The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

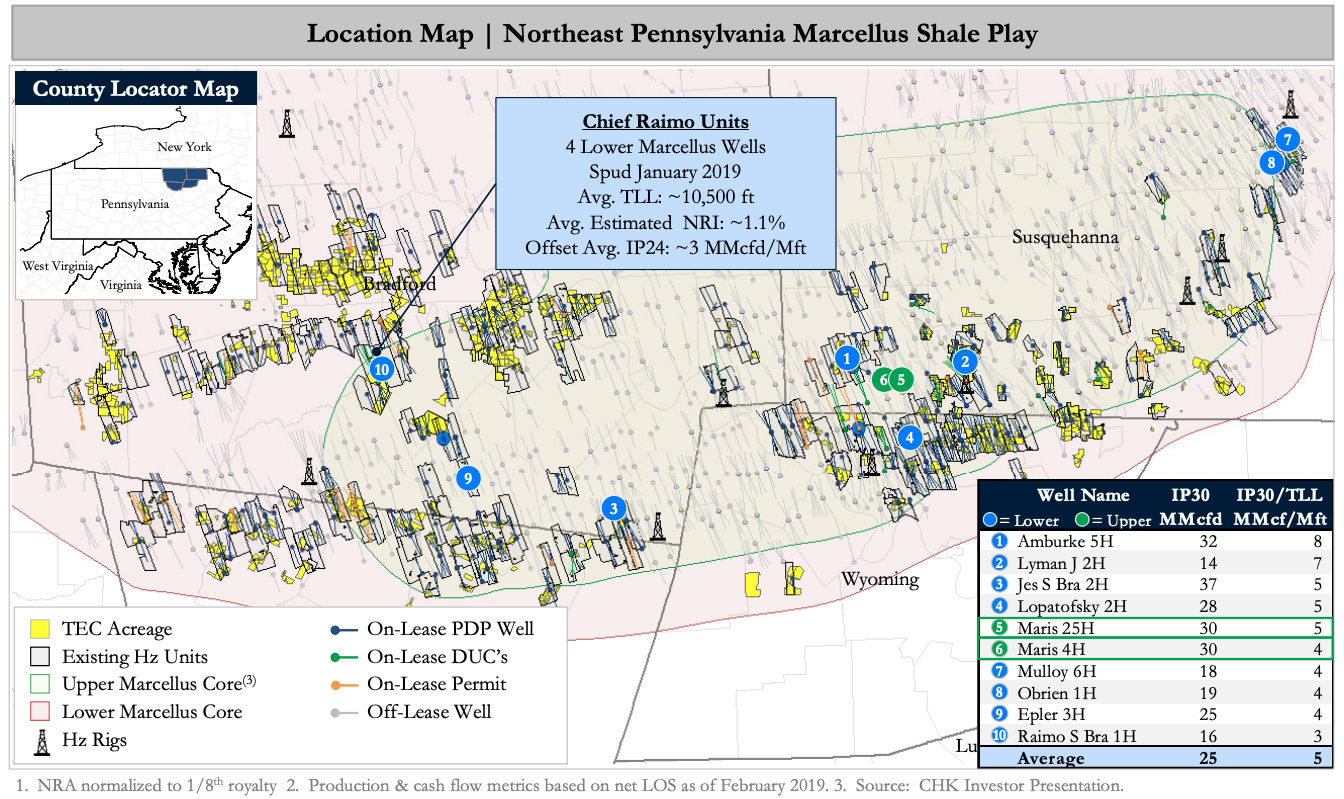

Three Energy Co. LLC retained Detring Energy Advisors for the sale of certain oil and gas royalty interests located within the of the Northeastern Pennsylvania (NEPA) Marcellus Shale play.

The offer comprise a concentrated, core position underneath premier operators generating world-class well results and superior economics, according to Detring.

Highlights:

- 5,589 Net Royalty Acres (100% overriding royalty interest (ORRI) | ~100% HBP)

- ORRI located throughout the core of the prolific NEPA Marcellus

- 100% HBP (About 80% in horizontal units, about 20% outside horizontal units)

- Exposure to premier operators whose NEPA positions represent the premier assets within their respective portfolios

- Top operators include Chief Oil & Gas LLC, Cabot Oil & Gas Corp. and Chesapeake Energy Corp.

- Multi-decade inventory of highly economic locations in the lowest break-even gas play in the Lower 48

- Roughly $500,000 per Month Cash Flow (about 4.7 million cubic feet per day Net Production)

- Substantial current production from roughly 600 horizontal wells generates significant free cash flow

- Strong near term development potential with about 39,000 net acres in existing horizontal drilling units with a gross footprint of roughly 170,000 acres

- Strong current on-lease activity:

- 27 drilled but uncompleted wells (DUCs)

- 47 permits

- Eight rigs within three miles of the assets

- Regional infrastructure build-out yielding vastly improved natural gas price differential

- World-Class Well Results from Two Distinct Benches

- Lower Marcellus highly delineated and de-risked across the entire position with average EURs greater than 4 billion cubic feet (Bcf) per thousand lateral feet

- Majority of the position within the core of the emerging Upper Marcellus play with average EURs greater than 3 Bcf per thousand lateral feet

Process Overview:

- Evaluation materials available via the Virtual Data Room on May 8

- Proposals due June 5

For information visit detring.com or contact Melinda Faust at mel@detring.com or 713-595-1004.

Recommended Reading

Yellen Expects Further Sanctions on Iran, Oil Exports Possible Target

2024-04-16 - U.S. Treasury Secretary Janet Yellen intends to hit Iran with new sanctions in coming days due to its unprecedented attack on Israel.

Watson: Implications of LNG Pause

2024-03-07 - Critical questions remain for LNG on the heels of the Biden administration's pause on LNG export permits to non-Free Trade Agreement countries.

Exclusive: ‘Reality Has Hit,’ NatGas Not Just a Bridge Fuel, Landrieu Says

2024-04-11 - The Biden administration's LNG pause is "disappointing" and natural gas is a "solution to energy woes," co-chairs for Natural Allies for a Clean Energy Future Senator Mary Landrieu and Congressman Kendrick Meek told Hart Energy's Jordan Blum at CERAWeek by S&P Global.

CEO: Linde Not Affected by Latest US Green Subsidies Package Updates

2024-02-07 - Linde CEO Sanjiv Lamba on Feb. 6 said recent updates to U.S. Inflation Reduction Act subsidies for clean energy projects will not affect the company's current projects in the United States.

Global Energy Watch: Corpus Christi Earns Designation as America's Top Energy Port

2024-02-06 - The Port of Corpus Christi began operations in 1926. Strategically located near major Texas oil and gas production, the port is now the U.S.’ largest energy export gateway, with the Permian Basin in particular a key beneficiary.