The following information is provided by BMO Capital Markets Corp. All inquiries on the following listings should be directed to BMO Capital Markets. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Juno Energy III retained BMO Capital Markets as exclusive financial adviser for the sale of its Permian Basin assets.

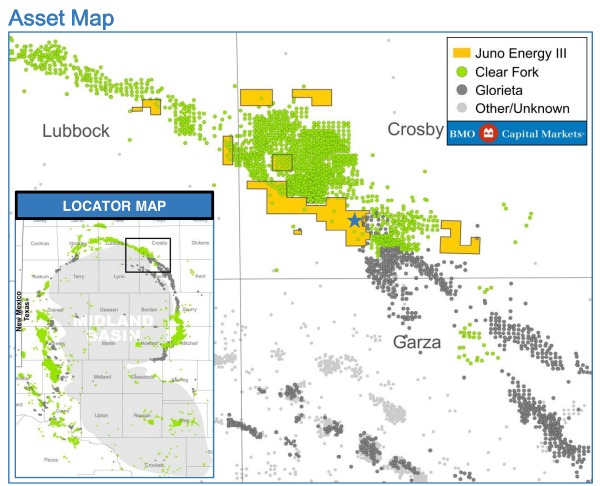

The offering includes a high-quality anchor asset in the heart of the Midland Basin’s Eastern Shelf in Crosby and Lubbock counties, Texas, with multiple stacked pay potential, according to BMO.

Highlights:

- Long-life, shallow decline oil assets located in the prolific Clear Fork oil trend of the Permian Basin

- Largely contiguous 10,250 net acre position located in the Hoople Field in Crosby and Lubbock counties, Texas

- 100% operated with high working interest (100%) and net revenue interest (more than 75%)

- Favorable leasehold position with little-to-no drilling obligations until 2021; more than 50% of acreage position under two leases from one landowner

- Current production of about 300 net barrels per day of oil (100% oil) with significant remaining drilling inventory consisting of roughly more than 200 low-risk Clear Fork locations

- Asset provides substantial, economic running room for organic and acquisitive growth

- Existing Clear Fork acreage only about 15% developed based on 10-acre development plan

- Additional upside through five-acre development, secondary recovery and Glorieta development as demonstrated in offsetting acreage; CO2 and Wolfcamp potential

- Multiple bolt-on acquisition opportunities and new leasing opportunities

- Existing Clear Fork acreage only about 15% developed based on 10-acre development plan

- Acreage position largely delineated through existing and offset development; full-scale development plan in place with drill-ready infrastructure

The virtual data room will be available in late February with data room presentations beginning in March.

For information on this listing contact Chelsea Neville at juno.permian@bmo.com or 713-546-9703.

Recommended Reading

Commentary: Are Renewable Incentives Degrading Powergen Reliability?

2024-02-01 - A Vistra Corp. chief, ERCOT’s vice chairman and a private investor talk about what’s really happening on the U.S. grid, and it’s not just a Texas thing.

Veriten’s Arjun Murti: Oil, Gas Prospectors Need to Step Up—Again

2024-02-08 - Arjun Murti, a partner in investment and advisory firm Veriten, says U.S. shale provided 90% of global supply growth—but the industry needs to reinvent itself, again.

Heard from the Field: US Needs More Gas Storage

2024-03-21 - The current gas working capacity fits a 60 Bcf/d market — but today, the market exceeds 100 Bcf/d, gas executives said at CERAWeek by S&P Global.

Liberty Energy CEO: NatGas is Here to Stay as Energy Transition Lags

2024-03-27 - The energy transition hasn’t really begun given record levels of global demand for oil, natural gas and coal, Liberty Energy Chairman and CEO Chris Wright said during the DUG GAS+ Conference and Expo.

Exclusive: Chevron Balancing Low Carbon Intensity, Global Oil, Gas Needs

2024-03-28 - Colin Parfitt, president of midstream at Chevron, discusses how the company continues to grow its traditional oil and gas business while focusing on growing its new energies production, in this Hart Energy Exclusive interview.