The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

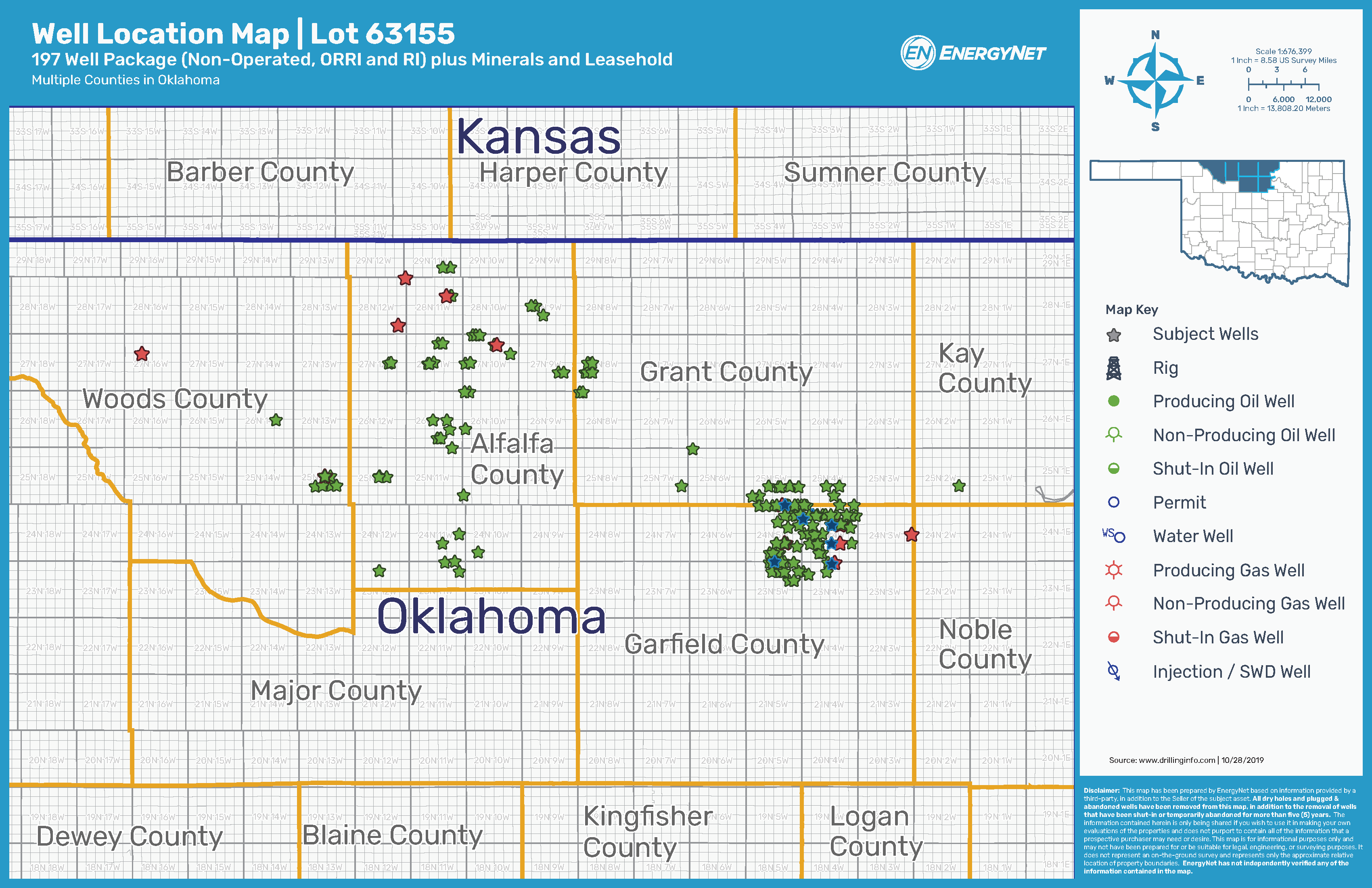

Remora Petroleum LP retained EnergyNet for the sale of a North Anadarko Basin/Mississippian package of Oklahoma assets through a sealed-bid offering closing Dec. 3.

The offering includes nonoperated working interest, overriding royalty interest (ORRI) and royalty interest in 197 wells plus minerals and leasehold in Alfalfa, Garfield, Grant, Kay, Noble and Woods counties, Okla.

Highlights:

- Nonoperated Working Interest in 195 Wells:

- 25.00% to 0.3125% Working Interest / 20.504181% to 0.253906% Net Revenue Interest

- An Additional 1.193356% ORRI in the Elmer 2312 1-4H and 2-4H Wells

- An Additional 0.160217% Royalty Interest in Four Wells

- 169 Producing Wells | Seven Saltwater Disposals | 18 Non-Producing Wells | One Plugged and Abandoned Well

- 3.515625% Royalty Interest in the Producing Egger 2311 1-12H Well

- 0.625% ORRI in the Producing Lancaster 2614 2H-23B Well

- Six-Month Average 8/8ths Production: 692 barrels per day of Oil and 14.318 million cubic feet per day of Gas

- 12-Month Average Net Cash Flow: $266,034 per Month

- 10,709.62 Net Leasehold Acres

- 495.99 Net Mineral Acres

- Operators include BCE-Mach LLC, Koda Operating LLC, Midstates Petroleum Co. Inc., Sandridge Exploration & Production LLC, SK Plymouth LLC and White Star Petroleum LLC

Bids are due by 4 p.m. CDT Dec. 3. For complete due diligence information visit energynet.com or email Cody Felton, vice president of business development, at Cody.Felton@energynet.com, or Denna Arias, director of transaction management, at Denna.Arias@energynet.com.

Recommended Reading

E&P Highlights: March 4, 2024

2024-03-04 - Here’s a roundup of the latest E&P headlines, including a reserves update and new contract awards.

E&P Highlights: March 11, 2024

2024-03-11 - Here’s a roundup of the latest E&P headlines, including a new bid round offshore Bangladesh and new contract awards.

Subsea7 Awarded Sizable Contract in GoM

2024-04-12 - Subsea7 will install a flowline for Talos’ Sunspear development in the Gulf of Mexico.

Seadrill Awarded $97.5 Million in Drillship Contracts

2024-01-30 - Seadrill will also resume management services for its West Auriga drillship earlier than anticipated.

CNOOC Makes 100 MMton Oilfield Discovery in Bohai Sea

2024-03-18 - CNOOC said the Qinhuangdao 27-3 oilfield has been tested to produce approximately 742 bbl/d of oil from a single well.