The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Marathon Oil Corp. retained EnergyNet to sell Anadarko Basin properties across multiple counties in Oklahoma including those located in the Stack Play.

The offer includes interest in more than 50 wells with a combined average net income of roughly $315,705.

Property Highlights:

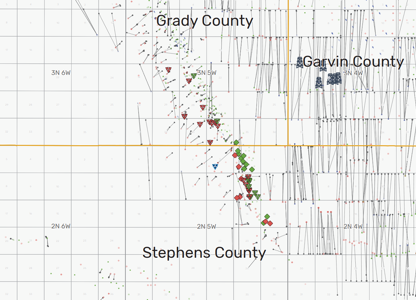

Lot: 55931

- Grady and Stephens Counties, Okla.

- 93.261719% to 18.75% Working Interest / 75.75685% to 16.40625% Net Revenue Interest in 48 Wells:

- An Additional 4.41828% to 0.32226% Overriding Royalty Interest in 26 Wells

- An Additional 0.56152% to 0.04272% Royalty Interest in 11 Wells

- The J Kaye 3 33 and Roy D Mercer 4 11 Wells are Completed in Multiple Formations

- 37 Producing Wells | 10 Shut-In Wells | 1 Temporarily Abandoned Well

- Six-Month Average 8/8ths Production: 187 barrels per day (bbl/d) of oil and 3.279 million cubic feet per day (MMcf/d) of gas

- Six-Month Average Net Income: $288,674 per Month

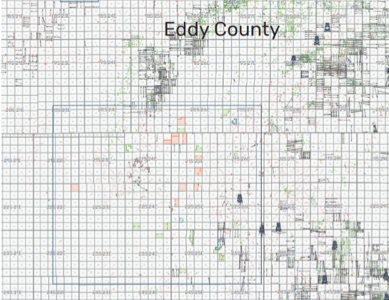

Lot: 55930

- Blaine, Canadian, Dewey, Grady and Kingfisher Counties, Okla.

- 100.00% to 6.9446% Working Interest / 85.253906% to 5.875784% Net Revenue Interest in 53 Wells:

- An Additional 1.674205% to 0.26584% Overriding Royalty Interest in Five Wells

- 27 Producing Wells | 26 Shut-In Wells

- Six-Month Average 8/8ths Production: 1.209 MMcf/d of gas and 21 bbl/d of oil

- Four-Month Average Net Income: $27,031 per Month

Bids close at 4 p.m. CST March 14. For complete due diligence information energynet.com or email Cody Felton, vice president of business development, at Cody.Felton@energynet.com, or Denna Arias, director of transaction management, at Denna.Arias@energynet.com.

Recommended Reading

What's Affecting Oil Prices This Week? (March 11, 2024)

2024-03-11 - Stratas Advisors expects oil prices to move higher in the middle of the year, but for the upcoming week, there is no impetus for prices to raise.

Oil Broadly Steady After Surprise US Crude Stock Drop

2024-03-21 - Stockpiles unexpectedly declined by 2 MMbbl to 445 MMbbl in the week ended March 15, as exports rose and refiners continued to increase activity.

US Gulf Coast Heavy Crude Oil Prices Firm as Supplies Tighten

2024-04-10 - Pushing up heavy crude prices are falling oil exports from Mexico, the potential for resumption of sanctions on Venezuelan crude, the imminent startup of a Canadian pipeline and continued output cuts by OPEC+.

US Could Release More SPR Oil to Keep Gas Prices Low, Senior White House Adviser Says

2024-04-16 - White House senior adviser John Podesta stopped short of saying there would be a release from the Strategic Petroleum Reserve any time soon at an industry conference on April 16.

Biden Administration Hits the Brake on New LNG Export Projects

2024-01-26 - As climate activists declare a win, the Department of Energy secretary says the pause is needed to update current policy.