The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

An affiliate of QEP Resources Inc. retained EnergyNet for the sale of a package of mineral and royalty assets across Indiana through an auction closing Dec. 3.

The package includes producing mineral and royalty interests in 12 wells plus non-producing minerals located in Gibson, Knox, Parke, Pike, Posey, Sullivan, Vanderburgh and Vigo counties, Ind.

Highlights:

- 691.74 Net Mineral Acres

- 512.08 Net Non-Producing Minerals

- 179.66 Net Producing Minerals

- 6.25% to 0.39062% Royalty Interest in 12 Wells:

- 11 Producing Wells | One Non-Producing Well

- Six-Month Average Net Income: $1,307 per Month

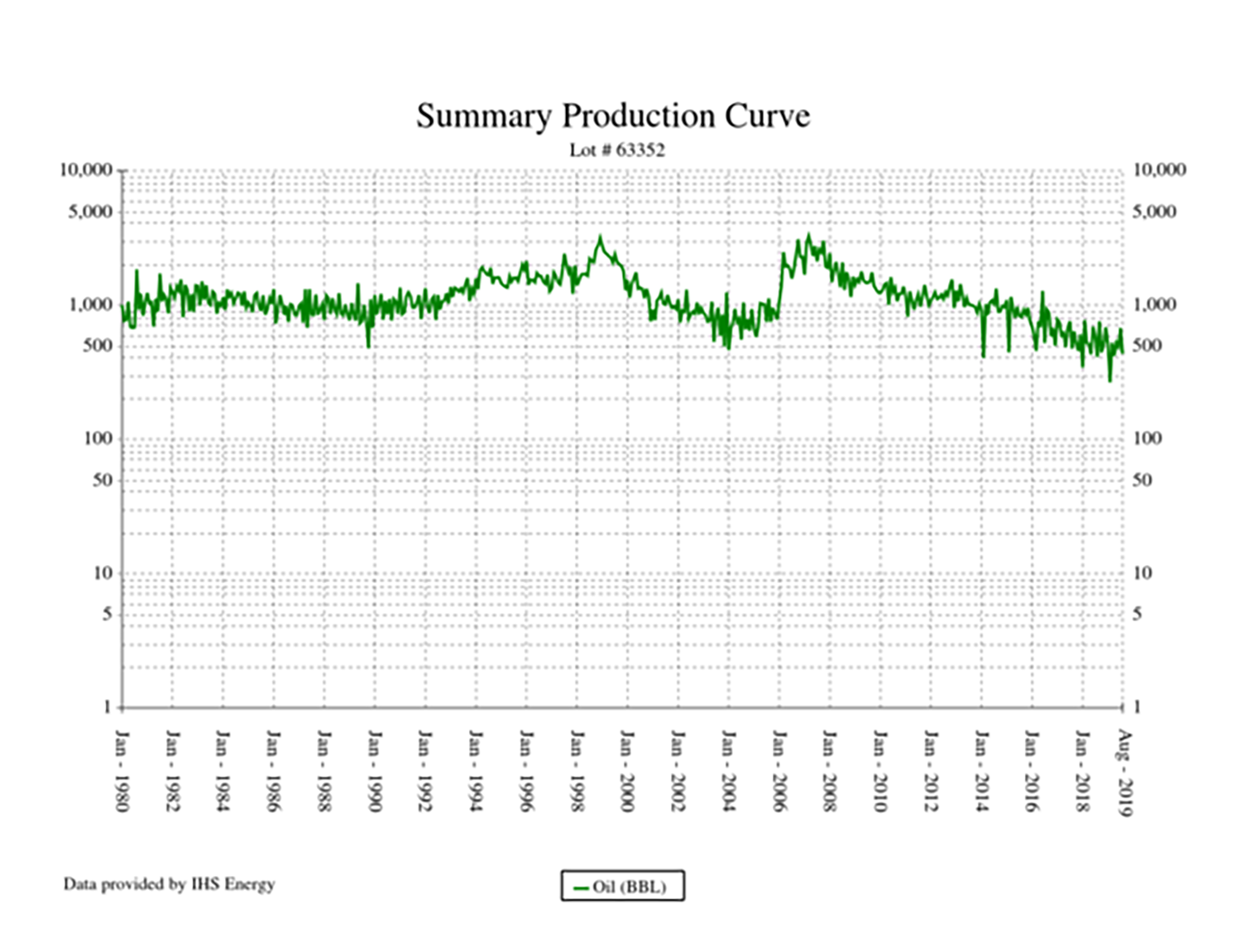

- Six-Month Average 8/8ths Production: 18 barrels per day of Oil

- Select Operators include CDG Operations LLC, Crown Well Service Inc. and Warren American Oil Co.

Bids are due by 2:40 p.m. CST Dec. 3. For complete due diligence information visit energynet.com or email Ryan P. Dobbs, vice president of business development, at Ryan.Dobbs@energynet.com, or Denna Arias, director of transaction management, at Denna.Arias@energynet.com.

Recommended Reading

Second Light Oil Discovery in Mopane-1X Well

2024-01-26 - Galp Energia's Avo-2 target in the Mopane-1X well offshore Namibia delivers second significant column of light oil.

CNOOC Sets Increased 2024-2026 Production Targets

2024-01-25 - CNOOC Ltd. plans on $17.5B capex in 2024, with 63% of that dedicated to project development.

Sinopec Brings West Sichuan Gas Field Onstream

2024-03-14 - The 100 Bcm sour gas onshore field, West Sichuan Gas Field, is expected to produce 2 Bcm per year.

E&P Highlights: March 11, 2024

2024-03-11 - Here’s a roundup of the latest E&P headlines, including a new bid round offshore Bangladesh and new contract awards.