The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Vanguard Natural Resources Inc. retained EnergyNet for the sale of Oklahoma oil and gas assets across several counties through a sealed-bid offering.

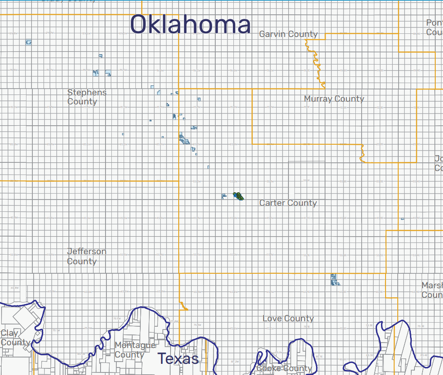

The offer includes operated and nonoperated interests in multiple wells plus royalty and overriding royalty interests in Carter, Johnson, Love, Marshall and Stephens counties, Okla. Select operators of the nonoperated properties include Cimarex Energy Co. and Exxon Mobil Corp. subsidiary, XTO Energy Inc.

Property Highlights:

- Operations in 21 Wells:

- 75.16% to 56.60% Working Interest / 63.96% to 43.61% Net Revenue Interest

- 18 Producing Wells | 3 Non-Producing Wells

- Nonoperated Working Interest in 37 Properties (Multiple Wells):

- 67.69% to 0.39% Working Interest / 59.23% to 0.39% Net Revenue Interest

- 30 Producing Properties | 7 Non-Producing Properties

- Select Operators include Cimarex Energy Co., Citation Oil and Gas Corp. and XTO Energy Inc.

- 12.26% to 0.01% Royalty Interest or Overriding Royalty Interest in 103 Properties (Multiple Wells):

- 79 Producing Properties | 23 Non-Producing Properties | 1 Temporarily Abandoned Well

- Select Operators include Arch Oil and Gas Co., Citation Oil and Gas Corp., Kaiser-Francis Oil Co. and Marathon Oil Co.

- Six-Month Average Net Income: $239,992 per Month

- Six-Month Average 8/8ths Production: 1,745 barrels per day of Oil and 4.743 million cubic feet per day of Gas

- 1,735.494 Net Leasehold Acres

Bids are due at 4 p.m. CST March 19. For complete due diligence information energynet.com or email Heidi Epstein, manager of business development, at Heidi.Epstein@energynet.com, or Denna Arias, director of transaction management, at Denna.Arias@energynet.com.

Recommended Reading

CorEnergy Infrastructure to Reorganize in Pre-packaged Bankruptcy

2024-02-26 - CorEnergy, coming off a January sale of its MoGas and Omega pipeline and gathering systems, filed for bankruptcy protect after reaching an agreement with most of its debtors.

Genesis Energy Declares Quarterly Dividend

2024-04-11 - Genesis Energy declared a quarterly distribution for the quarter ended March 31 for both common and preferred units.

TC Energy Appoints Sean O’Donnell as Executive VP, CFO

2024-04-03 - Prior to joining TC Energy, O’Donnell worked with Quantum Capital Group for 13 years as an operating partner and served on the firm’s investment committee.

HighPeak Energy Authorizes First Share Buyback Since Founding

2024-02-06 - Along with a $75 million share repurchase program, Midland Basin operator HighPeak Energy’s board also increased its quarterly dividend.

M4E Lithium Closes Funding for Brazilian Lithium Exploration

2024-03-15 - M4E’s financing package includes an equity investment, a royalty purchase and an option for a strategic offtake agreement.