The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

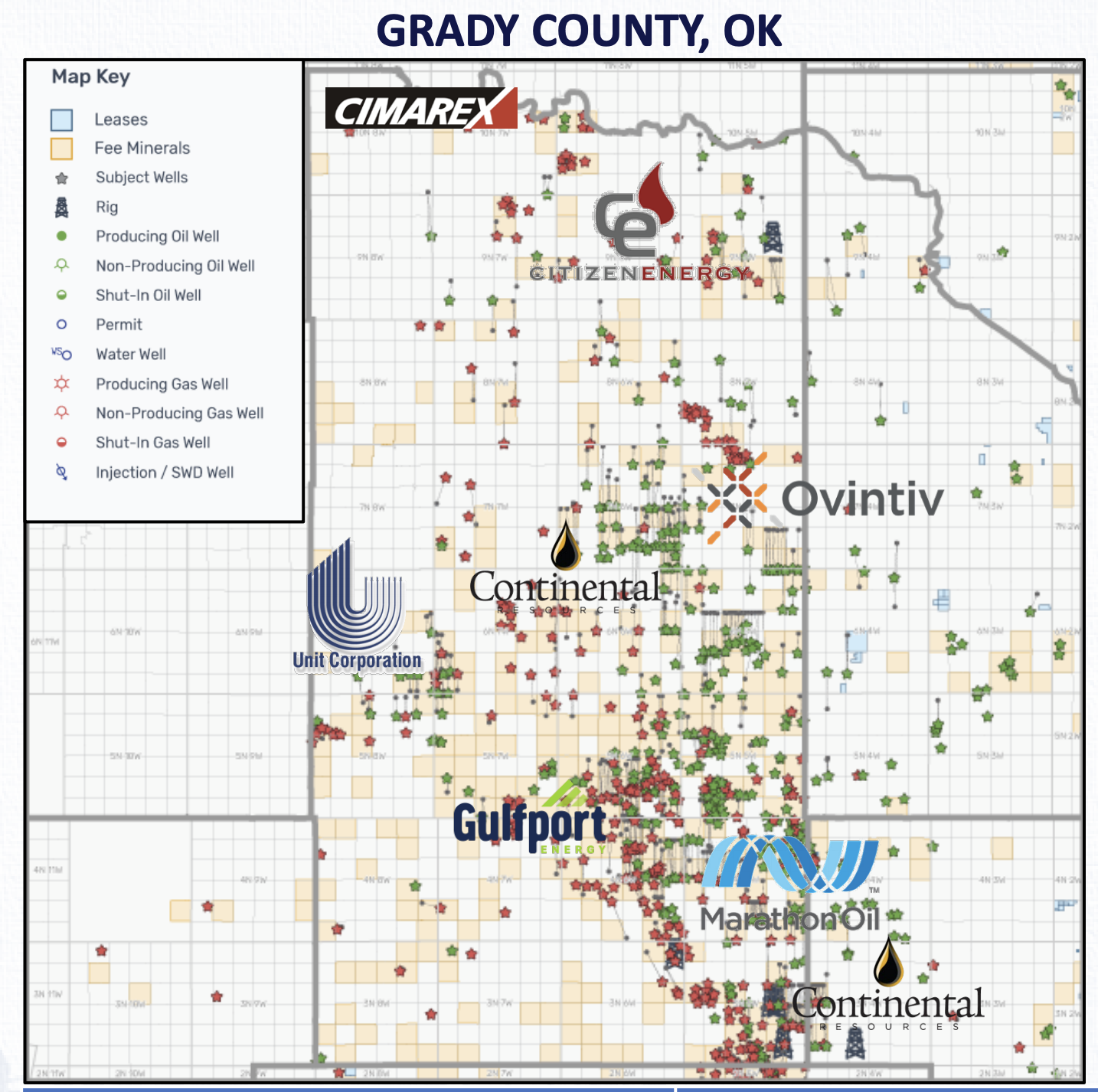

Riviera Resources Inc. retained EnergyNet for the sale of its remaining assets comprised of a nonop and royalty package located primarily in Oklahoma’s Grady County through a sealed-bid offering closing Oct. 26.

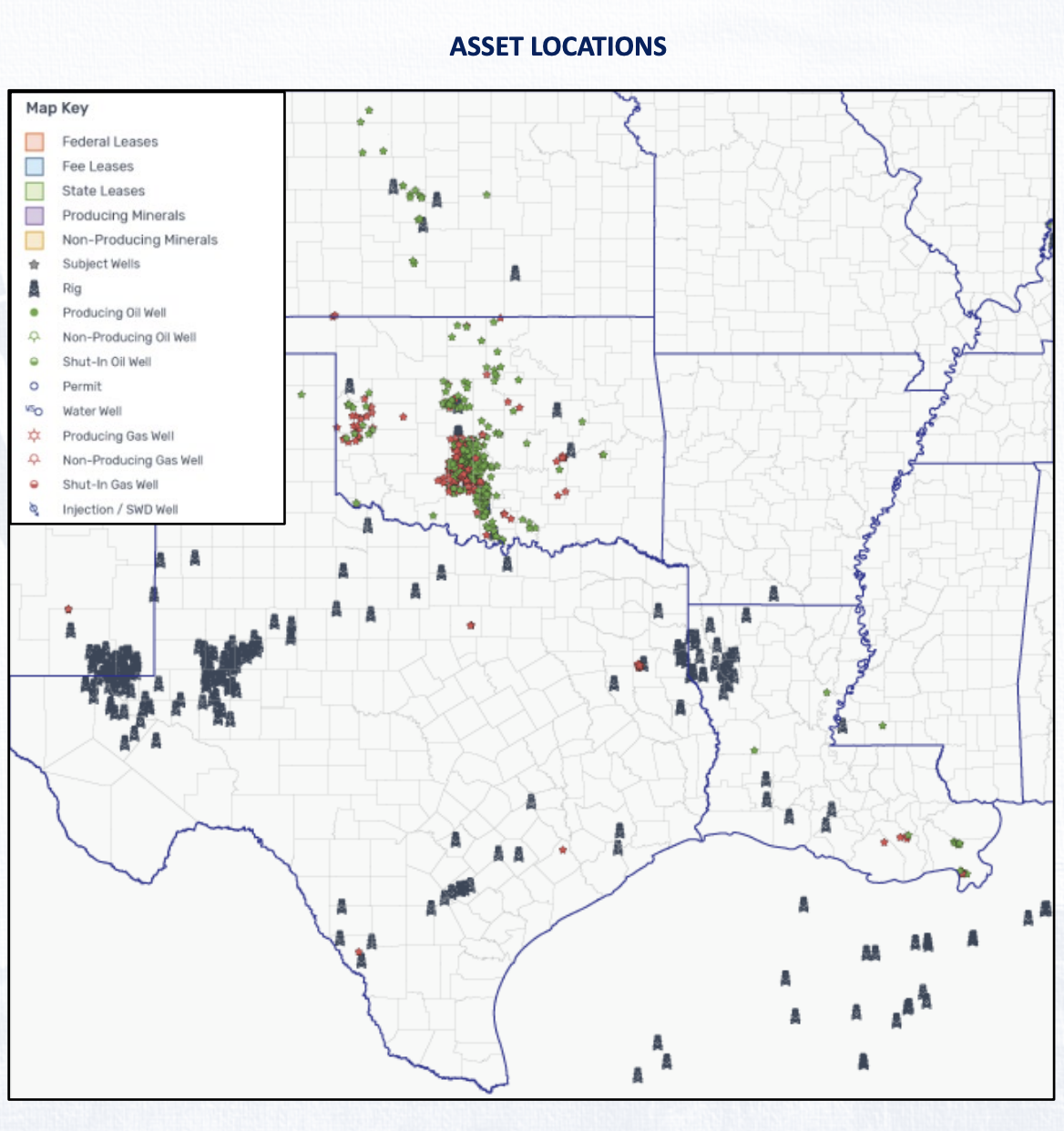

The offering, which includes leasehold and minerals across 17 states and 147 counties, represents a complete upstream oil and gas exit by Riviera Resources, according to EnergyNet.

Highlights:

- Various Nonoperated Working Interest and Royalty Interest in 1,573 Properties:

- 1,195 Producing Properties | One Permitted Property | 156 Non-Producing Properties | 157 Unknown Status | 11 Shut-In Properties | Three Temporarily Abandoned Properties | 50 Plugged and Abandoned Properties

- Select Operators include Apache Corp., Continental Resources Inc., Gulfport Midcon LLC and Marathon Oil Co. Inc.

- 2019 Average Net Income: $353,180 per Month

- First-quarter 2020 Average Net Income: $242,189 per Month (Commodity Prices down about 20%)

- Current Average 8/8ths Production: 46,622 bbl/d of Oil and 599.741 MMcf/d of Gas

- About 12,454.45 Net Mineral Acres

Bids are due by Oct. 26. A data room is available. The transaction is expected to close Nov. 2 with an effective date of Nov. 1.

For complete due diligence information visit energynet.com or email Cody Felton, vice president of business development, at Cody.Felton@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

EQT Sees Clear Path to $5B in Potential Divestments

2024-04-24 - EQT Corp. executives said that an April deal with Equinor has been a catalyst for talks with potential buyers as the company looks to shed debt for its Equitrans Midstream acquisition.

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.

Ithaca Energy to Buy Eni's UK Assets in $938MM North Sea Deal

2024-04-23 - Eni, one of Italy's biggest energy companies, will transfer its U.K. business in exchange for 38.5% of Ithaca's share capital, while the existing Ithaca Energy shareholders will own the remaining 61.5% of the combined group.

EIG’s MidOcean Closes Purchase of 20% Stake in Peru LNG

2024-04-23 - MidOcean Energy’s deal for SK Earthon’s Peru LNG follows a March deal to purchase Tokyo Gas’ LNG interests in Australia.