The following information is provided by Eagle River Energy Advisors LLC. All inquiries on the following listings should be directed to Eagle River. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

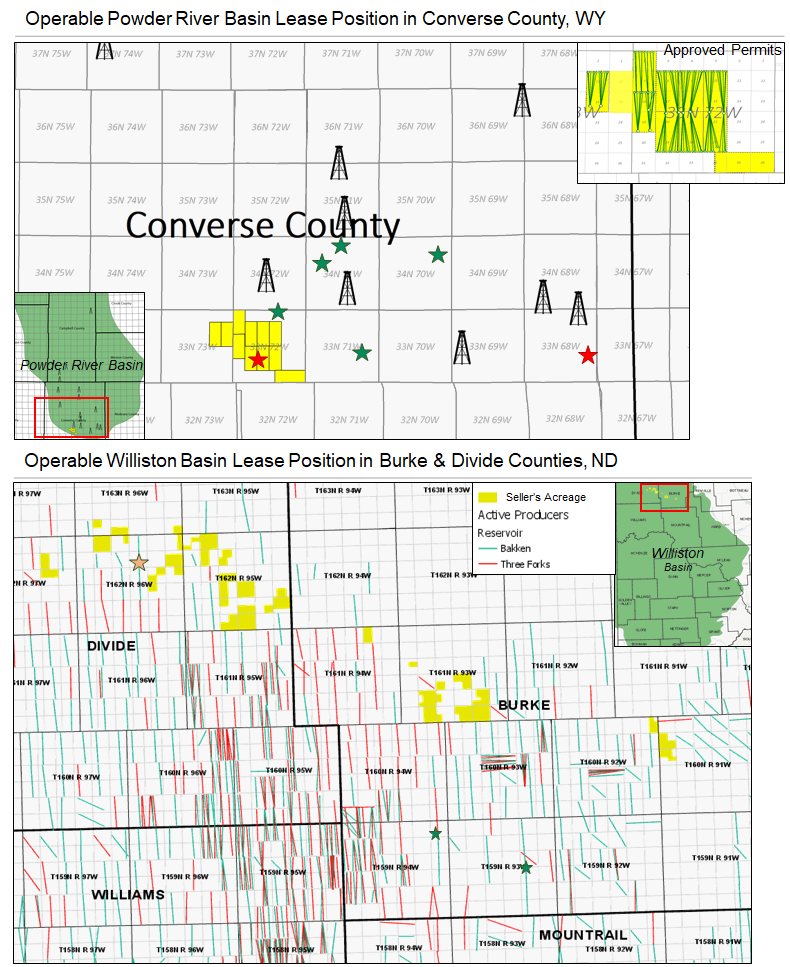

A private seller retained Eagle River Energy Advisors LLC for the divestiture of certain operable working interest leasehold and associated development rights in the Powder River Basin of Wyoming's Converse County and the Williston Basin of North Dakota's Burke and Divide counties.

Highlights:

Opportunity 1: Operated Leasehold in the Powder River Basin

- About 3,966 net acres majority operable leasehold in the Powder River Basin

- Nine approved drilling spacing units (DSUs)

- 115 operated permits submitted for the Niobrara, Turner and Mowry

- About 42 immediately drillable locations across multiple pay zones

- No major expirations until 2022 with extension eligibility

- Recent offset horizontal wells demonstrate economic viability of extended laterals and larger completion designs

- Prolific offset well results with 1,322 barrels of oil equivalent per day (boe/d) IP-30 average

- Strong shows and existing producing wells across Seller's acreage position de-risk development potential in multiple pay zones

- Analogous Turner geology to successful wells in Converse County

- Offset Mowry delineation proves economic viability

- Significant proved resource potential in the Niobrara and Turner

- Offset development and active delineation efforts by Basin-leading operators Chesapeake Energy Corp., Occidental Petroleum Corp. and Devon Energy Corp. proves stacked-pay potential

- Consistent offset activity with 8 active horizontal rigs currently drilling in the area

Opportunity 2: Operated Leasehold in the Williston Basin

- About 5,650 net acres majority operable leasehold in the Williston Basin

- About 25 operable DSUs lend two rig-years of potential inventory

- 17 1,280-acre DSUs and eight 1,920-acre DSUs

- About 125 quantified drilling locations in the Middle Bakken provide significant running room for development

- No major expirations until 2022 with extension availability

- Comparable Bakken reservoir quality to analog Kraken development area in central Williams County with average pay thickness of 50-plus feet

- Production uplift as high as three times to vintage, parent wells

- Continental Resources Inc. drilled successful Bakken well in 2018 directly offsetting leasehold in 162N 96W with 700 boe/d IP-30

- Liberty Resources LLC recently completed four, 3-mile laterals with 1,000 per ft proppant, with results in-line with the Kraken Middle Bakken type curve

- Economic Middle Bakken development potential with 1,052 MBoe EUR and $9 million drilling and completion cost yielding an internal rate of return of about 38%

- Significant probable resources potential in the Three Forks

Bids are due by 4 p.m. MT March 12. Virtual data room will be available starting Feb. 11. The transaction is expected to have a Jan. 1 effective date.

For information visit eagleriverholdingsllc.com or contact Austin McKee, managing director of Eagle River, at AMcKee@EagleRiverEA.com or 303-832-5128.

Recommended Reading

DXP Enterprises Buys Water Service Company Kappe Associates

2024-02-06 - DXP Enterprise’s purchase of Kappe, a water and wastewater company, adds scale to DXP’s national water management profile.

ARM Energy Sells Minority Stake in Natgas Marketer to Tokyo Gas

2024-02-06 - Tokyo Gas America Ltd. purchased a stake in the new firm, ARM Energy Trading LLC, one of the largest private physical gas marketers in North America.

California Resources Corp., Aera Energy to Combine in $2.1B Merger

2024-02-07 - The announced combination between California Resources and Aera Energy comes one year after Exxon and Shell closed the sale of Aera to a German asset manager for $4 billion.

DNO Acquires Arran Field Stake, Continuing North Sea Expansion

2024-02-06 - DNO will pay $70 million for Arran Field interests held by ONE-Dyas, and up to $5 million in contingency payments if certain operational targets are met.

Report: Devon Energy Targeting Bakken E&P Enerplus for Acquisition

2024-02-08 - The acquisition of Enerplus by Devon would more than double the company’s third-quarter 2023 Williston Basin production.