The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

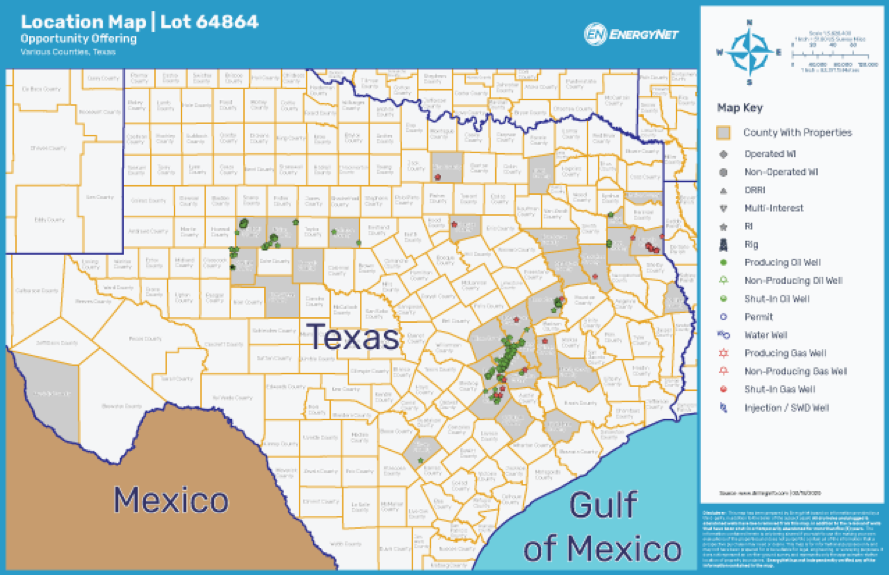

Noble Energy Inc. retained EnergyNet for the sale of a package of producing assets located in various Texas counties through an auction closing April 30.

The package is comprised of overriding royalty interest (ORRI), royalty interest and non-producing royalty interest in 380 producing properties plus mineral acreage. Select operators include affiliates of Exxon Mobil Corp., Chesapeake Energy Corp. and Magnolia Oil & Gas Corp.

Highlights:

- ORRI in 286 Properties (Multiple Wells):

- 6.9803% to 0.000351% ORRI / 0.020554% Royalty Interest in the North Westbrook Unit

- 254 Producing Properties | 18 Non-Producing Properties | 14 Status Unknown

- Select Operators include Chesapeake Operating LLC, Hawkwood Energy Operating LLC, Magnolia Oil & Gas Operating LLC and XTO Energy Inc.

- Royalty Interest in 88 Properties (Multiple Wells):

- 3.270833% to 0.001631% Royalty Interest

- 73 Producing Properties | Seven Non-Producing Properties | Eight Status Unknown

- Select Operators include Atoka Operating Permian LLC, Rockcliff Energy Operating LLC, Scout Energy Management LLC and Sheridan Production Co. LLC

- Various Non-Participating Royalty Interests in 6,173.69 Gross Acres

- Current Average 8/8ths Production: 17,089 barrels per day of Oil and 24.009 million cubic feet per day of Gas

- Six-Month Average Net Cash Flow: $68,545 per Month

Bids are due by 2:25 p.m. CT April 30. For complete due diligence information visit energynet.com or email Cody Felton, vice president of business development, at Cody.Felton@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

Enterprise’s SPOT Deepwater Port Struggles for Customers

2024-04-25 - Years of regulatory delays, a loss of commercial backers and slowing U.S. shale production has Enterprise Products Partners’ Sea Port Oil Terminal and rival projects without secured customers, energy industry executives say.

Report: Crescent Midstream Exploring $1.3B Sale

2024-04-23 - Sources say another company is considering $1.3B acquisition for Crescent Midstream’s facilities and pipelines focused on Louisiana and the Gulf of Mexico.

Energy Transfer Announces Cash Distribution on Series I Units

2024-04-22 - Energy Transfer’s distribution will be payable May 15 to Series I unitholders of record by May 1.

Balticconnector Gas Pipeline Back in Operation After Damage

2024-04-22 - The Balticconnector subsea gas link between Estonia and Finland was severely damaged in October, hurting energy security and raising alarm bells in the wider region.