The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

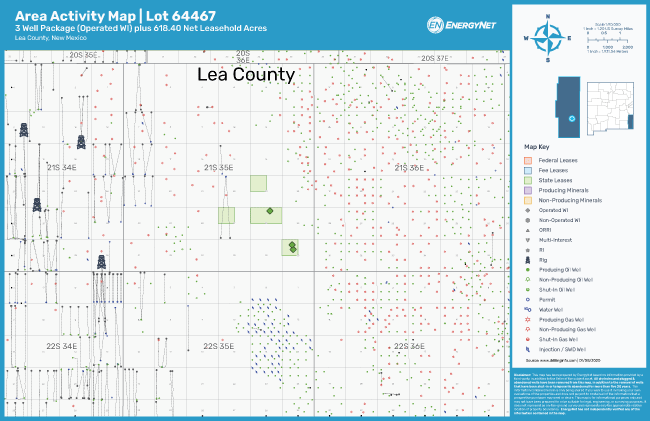

M&M Energy LLC retained EnergyNet for the sale of an operated asset package located in Lea County, N.M., of the Permian Basin in an auction closing Feb. 5.

The offering comprises operated interests in three wells plus leasehold acreage.

Highlights:

- 100.00% to 84.00% Working Interest / 81.25% to 68.484375% Net Revenue Interest in Three Producing Wells:

- Operators: Craft Operating NM LLC and M & M Energy LLC

- Six-Month Average 8/8ths Production: 26 barrels per day of Oil

- Six-Month Average Net Income: $21,709 per Month

- 588.80 Net Leasehold Acres:

- 428.80 Net HBP Leasehold Acres

- 160.00 Net Non-Producing Term Leasehold Acres

Bids are due by 2:10 p.m. CST Feb. 5. For complete due diligence information visit energynet.com or email Lindsay Ballard, vice president of business development, at Lindsay.Ballard@energynet.com, or Denna Arias, director of transaction management, at Denna.Arias@energynet.com.

Recommended Reading

PGS Wins 3D Contract Offshore South Atlantic Margin

2024-04-08 - PGS said a Ramform Titan-class vessel is scheduled to commence mobilization in June.

Going with the Flow: Universities, Operators Team on Flow Assurance Research

2024-03-05 - From Icy Waterfloods to Gas Lift Slugs, operators and researchers at Texas Tech University and the Colorado School of Mines are finding ways to optimize flow assurance, reduce costs and improve wells.

Sapura Acquires Exail Rovins’ Nano Inertial Navigation System

2024-02-01 - Exail Rovins’ Nano Inertial Navigation System is designed to enhance Sapura’s subsea installment capabilities.

TGS Commences Multiclient 3D Seismic Project Offshore Malaysia

2024-04-03 - TGS said the Ramform Sovereign survey vessel was dispatched to the Penyu Basin in March.

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.