The following information is provided by Eagle River Energy Advisors LLC. All inquiries on the following listings should be directed to Eagle River. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

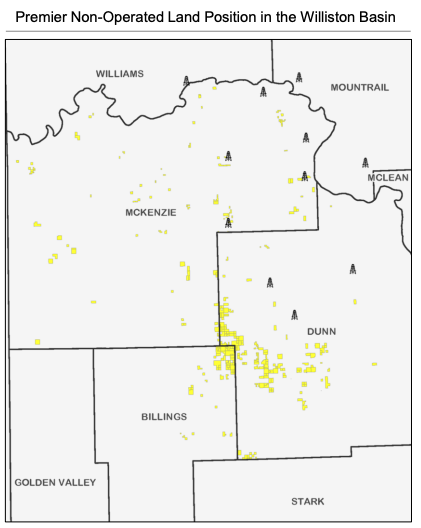

Eagle River Energy Advisors LLC has been exclusively retained by Lime Rock Resources to divest certain nonoperated working interest assets and associated development rights in the Williston Basin of Dunn, McKenzie and Billings counties of North Dakota through an offering closing Nov. 16.

Highlights:

- Significant Producing Assets in the Core Williston Basin

- Roughly 17,500 net acres nonoperated leasehold in the Core Williston Basin

- About 400 existing wells in Dunn, McKenzie & Billings Counties

- About 2,640 boe/d net production (six-month average; June 2020)

- 74% Oil / 16% Gas / 10% NGL

- About $19.6 million Trailing 12-months operating cash flow from existing wells (June 2020)

- Nonoperated interest in the Petro-Hunt Little Knife Gas Plant with about $1.7 million additional Trailing 12-months operating cash flow (June 2020)

- More than 84% average 8/8ths Net Revenue Interest provide high-margin drilling

- Stable and Diversified Position

- Diversified across 144 DSUs in three counties in North Dakota

- Position under multiple leading Basin operators: Continental Resources Inc., XTO Energy Inc., Marathon Oil Corp., Hess Corp., Petro-Hunt LLC and many others

- Flat production since 2017 as a result of about 30 wells drilled / year

- About $12 per boe average lifting cost provides positive cash flow at low commodity price environments

- Optimal Portfolio of Production with Upside Development

- High-quality undeveloped inventory remaining in the Core of the Basin

- Operators developing core areas during economic downturn as demonstrated by 59 wells drilled on Seller’s position in 2019-2020

- Three drilling rigs currently on Seller’s acreage with ConocoPhillips Co. (2) and WPX Energy Inc.

- Substantial production base with sizeable undeveloped inventory provides ideal mixture of PDP reserves versus upside

- Less than 3 average PDP wells / DSU with more than 50% of DSUs only having one well

- About 89 near-term locations either drilled or on confidential status and awaiting first sales with about 10 additional active permits

- High-quality undeveloped inventory remaining in the Core of the Basin

The transaction is expected to have an Oct. 1 effective date.

Bids are due at 4 p.m. MT on Nov. 16. A virtual data room will be available starting Oct. 19.

For information contact Mallory Weaver, marketing director at Eagle River, at 720-726-6093 or mweaver@eagleriverea.com.

Eagle River is an A&D advisory firm focused exclusively on the North American oil and gas sector. The firm specializes in middle-market transactions ranging from $5 million to $200 million. Eagle River has a team of industry professionals with diverse backgrounds in finance, land, business development, engineering and geology.

Recommended Reading

Going with the Flow: Universities, Operators Team on Flow Assurance Research

2024-03-05 - From Icy Waterfloods to Gas Lift Slugs, operators and researchers at Texas Tech University and the Colorado School of Mines are finding ways to optimize flow assurance, reduce costs and improve wells.

Axis Energy Deploys Fully Electric Well Service Rig

2024-03-13 - Axis Energy Services’ EPIC RIG has the ability to run on grid power for reduced emissions and increased fuel flexibility.

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.