The following information is provided by Houlihan Lokey Capital Inc. All inquiries on the following listings should be directed to Houlihan Lokey. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

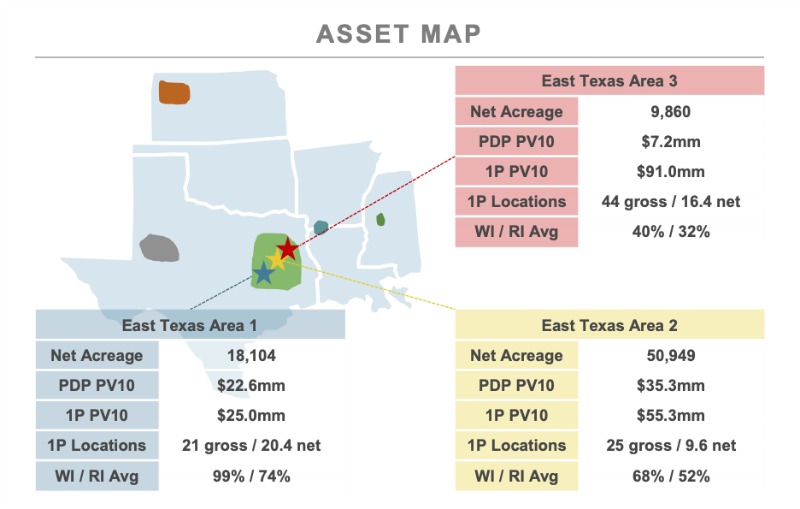

O'BENCO IV retained Houlihan Lokey Capital Inc. for the sale of its proved developed producing (PDP) weighted assets, primarily located in three core East Texas areas.

Highlights:

- Gas-weighted PDP foundation

- Compelling and technically de-risked stacked pay oil development opportunity offering top-tier full cycle returns

- Primary targets in Bossier, Cotton Valley and Rodessa Limestone plays with favorable economics

- Meaningful footprint of about 79,000 net acres, according to Houlihan Lokey

- Current production of roughly 3,300 barrels of oil equivalent (boe) per day net (23% liquids)

- Net reserves of roughly 26 million boe; PV-10 value of about $198 million or more

- 100% owned 45-mile gathering system (East Texas Area 1) and a 90% owned 25-mile gathering system (East Texas Area 2)

Bids are due April 5. For information visit hl.com or contact Jerry Eumont, director of Houlihan Lokey, at 832-319-5119 or JEumont@HL.com.

O'BENCO IV is an institutional quality, private, direct investment vehicle of O'Brien Energy Co., a fourth generation E&P company with a portfolio of upstream, midstream and mineral/fee assets in the Midcontinent and Gulf Coast regions.

Recommended Reading

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

After Megamerger, Canadian Pacific Kansas City Rail Ends 2023 on High

2024-02-02 - After the historic merger of two railways in April, revenues reached CA$3.8B for fourth-quarter 2023.

Enbridge Advances Expansion of Permian’s Gray Oak Pipeline

2024-02-13 - In its fourth-quarter earnings call, Enbridge also said the Mainline pipeline system tolling agreement is awaiting regulatory approval from a Canadian regulatory agency.

Canadian Natural Resources Boosting Production in Oil Sands

2024-03-04 - Canadian Natural Resources will increase its quarterly dividend following record production volumes in the quarter.

Shell’s CEO Sawan Says Confidence in US LNG is Slipping

2024-02-05 - Issues related to Venture Global LNG’s contract commitments and U.S. President Joe Biden’s recent decision to pause approvals of new U.S. liquefaction plants have raised questions about the reliability of the American LNG sector, according to Shell CEO Wael Sawan.