The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Grizzly Energy LLC retained EnergyNet for the sale of a package of Anadarko Northwest Texas assets through a sealed-bid offering closing Nov. 14.

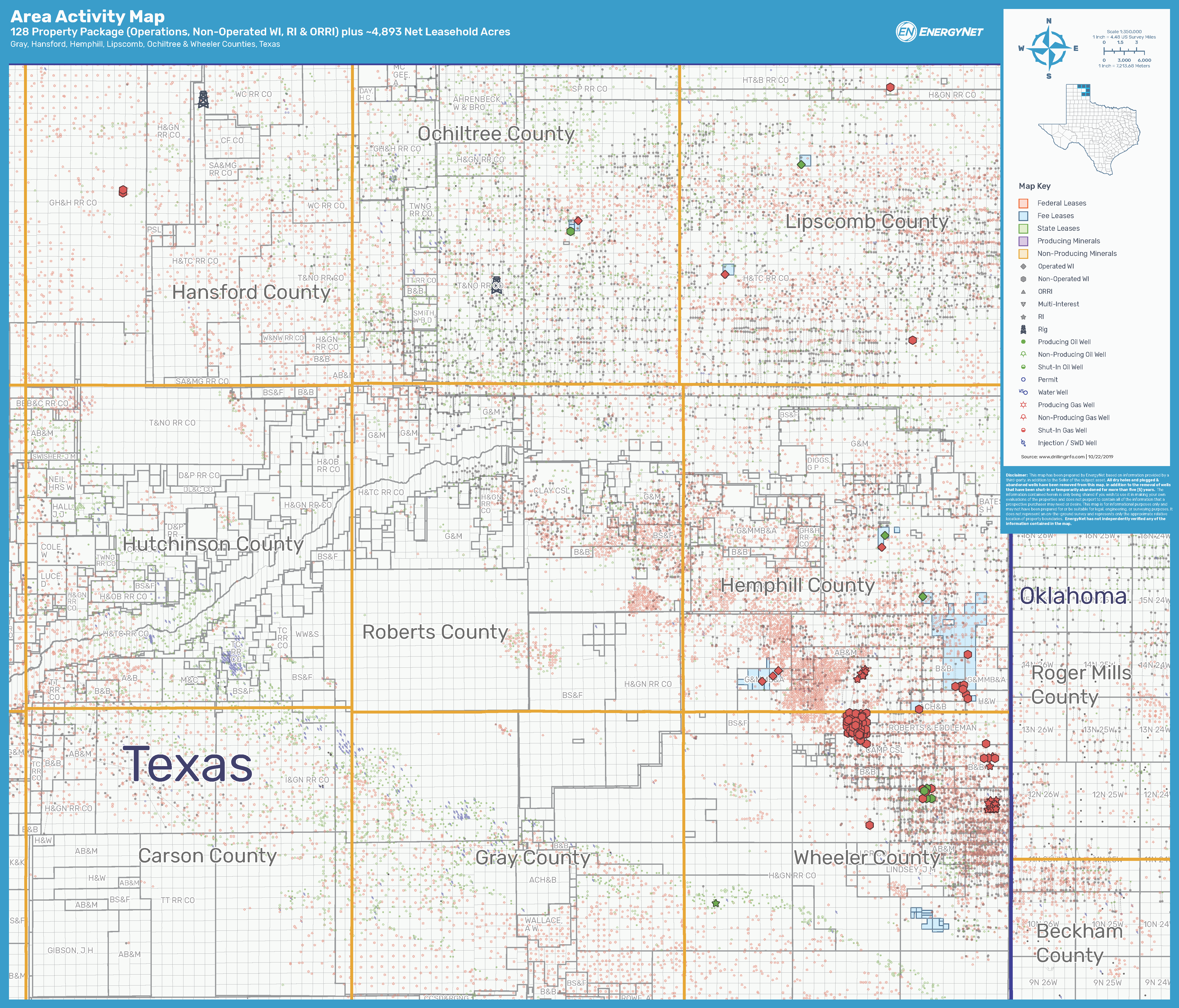

The offering comprises operations, non-operated working interest, royalty interest and overriding royalty interest (ORRI) in 128 properties plus leasehold acreage located in Gray, Hansford, Hemphill, Lipscomb, Ochiltree and Wheeler counties, Texas.

Highlights:

- Operations in 10 Wells:

- 100.00% to 70.62503% Working Interest / 81.25% to 57.381683% Net Revenue Interest

- Seven Producing Wells | Three Shut-In Wells

- Nonoperated Working Interest in 89 Wells:

- 36.00% to 0.3094% Working Interest / 27.00% to 0.267053% Net Revenue Interest (After Payout)

- 58 Producing Properties | 31 Non-Producing Properties

- 11 Wells are After Payout Only

- Select Operators include 4P Energy Texas LLC, Le Norman Operating LLC and Tecolote Energy LLC

- Royalty or ORRI in 28 Properties (Multiple Wells):

- 1.5625% to 0.030502% Royalty Interest/ORRI

- 21 Producing Properties | 7 Non-Producing Properties

- Select Operators include 4P Energy Texas LLC, RKI Energy Resources LLC and Tecolote Energy LLC

- Unknown Interest in the Reed 3 Well

- 12-Month Average Net Income: $31,685 per Month

- Six-Month Average 8/8ths Production: 313 barrels per day of Oil and 12.937 million cubic feet per day of Gas

- 4,893.92 Net Leasehold Acres

Grizzly Energy is the new moniker of Vanguard Natural Resources. Following the completion of a financial restructuring in July, Vanguard emerged with the new name as well as a new focus on operating long-lived producing properties primarily in the Rockies, Permian Basin and Midcontinent regions.

Bids are due for Grizzly's Anadarko Northwest Texas package by 4 p.m. Nov. 14.

The company also has two more packages on the market through EnergyNet comprised of sealed-bid opportunities in the Northern Scoop/Stack, Sourthern Scoop/Stack and Anadarko Southeast.

For more information on the offering as well as other opportunities visit energynet.com or email Heidi Epstein, manager of business development, at Heidi.Epstein@energynet.com, or Denna Arias, director of transaction management, at Denna.Arias@energynet.com.

Recommended Reading

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

Why Endeavor Energy's Founder Sold His Company After Years of Rebuffing Offers

2024-02-13 - Autry Stephens', the 85-year-old wildcatter, decision to sell came after he was diagnosed with cancer, according to three people who discussed his health with him.

Chevron Adds to Carbon Capture Tech Portfolio with ION Investment

2024-04-04 - Chevron New Energies led a funding round that raised $45 million in Series A financing for ION Clean Energy, according to a news release.

Sunoco’s $7B Acquisition of NuStar Evades Further FTC Scrutiny

2024-04-09 - The waiting period under the Hart-Scott-Rodino Antitrust Improvements Act for Sunoco’s pending acquisition of NuStar Energy has expired, bringing the deal one step closer to completion.

President: Financial Debt for Mexico's Pemex Totaled $106.8B End of 2023

2024-02-21 - President Andres Manuel Lopez Obrador revealed the debt data in a chart from a presentation on Pemex at a government press conference.