The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

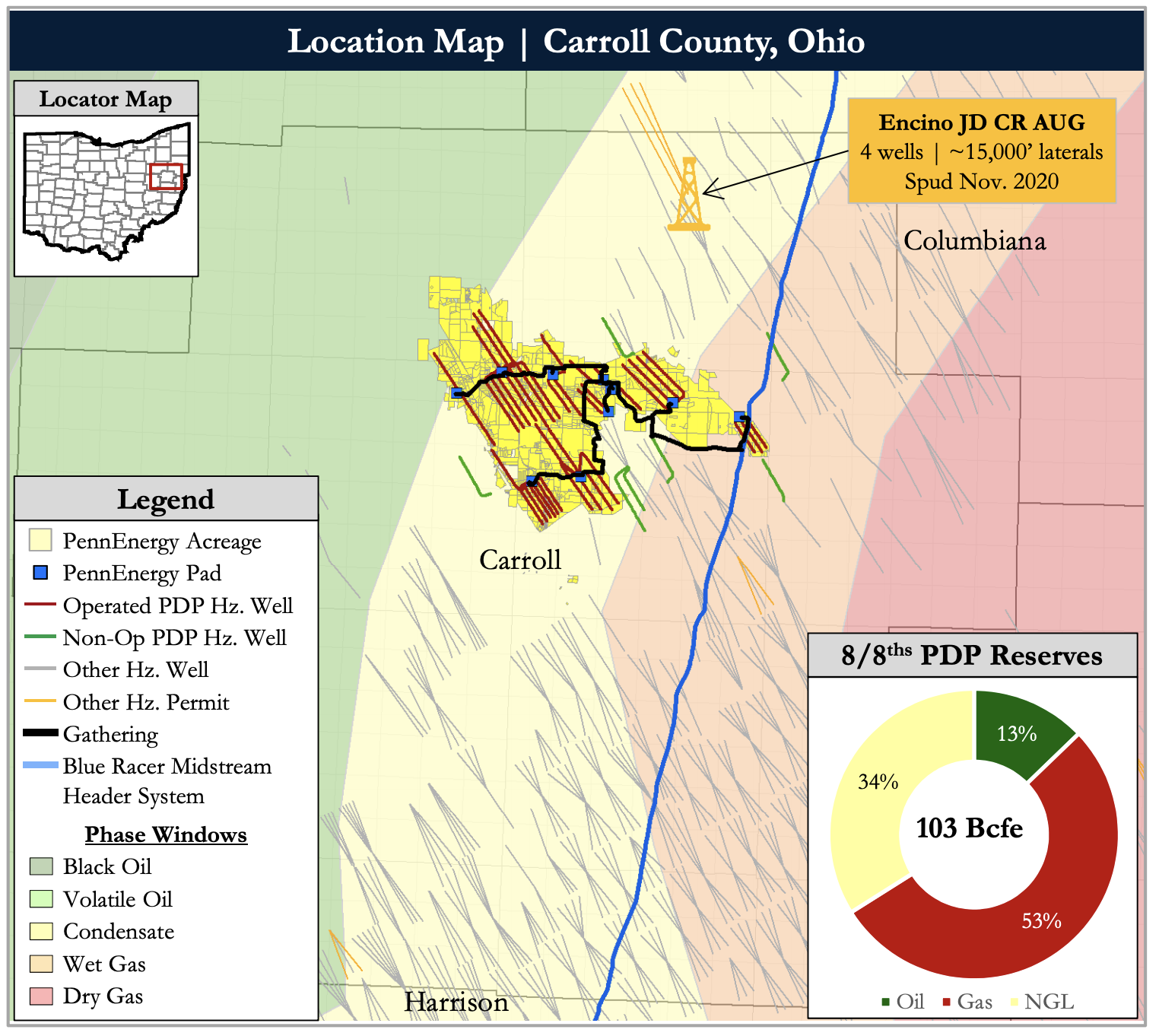

PennEnergy Resources LLC retained Detring Energy Advisors to market for sale its Utica Shale producing properties, leasehold and related assets located in Carroll County, Ohio.

According to Detring, the assets offer an attractive opportunity to acquire (i) an operated, 98% HBP, contiguous, “turn-key” position with robust infrastructure in place to facilitate growth; (ii) a liquids-rich production and cash flow base to fund development; and (iii) long-lateral undeveloped inventory with over 160,000 total lateral ft on lease.

Highlights:

- Substantial Liquids-Rich Production Base

- 40 operated (average 75% Working Interest) and seven nonop PDP wells (average 5% Working Interest)

- An owner in 19 PDP wells (average 52% Working Interest) maintains “Tag-Along Right” that will require a buyer to make an offer for the 8/8ths interests, while being prepared to purchase only the interests of PennEnergy

- 26 MMcfe/d production (8/8ths)

- 18 MMcfe/d net to PennEnergy

- 8 MMcfe/d net to “Tag-Along Right”

- $10.7 million Next 12-month Cash Flow (8/8ths)

- $7.1 million net to PennEnergy

- $3.6 million net to “Tag-Along Right”

- $42 million PDP PV-10% (8/8ths)

- $27 million net to PennEnergy

- $15 million net to “Tag-Along Right”

- 40 operated (average 75% Working Interest) and seven nonop PDP wells (average 5% Working Interest)

- Concentrated Position Ideal for Operations

- About 13,400 Net Acres

- 12,126 net acres to PennEnergy and an additional 1,253 net acres across 14 units associated with “Tag-Along Right”

- 98% HBP | 99% Operated

- Operator-friendly leases with de-risked title (opinions and abstracts organized in electronic lease files)

- Extensive infrastructure in-place

- 10 existing pad sites with gathering

- Impoundments and water lines to Buckeye Water District provides low cost access to frac water and opportunity for 3rd party water sales

- Significant market optionality at Natrium/Berne tailgates for both residue gas and NGL

- About 13,400 Net Acres

- Attractive Development Opportunities

- Contiguous position accommodating long-lateral development with 160,000-plus total undeveloped lateral feet on lease

- Only requires one new pad build

- Low-cost bolt-on / trade opportunities to increase nets and extend laterals

- Position spanning wet gas volatile oil phase windows provides commodity optionality (less than 5 to more than 100 bbl/Mcf)

- Contiguous position accommodating long-lateral development with 160,000-plus total undeveloped lateral feet on lease

- Consistent high-quality reservoir in the core of the Point Pleasant thickness trend

- Formation spans the liquids-rich phase windows, with liquids yield increasing to the west

- Quiet structural setting with no faulting provides an easily executable drilling target

- Core, well log and microseismic data confirm consistent reservoir quality and net pay thickness across the position, providing confidence in future Pont Pleasant development locations

Process Summary:

- Evaluation materials available via the Virtual Data Room on Jan. 14

- Proposals due on Feb. 17

For information visit detring.com or contact Melinda Faust at mel@detring.com or 512-296-4653.

Recommended Reading

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.

Uinta Basin: 50% More Oil for Twice the Proppant

2024-03-06 - The higher-intensity completions are costing an average of 35% fewer dollars spent per barrel of oil equivalent of output, Crescent Energy told investors and analysts on March 5.

In Shooting for the Stars, Kosmos’ Production Soars

2024-02-28 - Kosmos Energy’s fourth quarter continued the operational success seen in its third quarter earnings 2023 report.

M4E Lithium Closes Funding for Brazilian Lithium Exploration

2024-03-15 - M4E’s financing package includes an equity investment, a royalty purchase and an option for a strategic offtake agreement.

California Resources Corp. Nominates Christian Kendall to Board of Directors

2024-03-21 - California Resources Corp. has nominated Christian Kendall, former president and CEO of Denbury, to serve on its board.