The following information is provided by Energy Advisors Group Inc. (EAG), formerly PLS Divestment Services. All inquiries on the following listings should be directed to EAG. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

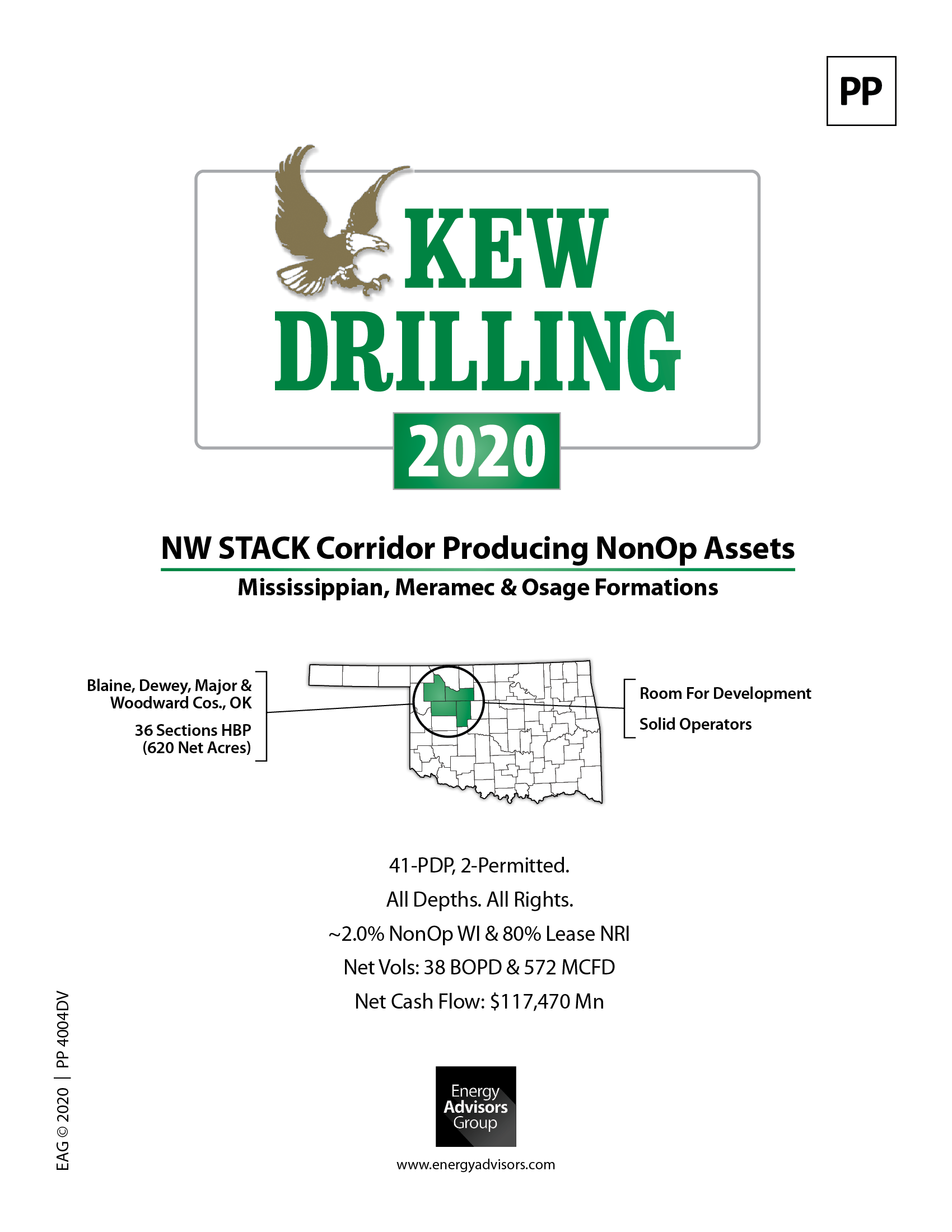

KEW Drilling retained Energy Advisors Group Inc. (EAG) for the sale of nonoperated producing properties located in the northwest corridor of the Stack play in Oklahoma's Blaine, Dewey, Major and Woodward counties.

The KEW package includes about 620 net acres across 36 sections. The sale package includes an average of about 2% nonoperated working interest and about 1.6% net revenue interest (80% lease net revenue interest).

The portfolio recent gross volumes of: 2,206 barrels per day (bbl/d) of oil and 38.887 million cubic feet per day (MMcf/d) of gas. Net volumes: 38 bbl/d of oil and 572,000 cubic feet per day of gas.

The wells are operated by solid operators, including Comanche Exploration Co. LLC, Continental Resources Inc., Ovintiv Inc. (Encana/Newfield), SandRidge Energy Inc., Staghorn Petroleum LLC and Tapstone Energy LLC, listed here.

Nonoperated Working Interest For Sale:

Small average about 2% nonop working interest but includes high 80% lease net revenue interest.

The leased area is actively developed with optimized drilling and completion design, resulting in dramatically reduced drilling and completion costs.

Highlights:

- Northwest Stack Nonop Working Interest For Sale

- 41 Proved Developed Producing, Two Permited

- Blaine, Dewey, Major and Woodward

- Mississippian, Meramec and Osage

- All Depths. All Rights. All HBP.

- 36 Sections HBP (620 Net Acres)

- About 2% Nonop Working Interest and 80% Lease Net Revenue Interest

- Gross Volumes: 2,206 bbl/d of Oil and 38.887 MMcf/d of Gas

- Net Volumes: 38 bbl/d of Oil 572,000 cubic feet per day of Gas

- Three-month Average Net Cash Flow: $117,470 per month

- Solid Operators

- Additional Acreage Available

Click here to view the online data room or visit energyadvisors.com to view our other assignments.

For more information, contact Carrie Calahan, associate with EAG, at scalahan@energyadvisors.com or 713-600-0137.

Recommended Reading

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.