The following information is provided by TenOaks Energy Advisors LLC. All inquiries on the following listings should be directed to TenOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

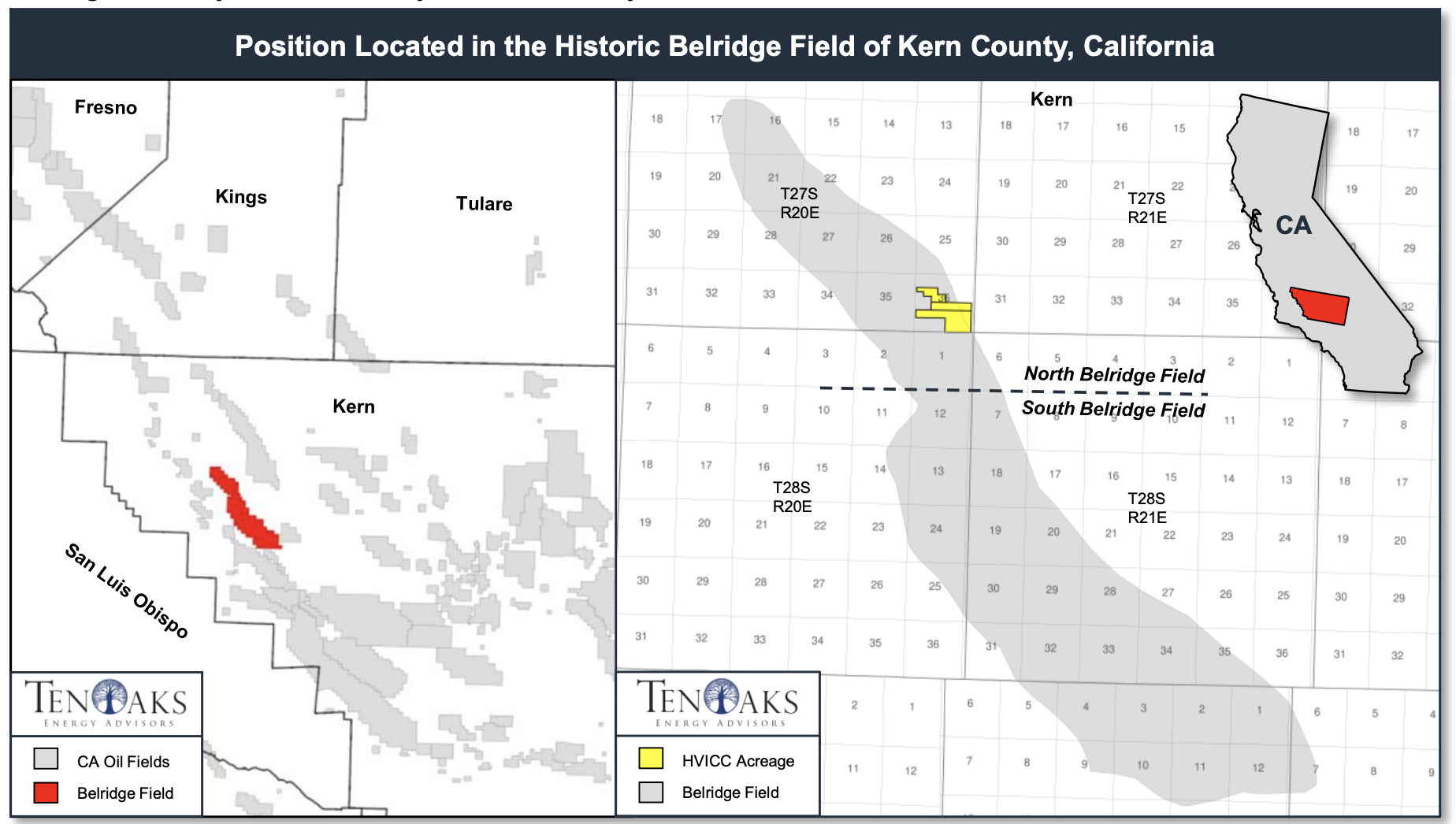

HVI Cat Canyon Inc. (HVICC) is offering for sale certain conventional oil properties located in the North Belridge Field of California's San Joaquin Valley.

In addition to this North Belridge sale, TenOaks Energy Advisors has been retained by HVICC in connection with the potential sale of all the assets of the company. All sales will be conducted pursuant to section 363 of the Bankruptcy Code following a voluntary Chapter 11 filing made by HVICC on July 25, 2019.

Highlights:

- North Belridge Sale Properties

- 270 gross/net acre position (100% HBP)

- Projected April 2020 net production of 60 bbl/d of oil from the Tulare and Diatomite formations

- Projected April 2020 LOE per barrel: $14.27/bbl

- Complete operational control (100% Working Interest) allows for flexible development and ease of project implementation

- HVICC is currently in the process of returning multiple wells to production

- 18 wells have been identified in the return to production (RTP) program

- Upside potential exists from various proven oil zones including the Tulare, Diatomite and Sub-Monterey

- All Other HVICC Properties

- About 570 gross bbl/d of oil, primarily in the Santa Maria Valley

- Legacy fields in the Santa Maria Valley that have been historically under capitalized

- Exceptional value potential from multiple RTP opportunities

Offers are due by April 29. The transaction is expected to have an April 1 effective date.

For information visit tenoaksenergyadvisors.com or contact Lindsay Sherrer at TenOaks Energy Advisors at 214-420-2324 or Lindsay.Sherrer@tenoaksadvisors.com.

Recommended Reading

Balticconnector Gas Pipeline Will be in Commercial Use Again April 22, Gasgrid Says

2024-04-17 - The Balticconnector subsea gas link between Estonia and Finland was damaged in October along with three telecoms cables.

Targa Resources Ups Quarterly Dividend by 50% YoY

2024-04-12 - Targa Resource’s board of directors increased the first-quarter 2024 dividend by 50% compared to the same quarter a year ago.

Canada’s First FLNG Project Gets Underway

2024-04-12 - Black & Veatch and Samsung Heavy Industries have been given notice to proceed with a floating LNG facility near Kitimat, British Columbia, Canada.

Biden Administration Argues Against Enbridge Pipeline Shutdown Order

2024-04-11 - The U.S. argues that shutting down the pipeline could interrupt service and violate a 1977 treaty between the U.S. and Canada to keep oil flowing.