The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

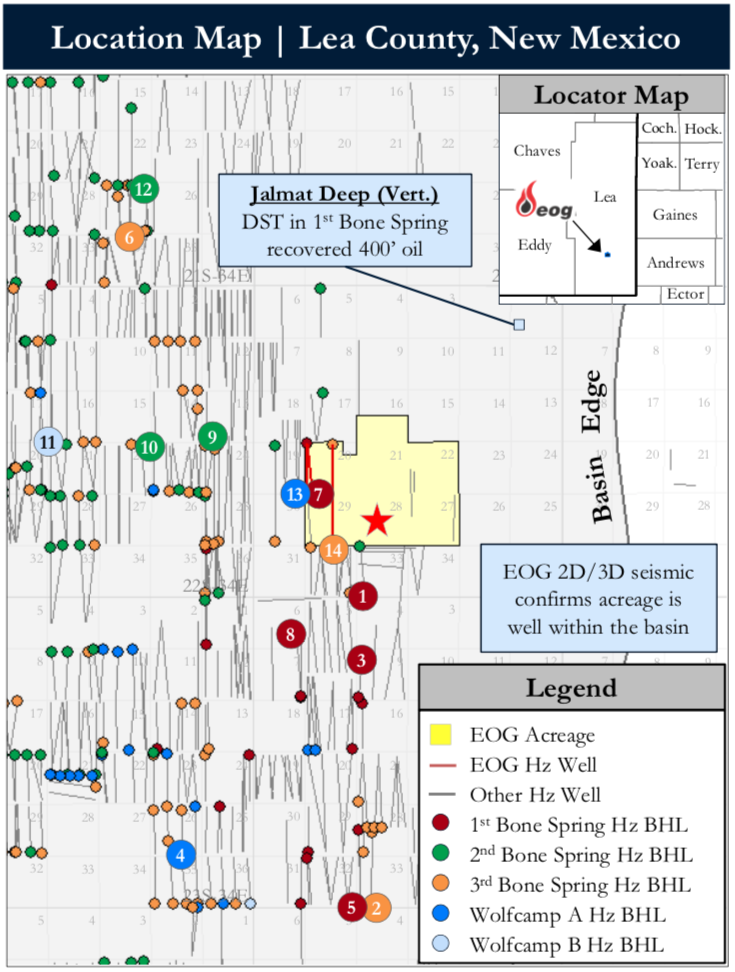

EOG Resources Inc. retained Detring Energy Advisors to market for sale its roughly 3,400 net-acre contiguous and operated position along the eastern region of the northern Delaware Basin in Lea County, N.M.

According to Detring, three operated, producing wells targeting three of the four primary zones have geologically de-risked the position, with substantial economic inventory remaining for development utilizing extended-reach laterals and efficient capital deployment via pad drilling.

Highlights:

- 3,385 net acres

- 100% operated

- About 82% average Working Interest

- Blocky, contiguous position with attractive opportunity for extended 10,000-plus ft laterals

- Efficient Drilling and Completion capital costs due to pad development and shared facilities

- Undeveloped inventory includes 95 gross locations averaging about 10,700 ft lateral length

- Three of four targets proven on-lease and currently productive (Wolfcamp A, 1st/3rd Bone Spring)

- Multiple proven results in the highly economic 2nd Bone Spring bracket the position

- About 340 barrels of oil equivalent per day net production (about 81% liquids)

- Proved Developed Producing (PDP): about $3.4 million Next 12-Month Cash Flow / $14 million PV-10 value

- Total 3P: about $380 million PV-10 value / 75 million barrel of oil equivalents net reserves (PDP plus Undeveloped)

- Roughly 3,850 ft of gross interval (about 2,750 ft Bone Spring / about 1,100 ft Wolfcamp)

- Primary targets include the 1st & 2nd Bone Spring, which generate 60%-75% Internal Rate of Return (IRR)—demonstrated both on-lease by EOG and proximal by offset operators

- Additional upside in the Wolfcamp A and 3rd Bone Spring (30%-40% IRR)

Process Summary:

- Evaluation materials available via the Virtual Data Room on Sept. 9

- Proposals due on Oct. 9

Detring said EOG anticipates executing a purchase and sales agreement by late October, with closing occurring by mid-December.

For information visit detring.com or contact Melinda Faust at mel@detring.com or 713-595-1004.

Recommended Reading

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.

M4E Lithium Closes Funding for Brazilian Lithium Exploration

2024-03-15 - M4E’s financing package includes an equity investment, a royalty purchase and an option for a strategic offtake agreement.

Laredo Oil Subsidiary, Erehwon Enter Into Drilling Agreement with Texakoma

2024-03-14 - The agreement with Lustre Oil and Erehwon Oil & Gas would allow Texakoma to participate in the development of 7,375 net acres of mineral rights in Valley County, Montana.

California Resources Corp. Nominates Christian Kendall to Board of Directors

2024-03-21 - California Resources Corp. has nominated Christian Kendall, former president and CEO of Denbury, to serve on its board.