The following information is provided by TenOaks Energy Advisors LLC. All inquiries on the following listings should be directed to TenOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

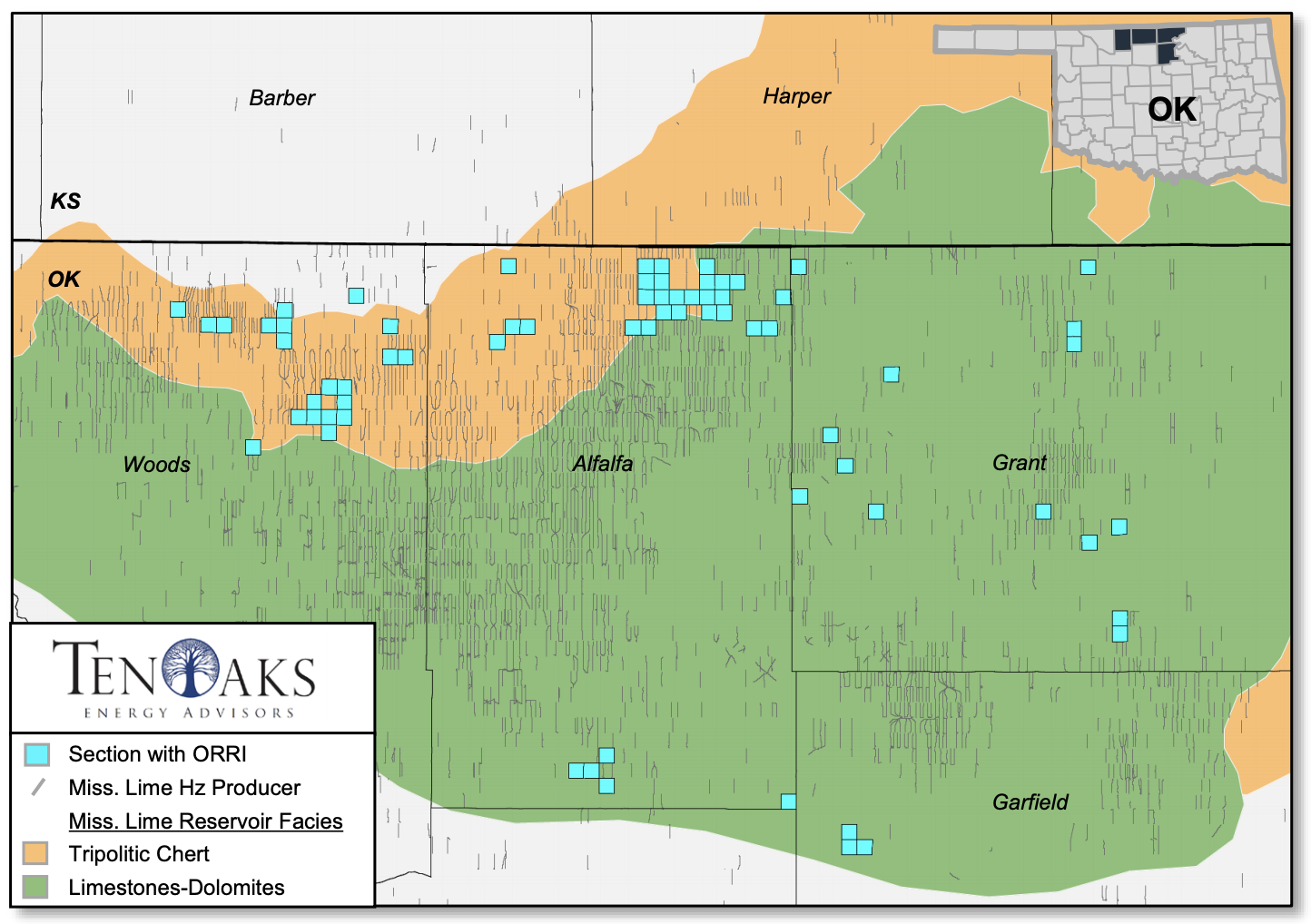

SandRidge Mississippian Trust I (SDT) is divesting all of its royalty interests located in Northern Oklahoma as part of a planned dissolution of the trust. SDT has retained TenOaks Energy Advisors as its exclusive adviser in connection with the transaction.

Highlights:

- ORRI position spanning 69 producing horizontal wells

- Low-decline production profile

- Strong cash flow generation | Next 12-Month cash flow: $2 million

- Diversified commodity base: 62% gas | 38% liquids

- Operators include SandRidge Energy Inc. and Mach Resources LLC

Bids are due by noon CST on Feb. 19. A virtual data room is available. For information visit tenoaksenergyadvisors.com or contact Trey Bonvino at TenOaks Energy Advisors at 214-420-2331 or Trey.Bonvino@tenoaksadvisors.com.