The following information is provided by PetroDivest Advisors. All inquiries on the following listings should be directed to PetroDivest. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

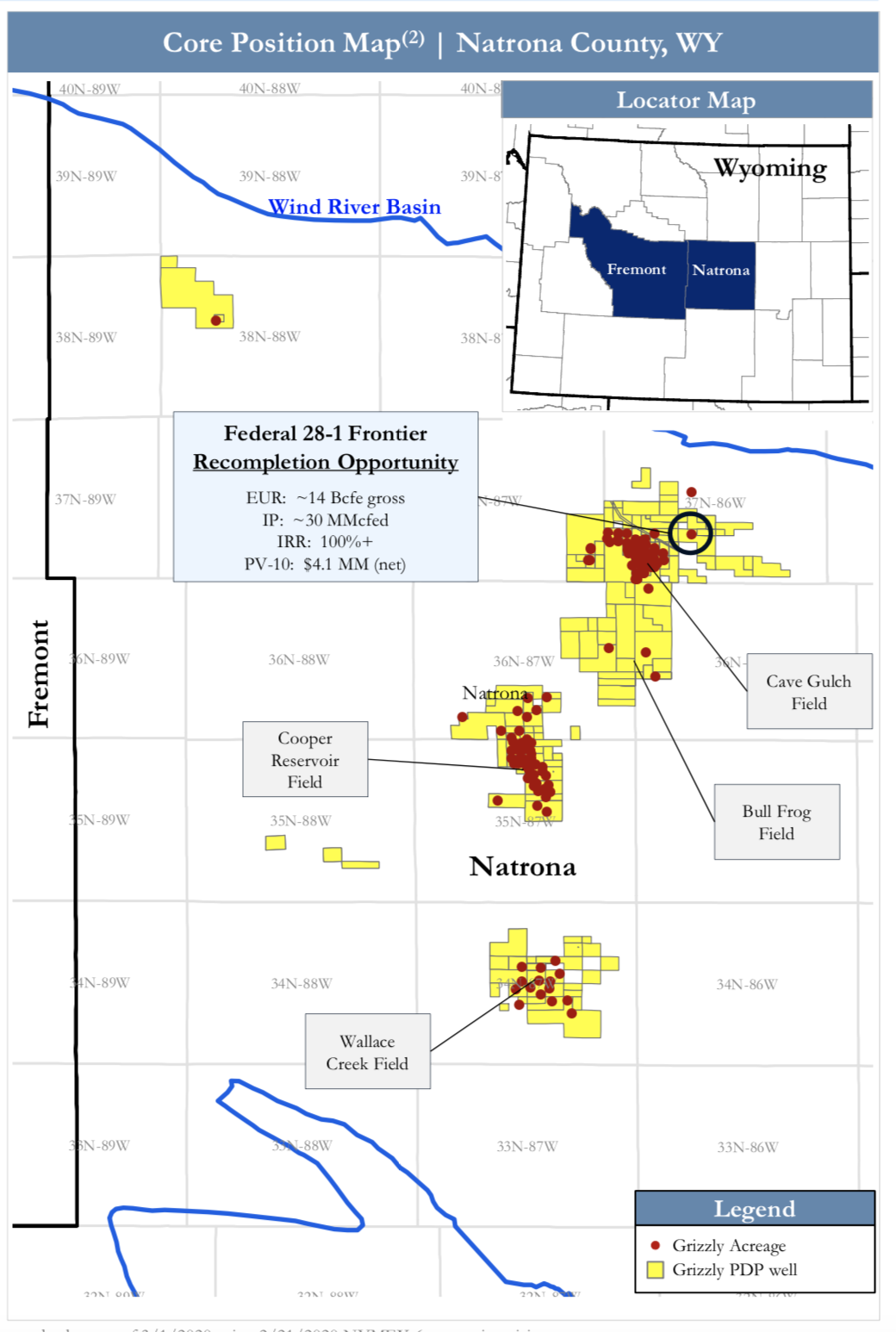

Grizzly Energy LLC is offering for sale its oil and gas producing properties, leasehold and related assets in the Wind River Basin located in Wyoming's Fremont and Natrona counties, according to PetroDivest Advisors, which has been retained by Grizzly as its exclusive adviser related to the transaction.

The sale represents a basin-wide exit consisting of a large, operated position supported by a low-decline production and cash flow base with high-quality behind-pipe opportunities, PetroDivest said.

Highlights:

- Low-Decline Production With Roughly 9% Decline

- Stable production base yielding significant cash flow

- About 6 million cubic feet equivalent per day (roughly 12% liquids)

- About 22 billion cubic feet equivalent (Bcfe) net reserves

- Roughly $900,000 next 12-month proved developed producing (PDP) cash flow

- About $8.9 million PDP PV-10%

- Highly delineated position with 136 operated and seven nonoperated producing wells

- Operated wells contribute over 98% of the daily net production and cash flow

- Six injection wells, gas gathering system and compressors included with sale

- Stable production base yielding significant cash flow

- Acreage Position With Material Development And Operational Upside

- About 30,200 gross (19,000 net) acres

- 100% HBP

- High net revenue interests of about 81% for Grizzly operated position

- Low-cost behind-pipe opportunities in the Frontier, Lakota and Raderville sands

- Reserves include four immediately actionable recompilations offering about 11 Bcfe net reserves and roughly $6.6 million PV-10 value with detailed technical support

- Additional, unquantified opportunities in the Muddy and Shannon formations

- Long-life, mature gas field with ample operational efficiencies and cost reduction measures to implement

- Limited recent capital investment leaves significant upside remaining

- About 30,200 gross (19,000 net) acres

Bids are due April 8. The virtual data room opens March 9.

For information visit petrodivest.com or contact Jerry Edrington, director of PetroDivest, at jerry@petrodivest.com or 713-595-1017.

Recommended Reading

NextEra Energy Dials Up Solar as Power Demand Grows

2024-04-23 - NextEra’s renewable energy arm added about 2,765 megawatts to its backlog in first-quarter 2024, marking its second-best quarter for renewables — and the best for solar and storage origination.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Enverus: Q1 Upstream Deals Hit $51B, But Consolidation is Slowing

2024-04-23 - Oil and gas dealmaking continued at a high clip in the first quarter, especially in the Permian Basin. But a thinning list of potential takeout targets, and an invigorated Federal Trade Commission, are chilling the red-hot M&A market.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

Ithaca Energy to Buy Eni's UK Assets in $938MM North Sea Deal

2024-04-23 - Eni, one of Italy's biggest energy companies, will transfer its U.K. business in exchange for 38.5% of Ithaca's share capital, while the existing Ithaca Energy shareholders will own the remaining 61.5% of the combined group.