The following information is provided by Meagher Energy Advisors. All inquiries on the following listings should be directed to Meagher. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Sheridan Holding Co. I LLC retained Meagher Energy Advisors for the sale of Oklahoma assets in Caddo and Grady counties including an operated waterflood unit and the Chitwood NW Field plus miscellaneous nonops.

Highlights:

- NE Verden Unit (NEVU)

- 7,917 Net Acres

- All leasehold is held by production

- Working Interest: 68.35%; Net Revenue Interest: 58.70%

- Average effective net royalty interest 86%

- Over 100 net mineral acres

- 32 producing wells, 28 shut in or temporarily abandoned, 23 injection and three water source wells, all operated

- Chitwood NW Field

- 1,664 Net Acres

- All leasehold is held by production

- Average Working Interest: 69.02%; Average Net Revenue Interest: 59.50%

- Average effective net royalty interest 86%

- 12 producing wells, 11 operated

- Production And Cash Flow

- Projections for April 2019

- Gross production: 399 barrels per day (bbl/d) of oil, 378,000 cubic feet per day of gas

- Net production: 234 bbl/d of oil and 231,000 cubic feet per day of gas

- Net operating cash flow $259,042

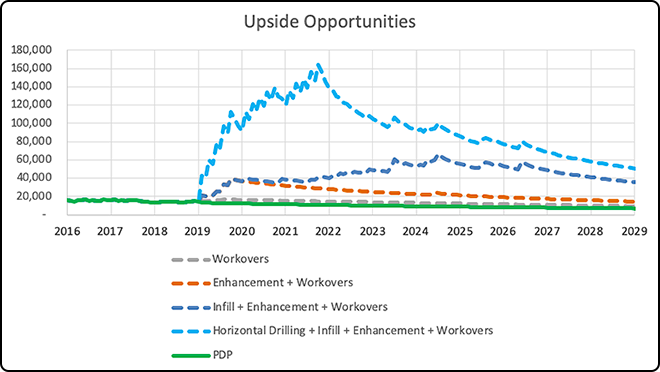

- Upside Potential

- Workovers

- Waterflood enhancement

- Infill development

- Horizontal drilling

Bids are due May 2. For information visit meagheradvisors.com or contact Derec Norman, director of marketing at Meagher, at dnorman@meagheradvisors.com or 918-481-5900 ext. 226.

Recommended Reading

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.