The following information is provided by TenOaks Energy Advisors LLC. All inquiries on the following listings should be directed to TenOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Felix Energy Holdings II LLC retained TenOaks Energy Advisors LLC for the sale of certain Delaware Basin nonoperated producing properties through an offering closing Oct. 10.

Highlights:

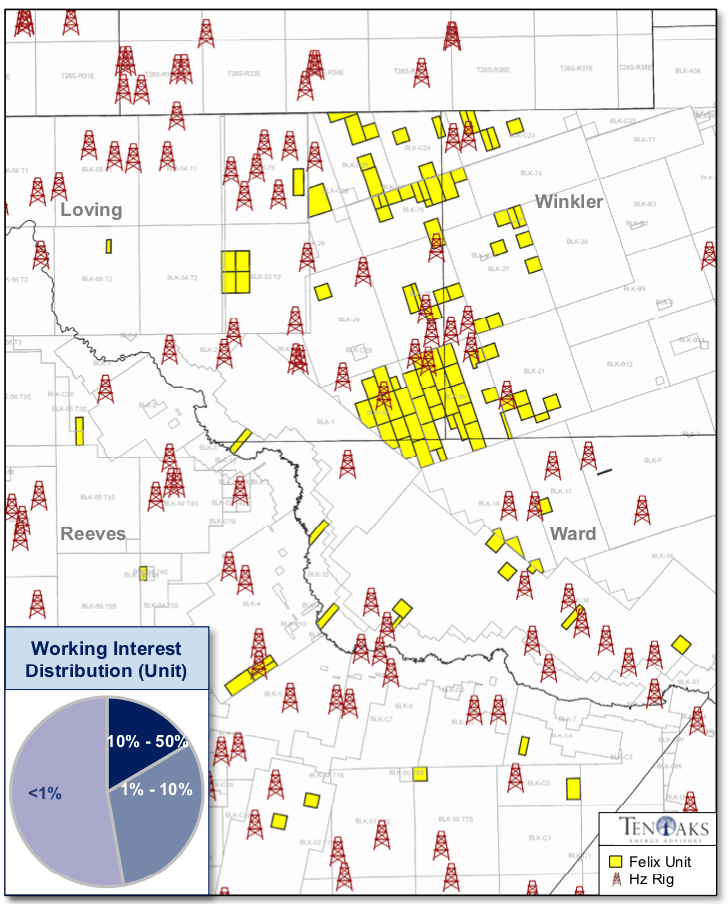

- Nonop Index Fund Across the Delaware Basin

- 2,700 net acres / Loving, Winkler, Ward and Reeves Counties, Texas

- Net production: about 720 barrels of oil equivalent per day (65% oil) from 200 wells

- Last 12-Month net cash flow: $550,000 per month

- 61 spuds since January 2018

- 32 Drilled but Uncompleted Wells / 20 Permits provide near-term growth

- Key Operators Among Delaware Basin leaders

- Mewbourne Oil Co., Callon Petroleum Co., EOG Resources Inc., Royal Dutch Shell Plc and Concho Resources Inc.

- Historical actuals average at or below AFE’s (authority for expenditure) for key operators

Bids are due by noon CST Oct. 10. For information visit tenoaksenergyadvisors.com or contact Lindsay Sherrer, TenOaks partner, at 214-420-2324 or Lindsay.Sherrer@tenoaksadvisors.com.

Recommended Reading

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.

Tethys Oil Releases March Production Results

2024-04-17 - Tethys Oil said the official selling price of its Oman Export Blend oil was $78.75/bbl.

Exxon Mobil Guyana Awards Two Contracts for its Whiptail Project

2024-04-16 - Exxon Mobil Guyana awarded Strohm and TechnipFMC with contracts for its Whiptail Project located offshore in Guyana’s Stabroek Block.