive adviser in connection with the sale of certain oil and gas properties across four packages comprising South Texas, South Louisiana, Permian Basin and Delaware Basin royalty interests.

Wagner will entertain offers for the entire asset as well as individual packages. Offers are due Sept. 15.

Highlights:

- Legacy, predominantly conventional asset base with majority operational control

- Net production: 3,012 boe/d (65% liquids)

- FTM PDP cash flow: $12.6 million

- PDP PV-10: $65.9 million

Upside:

- Several low-cost, high-impact recompletion, re-stim, and return-to-production projects

- Vertical and horizontal development opportunities

- Permian waterflood optimization project

- Continued operational enhancements

2) Price Deck: August 4th, 2020 NYMEX Strip Pricing

3) Not all of Wagner’s acreage is display ed on the map

A virtual data room is available. For information visit tenoaksenergyadvisors.com or contact Forrest Salge at TenOaks Energy Advisors at 214-420-2327 or Forrest.Salge@tenoaksadvisors.com.

Recommended Reading

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.