The following information is provided by PetroDivest Advisors. All inquiries on the following listings should be directed to PetroDivest. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Fairway Resources III LLC retained PetroDivest Advisors for the sale of Midcontinent leasehold across the Western Anadarko Basin in Oklahoma with bids due June 26.

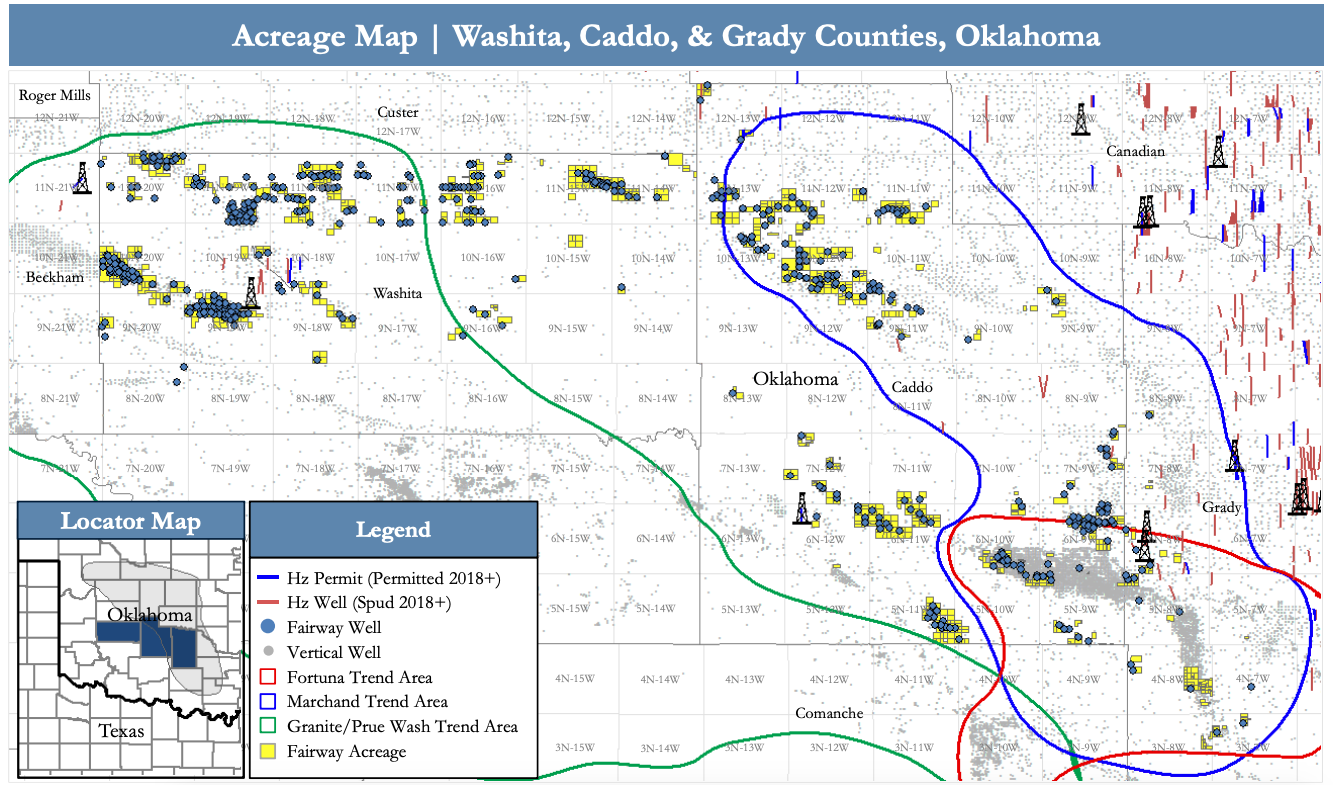

The assets comprise operated and nonoperated working interests in Washita, Caddo and Grady counties, Okla. PetroDivest, which is marketing the assets for Fairway, said the package includes a stable production base with long-term consistent cash flow overlapping future horizontal development opportunities and legacy vertical plays including the Springer, Prue, Atoka, Marchand and Hoxbar.

Highlights:

- 28,868 Net Acres roughly 100% HBP

- Diverse acreage position with exposure to multiple vertical and horizontal plays across the Western Anadarko Basin

- Large geographical footprint enables participation in future development throughout the position

- Active Marchand and Hoxbar permitting pushing west from Grady County / Western Scoop

- Recent permits filed for Prue development in Northwest Washita County

- Low-Decline, Stable Production Base Generates Robust, Positive Cash Flow Profile

- Consistent, long-term production provides confidence in returns and cash flow

- Net Production: about 10 million cubic feet equivalent per day (90% Gas)

- Net Proved Developed Producing (PDP) Reserves: about 41 billion cubic feet equivalent (92% Gas)

- Next 12-Month PDP Cash Flow: about $4.1 million

- Next 12-Month Decline: about 7% (11 years reserves-to-production ratio)

- Steady production from 435 active operated and nonop wells (81 Horizontal)

- 34 Operated PDP wells (Two horizontal | 32 vertical)

- Average roughly 53% Working Interest and 41% Royalty Interest

- 401 Nonop wells (79 horizontal | 322 vertical)

- Average of about 13% Working Interest and 11% Royalty Interest

- Consistent, long-term production provides confidence in returns and cash flow

(Source: PetroDivest Advisors)

Process Summary:

- Evaluation materials available in the Virtual Data Room on May 29

- Bids due June 26

Fairway anticipates signing a purchase and sale agreement by mid-July and closing by August. The company's preference will be given to bids for the entire asset, although offers for subsets of the package will be considered.

For information visit petrodivest.com or contact Ken Reed, director of PetroDivest, at ken@petrodivest.com or 713-595-1016.

Recommended Reading

Ozark Gas Transmission’s Pipeline Supply Access Project in Service

2024-04-18 - Black Bear Transmission’s subsidiary Ozark Gas Transmission placed its supply access project in service on April 8, providing increased gas supply reliability for Ozark shippers.

Scathing Court Ruling Hits Energy Transfer’s Louisiana Legal Disputes

2024-04-17 - A recent Energy Transfer filing with FERC may signal a change in strategy, an analyst says.

Balticconnector Gas Pipeline Will be in Commercial Use Again April 22, Gasgrid Says

2024-04-17 - The Balticconnector subsea gas link between Estonia and Finland was damaged in October along with three telecoms cables.

Targa Resources Ups Quarterly Dividend by 50% YoY

2024-04-12 - Targa Resource’s board of directors increased the first-quarter 2024 dividend by 50% compared to the same quarter a year ago.