The following information is provided by PetroDivest Advisors. All inquiries on the following listings should be directed to PetroDivest. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

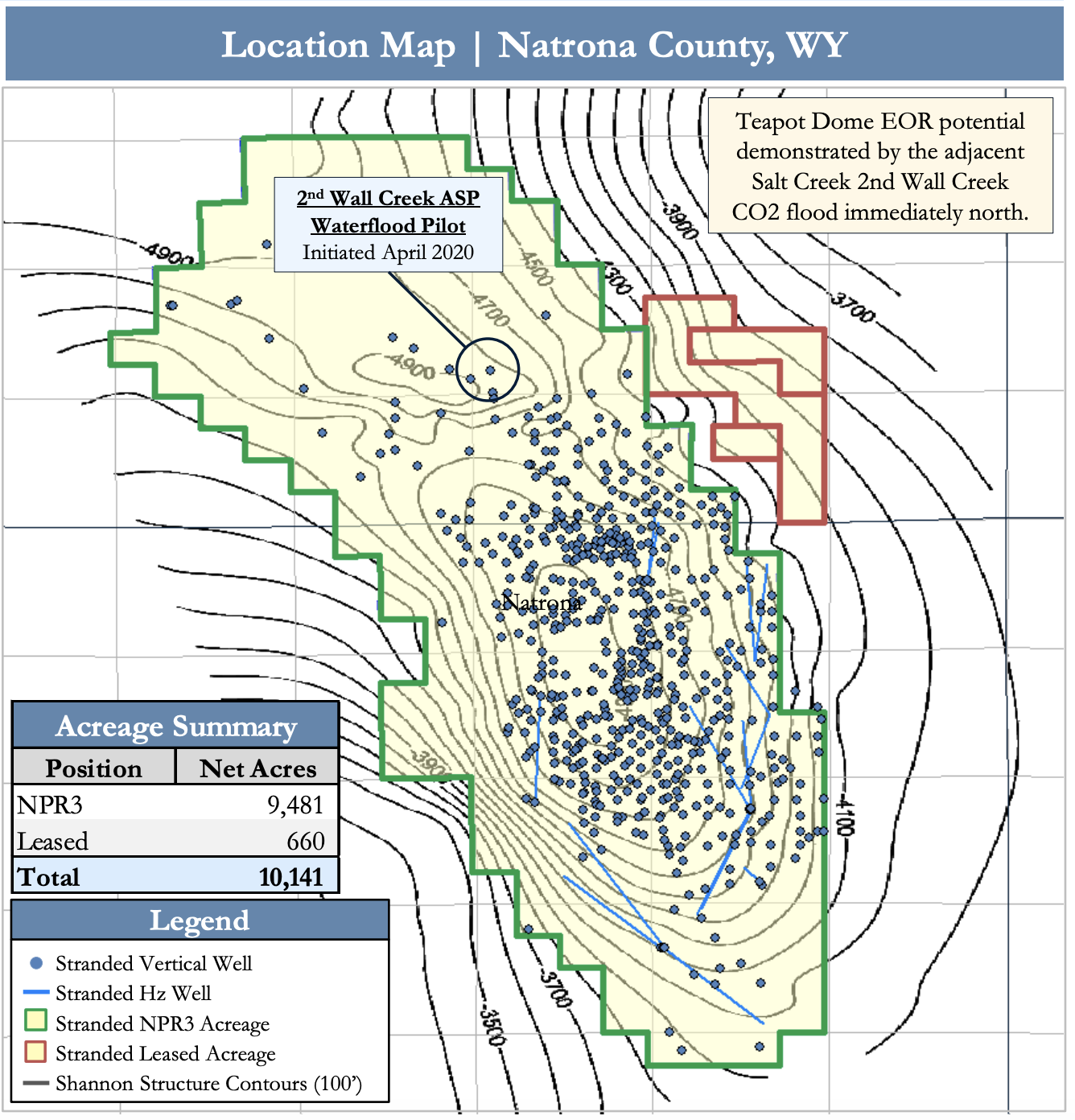

Stranded Oil Resources Corp. retained PetroDivest Advisors to market for sale its oil and gas properties, leasehold and related assets in Wyoming's Natrona County.

The sale, which represents a basin-wide exit, offers an opportunity to acquire a substantial base of fully operated oil production, steeped in historical significance with decades of supporting technical documentation, and an ongoing test of future waterflood potential, according to PetroDivest. The former National Petroleum Reserve 3 (NPR3) includes mineral rights with about 9,000 acres of surface rights available separately, providing freedom for future development.

Highlights:

- 10,141 net acres including mineral rights and about 9,000 acres of surface available through this process

- About 100% HBP and 100% operated

- National Petroleum Reserve 3 acreage is ‘fee simple’ with all mineral rights and 9,000 acres of surface rights available

- No royalty burden, providing superior economics and returns

- Substantial oil production & net cash flow

- 543 vertical & 10 horizontal producing wells (100% Working Interest and about 100% Royalty Interest average)

- Long-life, low-cost assets with near-term operational improvements

- About $20/boe lifting costs

- Net Production: about 340 boe/d (98% oil)

- Net PDP NTM Cash Flow: $1.4 million

- Net PDP Reserves: about 620,000 boe

- Net PDP PV10%: about $6 million

- Ongoing 2nd Wall Creek waterflood pilot

- Pilot waterflood program initiated with results anticipated by year-end

- Nine injection patterns for imminent development following the pilot

- Net PV10%: about $50 million

- Net Reserves: about 4.6 million barrels of oil

- Additional patterns available for future waterflood expansion

- About 27 million barrels of oil produced to date from six horizons

- Tremendous remaining incremental recovery potential

Process Summary:

- Evaluation materials available via the virtual data room on July 15

- Proposals due Aug. 19

For information visit petrodivest.com or contact Jerry Edrington, director of PetroDivest, at jerry@petrodivest.com or 713-595-1017.

Recommended Reading

BP’s Kate Thomson Promoted to CFO, Joins Board

2024-02-05 - Before becoming BP’s interim CFO in September 2023, Kate Thomson served as senior vice president of finance for production and operations.

Magnolia Oil & Gas Hikes Quarterly Cash Dividend by 13%

2024-02-05 - Magnolia’s dividend will rise 13% to $0.13 per share, the company said.

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

HighPeak Energy Authorizes First Share Buyback Since Founding

2024-02-06 - Along with a $75 million share repurchase program, Midland Basin operator HighPeak Energy’s board also increased its quarterly dividend.