The following information is provided by Wells Fargo Securities LLC. All inquiries on the following listings should be directed to Wells Fargo Securities. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

PT Petroleum LLC and affiliated companies are offering for sale certain upstream assets within the Southern Midland Basin.

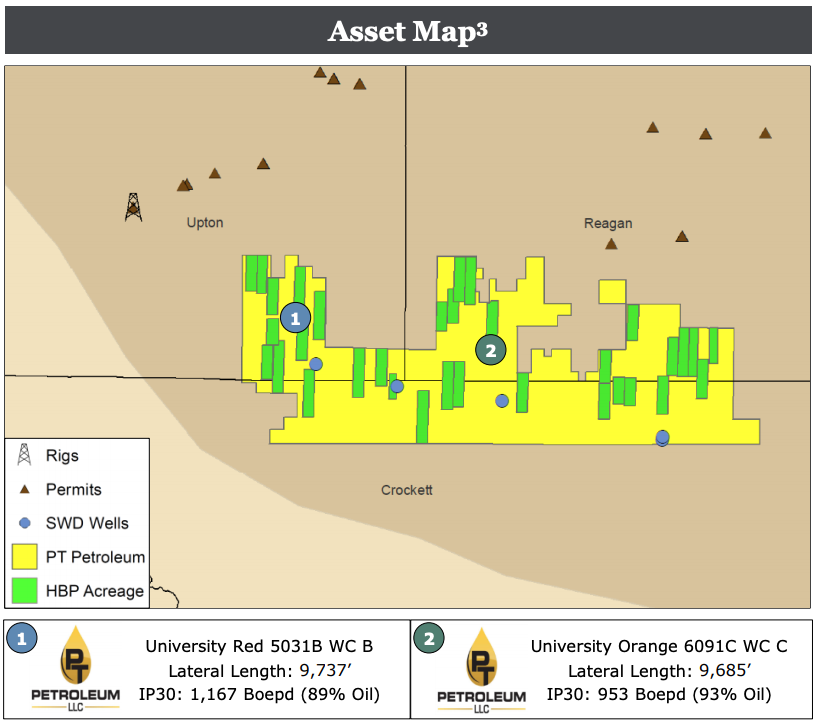

Wells Fargo Securities LLC has been retained as the exclusive adviser to the sellers, which also include Carrier Energy Partners II and KA Henry II. The offer comprises production and a contiguous HBP acreage position across multiple Wolfcamp formations in the Permian Basin in Crockett, Reagan and Upton counties, Texas.

Highlights:

- Shallow decline, oil-weighted production and cash flow

- Production of about 1,750 boe/d (72% oil) from 38 gross producers targeting the Wolfcamp A, Wolfcamp B and Wolfcamp C

- PDP PV-10 value of $67 million and PDP next 12-month EBITDA of $16 million

- Production holds about 15,500 gross acres and 128 gross locations

- Production of about 1,750 boe/d (72% oil) from 38 gross producers targeting the Wolfcamp A, Wolfcamp B and Wolfcamp C

- Opportunity to acquire attractive resource option across multiple Wolfcamp formations

- Unique opportunity to acquire contiguous acreage position across about 60,000 net acres, 100% operated

- Single development unit with one surface and royalty owner

- Stacked pay and existing delineation wells across the Wolfcamp A, B and C

- Offset operators, PXD, Sable, and Hunt Oil lead activity in the region

- PT's Orange 6091C Wolfcamp C – IP-30 953 boe/d (93% oil) highlights potential in the Wolfcamp C

- Extensive and scalable infrastructure in place

- Four saltwater disposal wells with 100,000 barrels per day of water permitted capacity

- About 3.8 million barrels of water storage available from 10 frac pits

- Combination of existing infrastructure and long lateral development results in a low-cost operation

(Source: Wells Fargo Securities LLC; DrillingInfo, company presentation, RigData as of May 3.)

3. Permits in map are active horizontal permits; not spud (as of May 1).

Process overview:

- Confidential data via virtual data room: July 1

- Data rooms commenced June 17 in Wells Fargo Securities' Houston office

For further information contact Norbie Juist at norbie.juist@wellsfargo.com.

Recommended Reading

Going with the Flow: Universities, Operators Team on Flow Assurance Research

2024-03-05 - From Icy Waterfloods to Gas Lift Slugs, operators and researchers at Texas Tech University and the Colorado School of Mines are finding ways to optimize flow assurance, reduce costs and improve wells.

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.