The following information is provided by Eagle River Energy Advisors LLC. All inquiries on the following listings should be directed to Eagle River. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

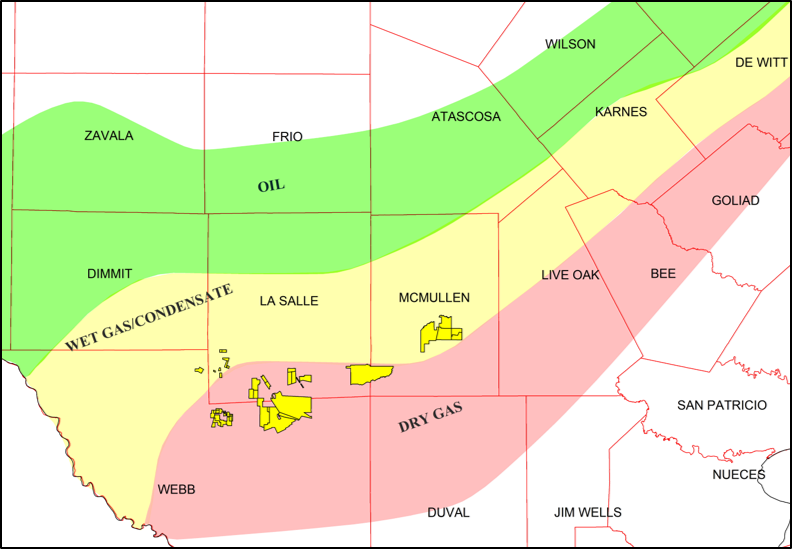

Vitruvian Exploration IV LLC retained Eagle River Energy Advisors LLC to divest certain operated working interest assets and associated lands in the dry gas window of the Eagle Ford Shale of South Texas.

Highlights:

- About 97,850 net acres in the dry gas window of the Eagle Ford Shale of South Texas (McMullen, La Salle and Webb Counties)

- More than 50% with expirations in 2021-plus

- Consolidated leasehold position with 67,000 net acres under only five leases

- Operational autonomy with high Working Interest in undeveloped leasehold & 100% Working Interest in PDP wells

- About 11.9 million cubic feet per day three-month net production (100% Gas)

- $380,000 three-month average lease-level income (October 2019)

- Low basis differentials with proximity to Henry Hub

- Low lifting costs at less than $0.50 per thousand cubic feet equivalent (2019 average)

- Offset operators such as EOG Resources Inc. and Comstock Resources Inc. are pushing the former economic limits of the dry gas window of the Eagle Ford

- Implementation of "higher intensity" frac designs provide an opportunity for value add

- Execution of pressure drawdown management offers potential for increased well productivity, profitability and ultimate recoveries

- Austin Chalk potential is being delineated by Basin-leading, offset operator EOG

- Significant leverage to higher gas prices

Bids are due by 4 p.m. MT March 12. Virtual data room will be available starting Feb. 14. The transaction is expected to have a Feb. 1 effective date.

For information visit eagleriverholdingsllc.com or contact James Barnes, director of Eagle River, at JBarnes@EagleRiverEA.com or 832-680-0112.

Recommended Reading

Stonepeak Joins Shizen to Form Asian Onshore Wind Platform

2024-03-26 - Stonepeak will have an 80% interest in the onshore wind energy platform, with Japan-based Shizen retaining the remaining 20% interest.

Scout Signs Agreement with AdventHealth for Texas Wind Farm

2024-02-01 - Scout Clean Energy will supply a portion of its Heart of Texas wind farm to support 40% of AdventHealth’s electricity needs.

Bunge, Chevron Announce FID on Oilseed Processing Plant

2024-03-05 - Bunge Chevron Ag Renewables' facility will be used to manufacture low carbon renewable fuels from oilseed.

Avangrid Begins Construction on its First California Solar Farm

2024-04-10 - Avangrid’s Camino Solar project will generate 57 megawatts of power, the equivalent of the power needs of about 14,000 U.S. homes.

EE North America, Montauk Sign Biogenic CO2 Delivery Deal

2024-02-14 - EE North America and Montauk Renewables signed a contract for the delivery of 140,000 tons per year of biogenic CO2, which will be turned into e-methanol.