Permian Basin oil and gas properties throughout West Texas are for sale in five separate, sealed-bid offerings being handled by EnergyNet.

The offerings comprise operated and nonop interests, HBP leasehold acreage and producing wells. Sellers consist of Energy Properties 2000-I LLC, Jones Energy Inc. (NYSE: JONE), Bold Energy II LLC, Fletcher Exploration LLC and Monadnock Resources LLC.

The assets are in Gaines, Irion, Reeves, Upton and Yoakum counties, Texas, and some offers include Wolfcamp rights.

For information visit energynet.com or contact EnergyNet’s Denna Arias at 281-949-8463.

Energy Properties—Gaines County

Energy Properties 2000-I is selling its working interests, overriding royalty and royalty interests in the ODC (San Andres) Unit and the W.J. Taylor "A" lease, including 1,226 gross HBP acres, in Gaines.

Highlights:

- 41.45959% working interest, 34.743488% net revenue interest, 0.006602% overriding royalty interest, 0.211067% royalty interest in the ODC (San Andres) Unit;

- 25 producing and 20 injector wells;

- 48% working interest, 41.51% net revenue interest and 0.331614% royalty interest in the W.J. Taylor "A" Lease;

- One producing and one disposal well;

- Six-month average 8/8ths production of 148 barrels per day (bbl/d) of oil and 50,000 cubic feet per day (Mcf/d) of gas;

- Six-month average net income of $29,508 per month;

- 1,226 gross acres/HBP acreage; and

- Operated by Denver-based Wilbanks Reserve Corp.

Upon closing of the sale of Energy Properties’ interest, Wilbanks Reserve will agree in writing to resign as operator, according to EnergyNet.

Sealed-bids are due by 4 p.m. CST July 19 and can be emailed at Ryan Dobbs, vice president of business development for EnergyNet.

Jones—Reeves County

Jones Energy is selling its operated working interest in two wells and nonoperated working interest in 13 wells, plus leasehold acreage covering about 1,353.028 net acres in Reeves.

Highlights:

- 6,227.8 gross (1,353.028 net) leasehold acres;

- Depths including Wolfcamp comprise 793.535 net acres;

- Deeper formations comprise 559.493 net acres;

- Average net revenue interest of 75%;

- Operations in two producing wells;

- 75% gross working interest and 56.25%-59.587614% net revenue interest;

- Nonoperated working interest in 13 producing wells;

- 2.623958%-12.150555% working interest and 1.979592%-8.897707% net revenue interest;

- Operated by COG Operating LLC, an affiliate of Cabot Oil & Gas Corp. (NYSE: COG); and

- Six-month average 8/8ths production of 1.985 MMcf/d.

Sealed-bids are due by 4 p.m. CST July 20 and can be emailed to Cody Felton, business development manager for EnergyNet.

Bold Energy—Irion County

Bold Energy II is selling its nonoperated working interest in more than 15 wells as well as associated leasehold acreage in Irion.

Highlights:

- 5%-20% gross working interest and 3.75%-16% net revenue interest;

- 17 producing wells;

- Two permitted wells;

- 10,040 gross (2,008 net) leasehold acres;

- 10-month average net income of $18,429 per month;

- Current average 8/8ths production of 388 bbl/d of oil and 2.338 MMcf/d of gas; and

- Operated by Discovery Natural Resources LLC.

Sealed-bids are due by 4 p.m. CST July 20 and can be emailed to Lindsay Ballard, business development manager for EnergyNet.

Fletcher—Upton County

Fletcher Exploration is selling its leasehold position covering about 1,040 gross (880 net) acres and its 100% gross working interest with operations in six wells in Upton.

Highlights:

- 1,040 gross (880 net) leasehold acres;

- 100% gross working interest and 75% net revenue interest in six wells;

- Three Emerald wells producing and two wells shut-in;

- Aquamarine lease (one well currently shut-in) in primary term until February 2018;

- Six-month average 8/8ths production of 16 Mcf/d of gas and 1 bbl/d of oil;

- Natural gas pipeline on site and tied in;

- 6,000-bbl facility in “like new” condition, according to Fletcher Exploration;

- Option on about 4,000 acres to lease; and

- Potential upside in the Clearfork, Spraberry, Wolfcamp A, B, C, Atoka and Devonian formations.

Sealed-bids are due by 4 p.m. CST July 20 and can be emailed to EnergyNet’s Felton.

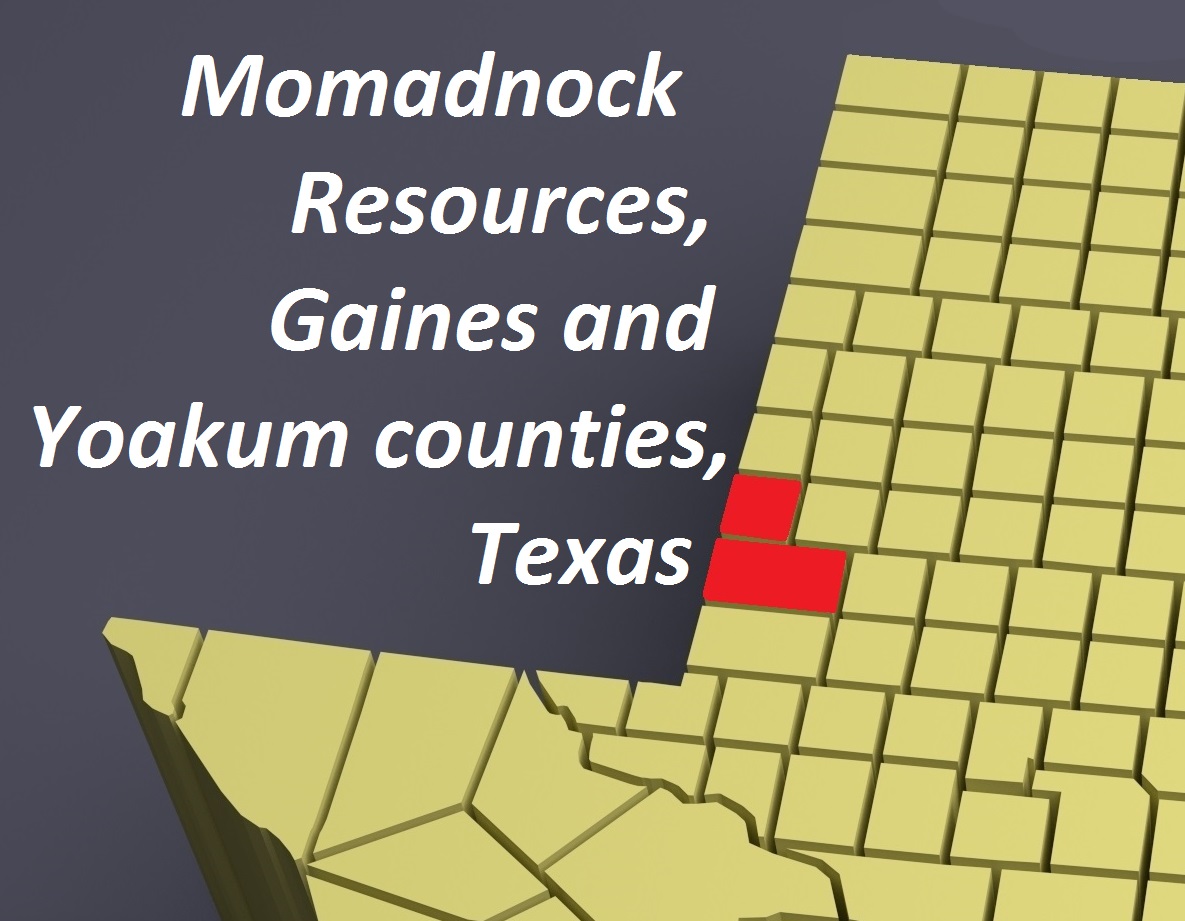

Momadnock—Gaines and Yoakum Counties

Monadnock Resources is offering its non-producing leasehold position covering about 11,059.39 gross/net acres in northwest Gaines and southwest Yoakum.

Highlights:

- 100% working interest in 11,059.39443867 gross/net acres;

- Includes 25% interest leased by Double Eagle Andrews;

- Leases can be held by running more than one rig per year;

- 33 total leases;

- 14 leases contain continuous drilling clauses (6,698 net acres);

- 21 leases have two-year extensions (3,757 net acres);

- Three leases have five-year primary terms (60 net acres);

- Extension of the Wasson Field (cumulative production of 1,840 million bbl of oil);

- Shallow objective (5,250 ft total vertical depth) and low development well cost ($2.3 million per well);

- 70% internal rate of return type well at $50/bbl (flat), EnergyNet said; and

- Horizontal San Andres activity offsets the assets.

Sealed-bids are due by 4 p.m. CST July 22 and can be emailed to Michael Baker, business development manager for EnergyNet.

Recommended Reading

Energy Transition in Motion (Week of March 22, 2024)

2024-03-22 - Here is a look at some of this week’s renewable energy news, including a new modeling tool for superhot rock.

Tax Credit’s Silence on Blue Hydrogen Adds Uncertainty

2024-01-31 - Proposed rules for the 45V hydrogen production tax credit leave blue hydrogen up in the air, but producers planning to use natural gas with carbon capture and storage have options.

DOE Considers Technip, LanzaTech For $200MM ‘Breakthrough’ Technology Award

2024-03-25 - The U.S. Department of Energy funding will be used to develop technology that turns CO2 into sustainable ethylene.

CEO: Linde Not Affected by Latest US Green Subsidies Package Updates

2024-02-07 - Linde CEO Sanjiv Lamba on Feb. 6 said recent updates to U.S. Inflation Reduction Act subsidies for clean energy projects will not affect the company's current projects in the United States.

Exclusive: ‘Reality Has Hit,’ NatGas Not Just a Bridge Fuel, Landrieu Says

2024-04-11 - The Biden administration's LNG pause is "disappointing" and natural gas is a "solution to energy woes," co-chairs for Natural Allies for a Clean Energy Future Senator Mary Landrieu and Congressman Kendrick Meek told Hart Energy's Jordan Blum at CERAWeek by S&P Global.