The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

EnerVest Energy Institutional Fund XIV-1A LP has retained Detring Energy Advisors to market for sale a 15% nonoperated position in its Nora Field assets located in Virginia and West Virginia.

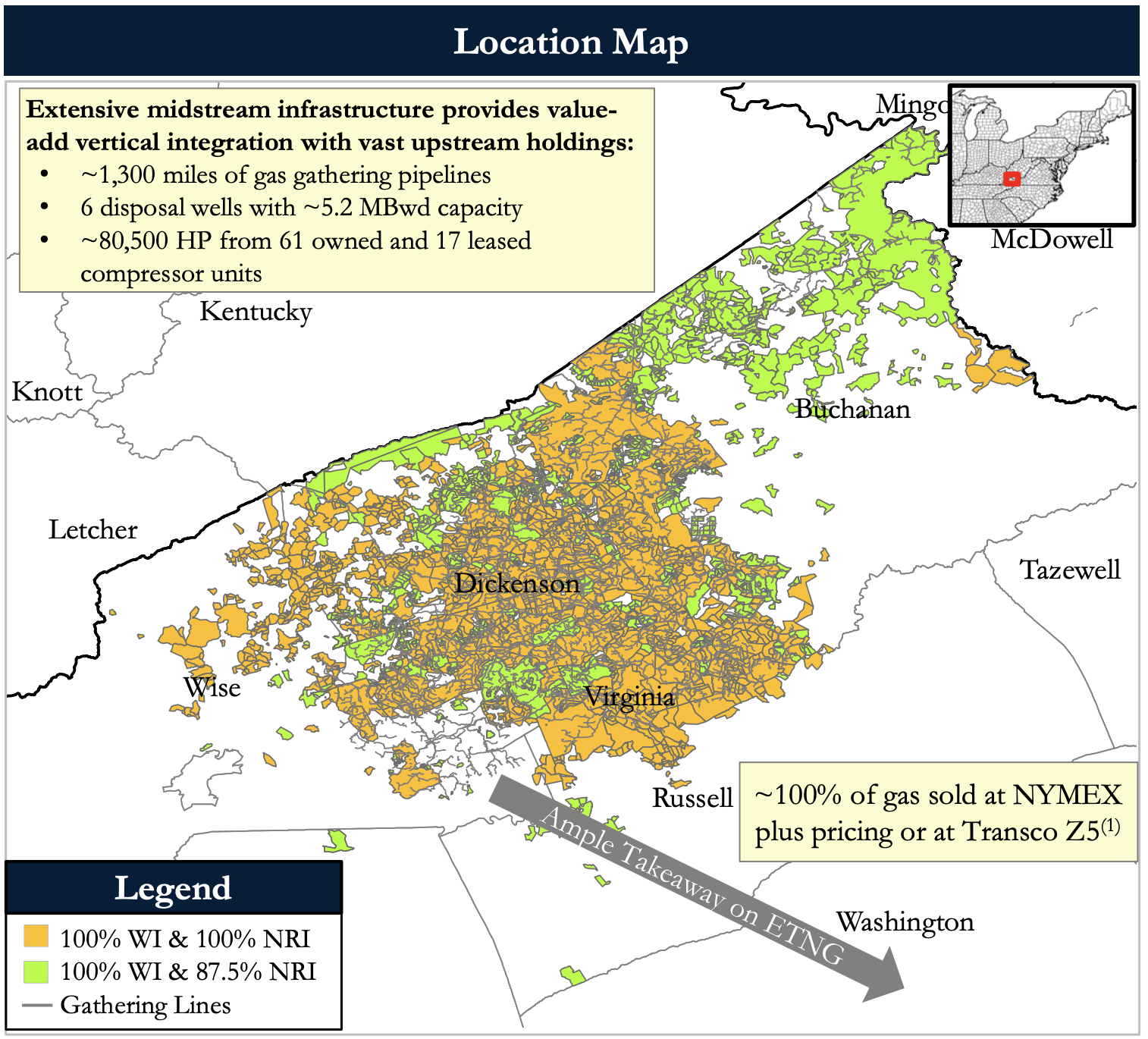

The package includes upstream properties, gathering pipelines, disposal wells and a compressor fleet located in Virginia’s Dickenson, Buchanan, Wise and Russell counties and West Virginia’s Clay and Kanawha counties. Underpinned by strong, shallow-decline production, low royalty burdens, advantaged pricing, and a top conventional operator (EnerVest Ltd.), the asset yields robust and predictable cash flow and provides substantial optionality across the fully HBP position, Detring said.

Highlights:

- 15% nonoperated interest in the highly contiguous Nora Field

- About 54,000 Net Acres (100% HBP)

- EnerVest owns the remaining 85% interest, ensuring alignment of interest

- Significant royalty interests buoy field level economics

- 98% average Net Revenue Interest

- Robust operating cash flow (about $7 million next 12-month PDP)

- Net Production: about 15 MMcf/d (100% gas)

- About 6% annual decline next 12-month

- PDP: $54 million PV-10 value (95 Bcfe net reserves)

- Reserves to Production ratio: 18 years

- Net Production: about 15 MMcf/d (100% gas)

- About 100% of gas sold at plus pricing or at Transco Z5

- Advantageous location for marketing and transportation yields realized pricing of +$0.04 (2020E), +$0.23 (2021E), and +$0.25 (2022E) to Henry Hub

- Extensive midstream infrastructure provides value-add integration with vast upstream holdings

- About 1,300 miles of gas gathering pipelines

- Six disposal wells with roughly 5,200 bbl/d of water capacity

- About 80,500 HP from 61 owned and 17 leased compressor units

- Low risk, repeatable development locations allow for flexible operations

- Drilling 75 wells/year within cash flow holds production flat

- Active workover program of about 35 projects scheduled for 2020

- 2019 program of 56 workovers yielded 200% internal rate of return

- Production from multiple intervals highlights the stacked-pay capabilities of the asset

- Current production from shallow coalbed methane, deeper conventional sands and carbonate intervals, along with the local unconventional horizontal target, the Huron shale

- Partnership with Virginia Tech and the Department of Energy is currently testing new horizons

Process Summary:

- Evaluation materials available via the virtual data room on June 3

- Proposals due July 1

For information visit detring.com or contact Melinda Faust at mel@detring.com or 512-296-4653.

Recommended Reading

For Sale, Again: Oily Northern Midland’s HighPeak Energy

2024-03-08 - The E&P is looking to hitch a ride on heated, renewed Permian Basin M&A.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

Gibson, SOGDC to Develop Oil, Gas Facilities at Industrial Park in Malaysia

2024-02-14 - Sabah Oil & Gas Development Corp. says its collaboration with Gibson Shipbrokers will unlock energy availability for domestic and international markets.

TotalEnergies Acquires Eagle Ford Interest, Ups Texas NatGas Production

2024-04-08 - TotalEnergies’ 20% interest in the Eagle Ford’s Dorado Field will increase its natural gas production in Texas by 50 MMcf/d in 2024.

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.