The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

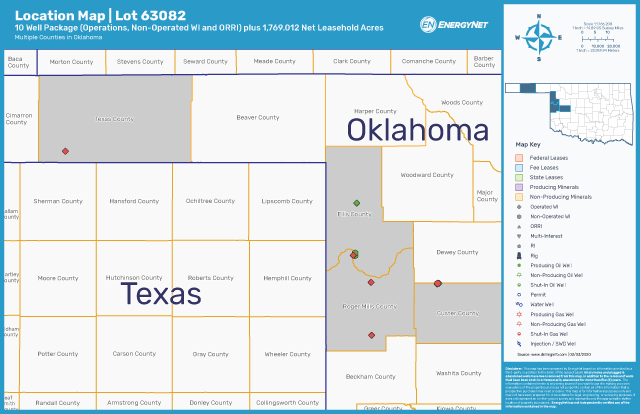

Grizzly Energy LLC retained EnergyNet for the sale of Anadarko Basin assets in northwest Oklahoma through a sealed-bid offering closing March 25.

The offering includes operations, nonoperated working interest and overriding royalty interest (ORRI) in a 10-well package plus leasehold acreage located in Oklahoma's Custer, Ellis, Roger Mills and Texas counties.

Highlights:

- Operations in Six Wells:

- 100.00% to 37.50% Working Interest / 78.0313% to 28.875% Net Revenue Interest

- Three Producing Wells | Three Shut-In Wells

- An Additional ORRI in Three Wells

- Nonoperated Working Interest in Three Wells:

- 34.972476% to 1.038711% Working Interest / 27.872032% to 0.59172% Net Revenue Interest

- Two Producing Wells | One Non-Producing Well

- An Additional ORRI in All Three Wells

- Operators include Excalibur Resources LLC, Smith L & L Energy Corp. and Templar Operating LLC

- ORRI in the BMB 3H-6 Producing Well:

- 4.405325% ORRI

- Operator: Templar Operating, LLC

- Six-Month Average Net Income: $7,427/Month

- Six-Month Average 8/8ths Production: 25 barrels per day of Oil and 342,000 cubic feet per day of Gas

- 1,769.012 Net Leasehold Acres

Bids are due by 4 p.m. CT March 25. For complete due diligence information visit energynet.com or email Heidi Epstein, manager of business development, at Heidi.Epstein@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

McDermott Consortia Scoops Up Two Ruya Project Contracts

2024-02-01 - The EPCIC contracts support the expansion of the offshore Al-Shaheen Field, Qatar’s largest oil field.

E&P Highlights: April 1, 2024

2024-04-01 - Here’s a roundup of the latest E&P headlines, including new contract awards.

E&P Highlights: Jan. 29, 2024

2024-01-29 - Here’s a roundup of the latest E&P headlines, including activity at the Ichthys Field offshore Australia and new contract awards.

Deepwater Roundup 2024: Offshore Australasia, Surrounding Areas

2024-04-09 - Projects in Australia and Asia are progressing in part two of Hart Energy's 2024 Deepwater Roundup. Deepwater projects in Vietnam and Australia look to yield high reserves, while a project offshore Malaysia looks to will be developed by an solar panel powered FPSO.

Deepwater Roundup 2024: Offshore Africa

2024-04-02 - Offshore Africa, new projects are progressing, with a number of high-reserve offshore developments being planned in countries not typically known for deepwater activity, such as Phase 2 of the Baleine project on the Ivory Coast.