The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Four Corners Petroleum II LLC retained Detring Energy Advisors LLC to market for sale Central Basin Platform asset packages within the Permian.

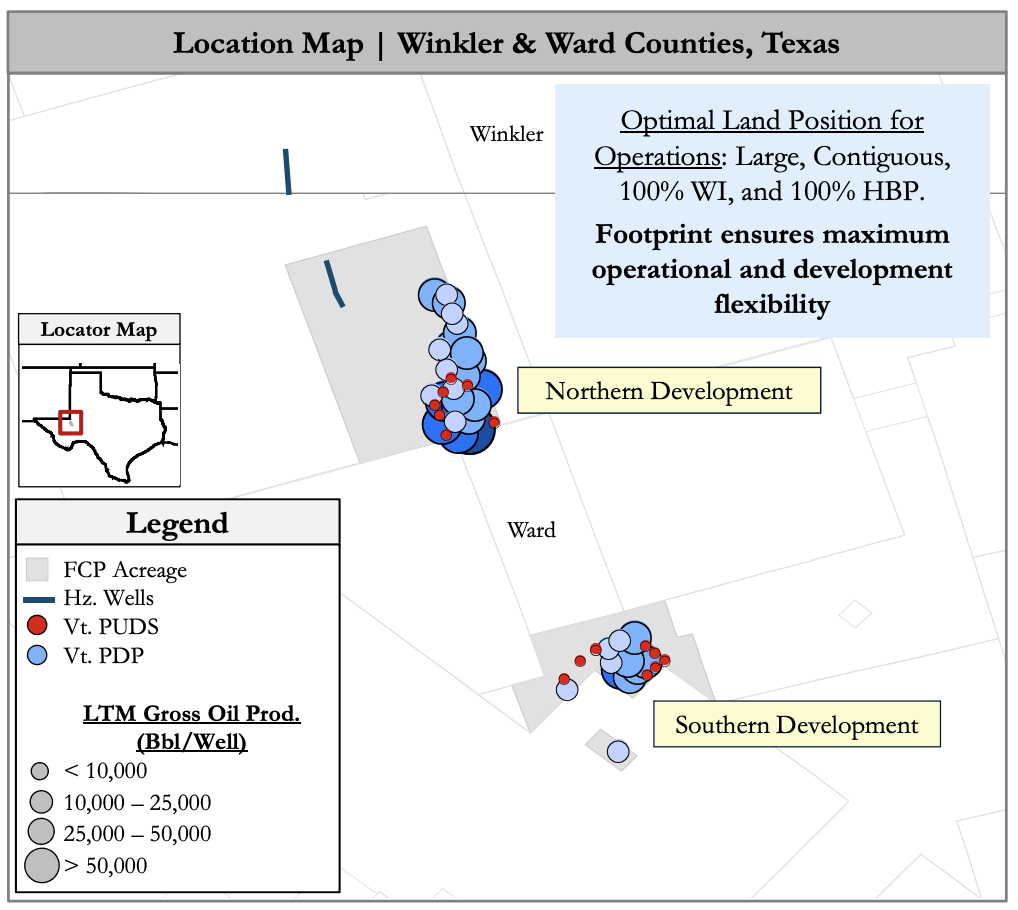

The offering includes oil and gas leasehold, royalty and related assets located in Ward and Winkler counties, Texas, in two sub-packages: working interest and royalties.

Detring said the assets offer an opportunity to acquire durable, high-margin cash flow due to efficient operations and advantaged marketing agreements; a differentiated investment portfolio that strikes an optimal balance between concentration risk and operational scope; and a turn-key operational platform to serve as a base for additional development expansion.

Highlights:

- Robust Operating Cash Flow ($12.4 million next 12-month PDP) and Production (2,100 boe/d)

- Working Interest Package:

- 38 PDP wells

- $11.5 million next 12-month PDP cash flow

- PV-10 and reserves of $47 million and 4.7 million boe, respectively (PDP)

- Royalties Package:

- 36 PDP wells (FCP op. only)

- $900,000 next 12-month PDP cash flow

- PV-10 and reserves of $4 million and 275,000 boe, respectively (PDP)

- Total Package:

- 38 PDP wells

- PV-10 and reserves of $51 million and 5 million boe, respectively (PDP)

- Working Interest Package:

- Optimal land position ensures maximum operational and development flexibility

- About 14,000 net acres

- 100% HBP / 100% Working Interest

- Depths primarily from the base of the Queen to the top of the Barnett

- Large, contiguous position ideal for operations with no CDO’s, Pugh clauses, or acreage retention provisions

- Low risk, repeatable development locations underpinned by extensive geologic analysis of key subsurface drivers of the Pennsylvanian

- Northern Development

- Seven remaining PUD locations

- 25%-plus IRR at $50/$2.50 flat pricing

- Southern Development

- Eight remaining PUD locations

- 15%-plus IRR at $50/$2.50 flat pricing

- All locations are offset by current PDP wells/production

- Additionally 56 PDNP opportunities have been identified, and 1.5 million barrels of oil upside potential exists in a pre-scoped waterflood project

- Northern Development

Process Summary:

- Evaluation materials available via the Virtual Data Room on Nov. 4

- Proposals due on Dec. 9

- Bids will be requested by package (Working Interest and Royalties) with preference given to offers for the combined position

For information visit detring.com or contact Melinda Faust at mel@detring.com or 512-296-4653.

Recommended Reading

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

Petrie Partners: A Small Wonder

2024-02-01 - Petrie Partners may not be the biggest or flashiest investment bank on the block, but after over two decades, its executives have been around the block more than most.

CEO: Magnolia Hunting Giddings Bolt-ons that ‘Pack a Punch’ in ‘24

2024-02-16 - Magnolia Oil & Gas plans to boost production volumes in the single digits this year, with the majority of the growth coming from the Giddings Field.

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.

Nebula Energy Buys Majority Stake in AG&P LNG

2024-01-31 - AG&P will now operate as an independent subsidiary of Nebula Energy with key offices in UAE, Singapore, India, Vietnam and Indonesia.