The following information is provided by BOK Financial Securities Inc. All inquiries on the following listings should be directed to BOK Financial Securities. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Unit Petroleum Co. is offering for sale producing operated properties and associated water and gathering lines in central Kansas. The company retained BOK Financial Securities as its exclusive adviser in connection with the sale.

Highlights:

- Asset Overview

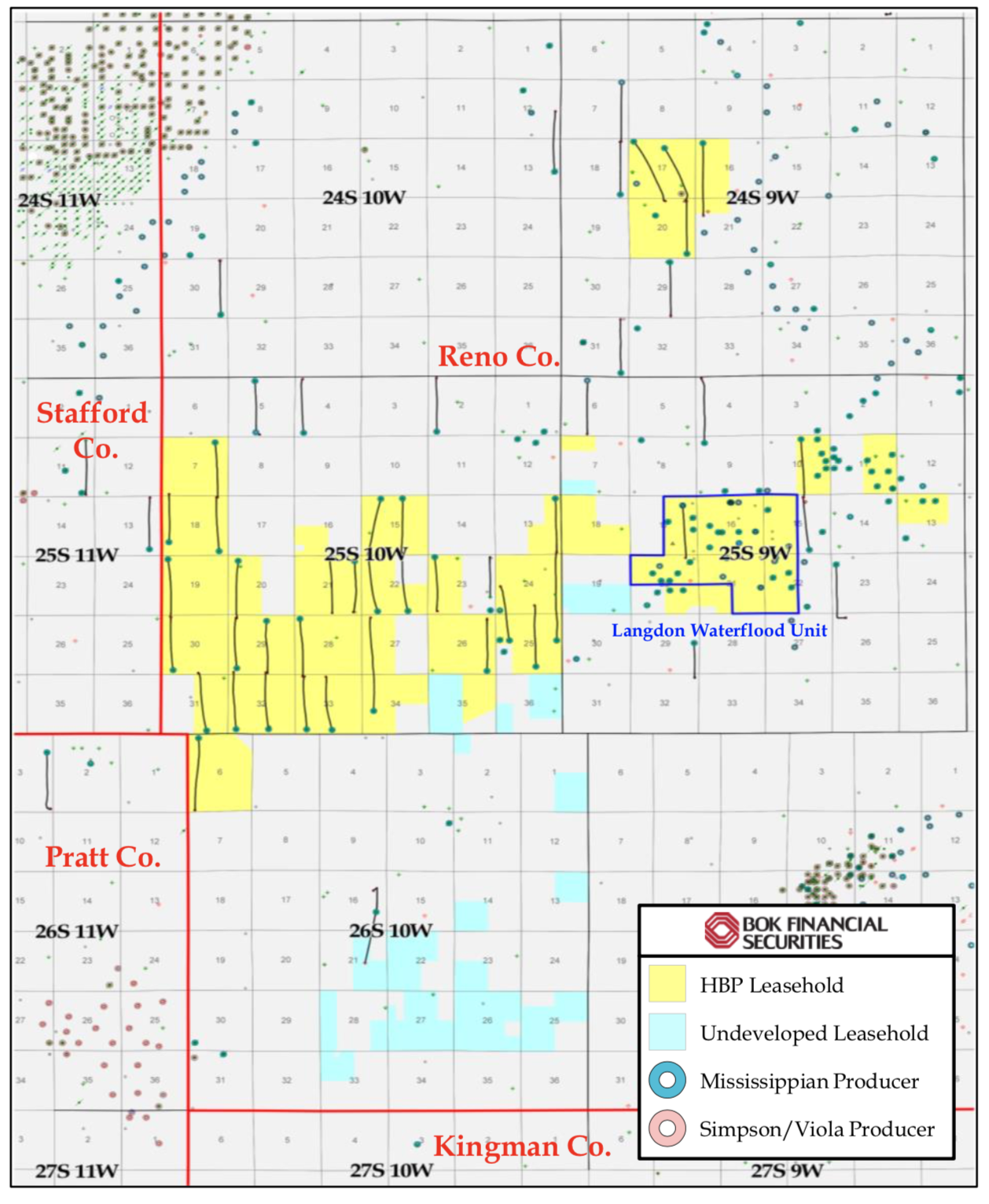

- 21,940 net acres (82% HBP) concentrated in the Sedgwick Basin in western Reno County, Kan.

- 100% Working Interest / 81.5% Net Revenue Interest

- 33 operated producing wells and one nonoperated producing well

- Primary producing targets is Mississippi Chert

- Excess capacity in 100% owned saltwater disposal system and natural gas gathering lines

- 21,940 net acres (82% HBP) concentrated in the Sedgwick Basin in western Reno County, Kan.

- Production & Cash Flow Profile

- Steady production base established by 2013-14 vintage horizontal wells

- December 2020 net production of 222 bbl/d of oil, 904 Mcf/d of gas and 88 bbl/d of NGL

- PDP R/P of 7.1 times

- 6% oil decline (current)

- Trailing three-month average net cash flow of $116,000 per month

- Steady production base established by 2013-14 vintage horizontal wells

- Upside Opportunities

- Langdon Waterflood Unit, unitized in 2017, is currently in fill-up stage (injecting 4,115 bbl/d of water)

- Operational upside from centralized compression and pump changes

- Six 3D supported Mississippian PUD locations

- 86 squares of Proprietary 3D available to license

- Additional exploratory potential in the Lansing-Kansas City, Viola and Simpson formations

Bid are due Feb. 11. The transaction is expected to have a Feb. 1 effective date. A virtual data room is open.

For information, contact Jason Reimbold at jreimbold@bokf.com or Jeff Hawes at jhawes@bokf.com.

Recommended Reading

TC Energy’s Keystone Back Online After Temporary Service Halt

2024-03-10 - As Canada’s pipeline network runs full, producers are anxious for the Trans Mountain Expansion to come online.

TC Energy's Keystone Oil Pipeline Offline Due to Operational Issues, Sources Say

2024-03-07 - TC Energy's Keystone oil pipeline is offline due to operational issues, cutting off a major conduit of Canadian oil to the U.S.

Early Startup of Trans Mountain Pipeline Expansion Surprises Analysts

2024-04-04 - Analysts had expected the Trans Mountain Pipeline expansion to commence operations in June but the company said the system will begin shipping crude on May 1.

Enterprise Gains Deepwater Port License for SPOT Offshore Texas

2024-04-09 - Enterprise Products Partners’ Sea Port Oil Terminal is located approximately 30 nautical miles off Brazoria County, Texas, in 115 ft of water and is capable of loading 2 MMbbl/d of crude oil.

Enbridge Announces $500MM Investment in Gulf Coast Facilities

2024-03-06 - Enbridge’s 2024 budget will go primarily towards crude export and storage, advancing plans that see continued growth in power generated by natural gas.