The following information is provided by UBS Securities LLC. All inquiries on the following listings should be directed to UBS. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

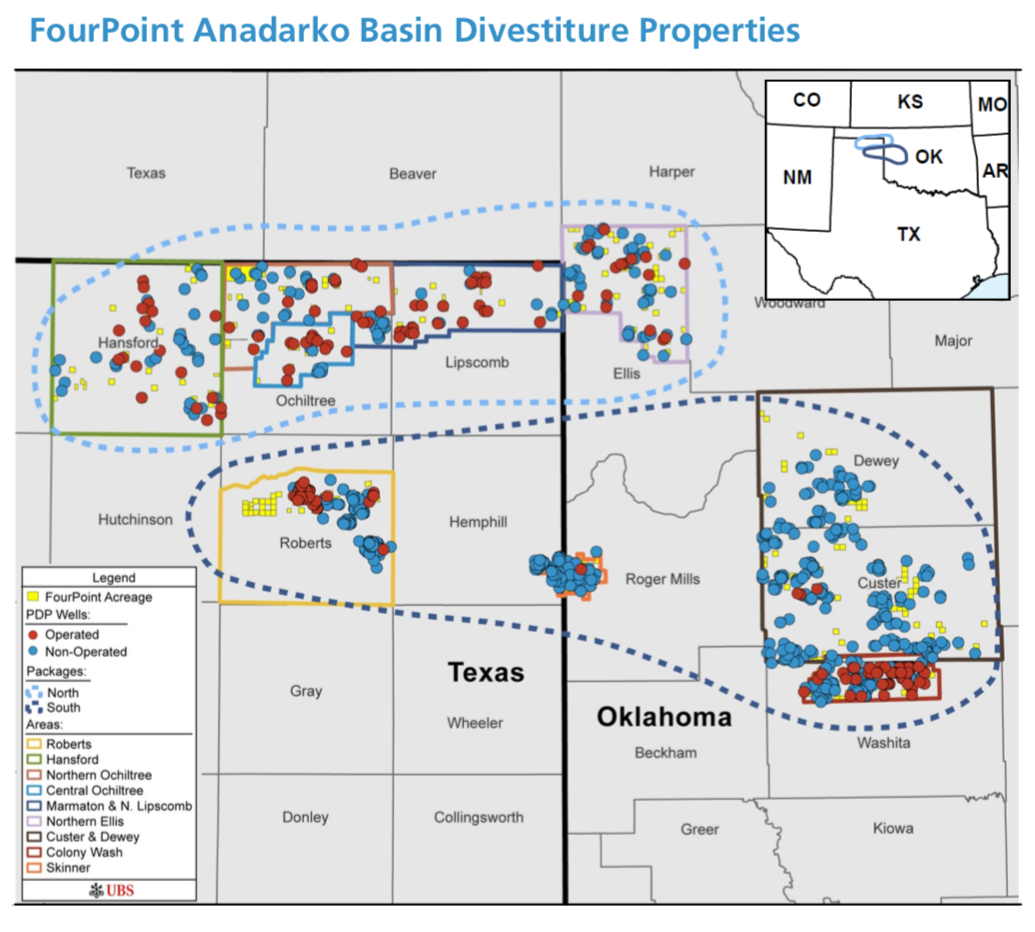

FourPoint Energy LLC retained UBS Securities LLC for the sale of noncore assets located in the Anadarko Basin across Oklahoma and the Texas Panhandle.

Bids are due by late September. FourPoint's preference is to sell the properties in a single cash transaction but will seriously consider offers on individual areas and/or packages, according to UBS, which is serving as the company's exclusive financial adviser for the transaction.

Highlights:

- Opportunity to acquire a diverse portfolio of long-life assets across the Anadarko Basin

- Substantial lease position of about 100,000 net acres (greater than 99% HBP)

- Strong net production of

- 18.0 million cubic feet equivalent per day (based on estimated next 12 months) from 200 FourPoint-operated and 640 nonoperated active wells

- Significant annual net cash flow of $11.5 million (based on estimated next 12 months)

- Average operated Proved Developed Producing (PDP) Working Interest / Net Revenue Interest of 78% / 62% (about 80.5 Net Revenue Interest ratio); average total Working Interest / Net Revenue Interest of 28% / 23%

- Large, operated PDP component provides significant COPAS income of about $85,000 per month net

- Diversified PDP production with predictable, low declines

- Inventory of about 125 economic horizontal and vertical development opportunities

- North Package features predominantly Cleveland production and upside opportunities

- South Package features mostly Granite Wash and Skinner Sands production and opportunities

UBS said the transaction effective date is July 1. An online virtual data room is available. Contact UBS at FourPointNonCore@ubs.com for information.

Recommended Reading

Deepwater Roundup 2024: Offshore Europe, Middle East

2024-04-16 - Part three of Hart Energy’s 2024 Deepwater Roundup takes a look at Europe and the Middle East. Aphrodite, Cyprus’ first offshore project looks to come online in 2027 and Phase 2 of TPAO-operated Sakarya Field looks to come onstream the following year.

E&P Highlights: April 15, 2024

2024-04-15 - Here’s a roundup of the latest E&P headlines, including an ultra-deepwater discovery and new contract awards.

Trio Petroleum to Increase Monterey County Oil Production

2024-04-15 - Trio Petroleum’s HH-1 well in McCool Ranch and the HV-3A well in the Presidents Field collectively produce about 75 bbl/d.

Trillion Energy Begins SASB Revitalization Project

2024-04-15 - Trillion Energy reported 49 m of new gas pay will be perforated in four wells.

Exxon Ups Mammoth Offshore Guyana Production by Another 100,000 bbl/d

2024-04-15 - Exxon Mobil, which took a final investment decision on its Whiptail development on April 12, now estimates its six offshore Guyana projects will average gross production of 1.3 MMbbl/d by 2027.