The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

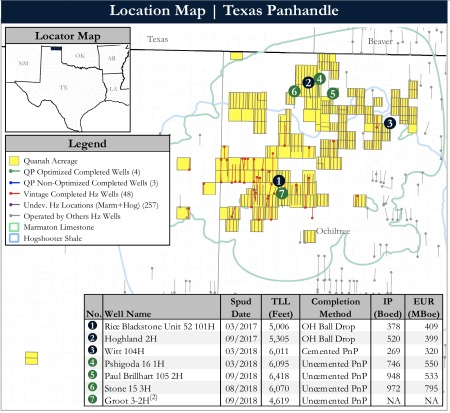

Detring Energy Advisors has been retained for the sale of Quanah Panhandle LLC and its oil and gas producing properties, leasehold and related assets located in Ochiltree, Hansford and Lipscomb counties of the Texas Panhandle. The assets offer an attractive opportunity to acquire a drill-ready program targeting the Marmaton Limestone underwritten by liquids-heavy production, according to Detring.

Asset Highlights:

- Large, contiguous, operated position of roughly 50,100 net acres

- 51% HBP with high average Working Interest (about 98%) and Net Revenue Interest (about 78%)

- Minimal near-term expirations

- Development plan focuses on the prolific Marmaton Limestone including about 200 operated horizontal locations (160-acre spacing)

- 51% HBP with high average Working Interest (about 98%) and Net Revenue Interest (about 78%)

- Optimized completion design and engineered new drill locations yield 80%-100% Rate-Of-Return (ROR)

- 890 boe/d (IP-30) / 520 MBoe (EUR) at about 85% liquids (Three stream)

- $3.75 million Drilling and Completion Capex for 7,500-ft treated lateral length

- Modern completions out-performing legacy horizontal wells by 3-4x

- Substantial, Liquids-Heavy Production Base of about 2,400 boe/d (84% Liquids)

- Roughly $2.6 million per month operating cash flow with greater than 85% revenue attributable to oil

- About $90 million Proved Developed Producing (PDP) PV-10 Value

- 110 producing wells (50 horizontal / 60 vertical)

- Significant Resource Potential from both the Marmaton Limestone and Hogshooter Shale

- The Marmaton consists of greater than 350 ft of high quality stacked pay throughout Quanah acreage

- Ochiltree County Marmaton limestone’s high percentage of carbonate material and significant tectonic overprint promoted natural fracture development, resulting in enhanced hydrocarbon storage in fracture porosity

- Reservoir averages 13 million barrels of oil equivalent per square mile and responds well to modern completions

- Core and vertical tests support uphole Hogshooter potential, an organic-rich shale with greater than 150 ft of net pay

- Microseismic data, petrophysical analysis, and core studies support four horizontal Marmaton wells and two to four horizontal Hogshooter wells per square mile

- The Marmaton consists of greater than 350 ft of high quality stacked pay throughout Quanah acreage

Process Overview:

- Evaluation materials available via the Virtual Data Room on Feb. 18

- Proposals due on March 20

For information visit detring.com or contact Melinda Faust at mel@detring.com or 713-595-1004.

Recommended Reading

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.

Daniel Berenbaum Joins Bloom Energy as CFO

2024-04-17 - Berenbaum succeeds CFO Greg Cameron, who is staying with Bloom until mid-May to facilitate the transition.

Equinor Releases Overview of Share Buyback Program

2024-04-17 - Equinor said the maximum shares to be repurchased is 16.8 million, of which up to 7.4 million shares can be acquired until May 15 and up to 9.4 million shares until Jan. 15, 2025 — the program’s end date.