The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

EnergyNet has been retained by EnerVest Energy Institutional Co-Investment XII-1A LP to offer for sale a 593-well package and leasehold acreage in North Texas through an auction closing June 10.

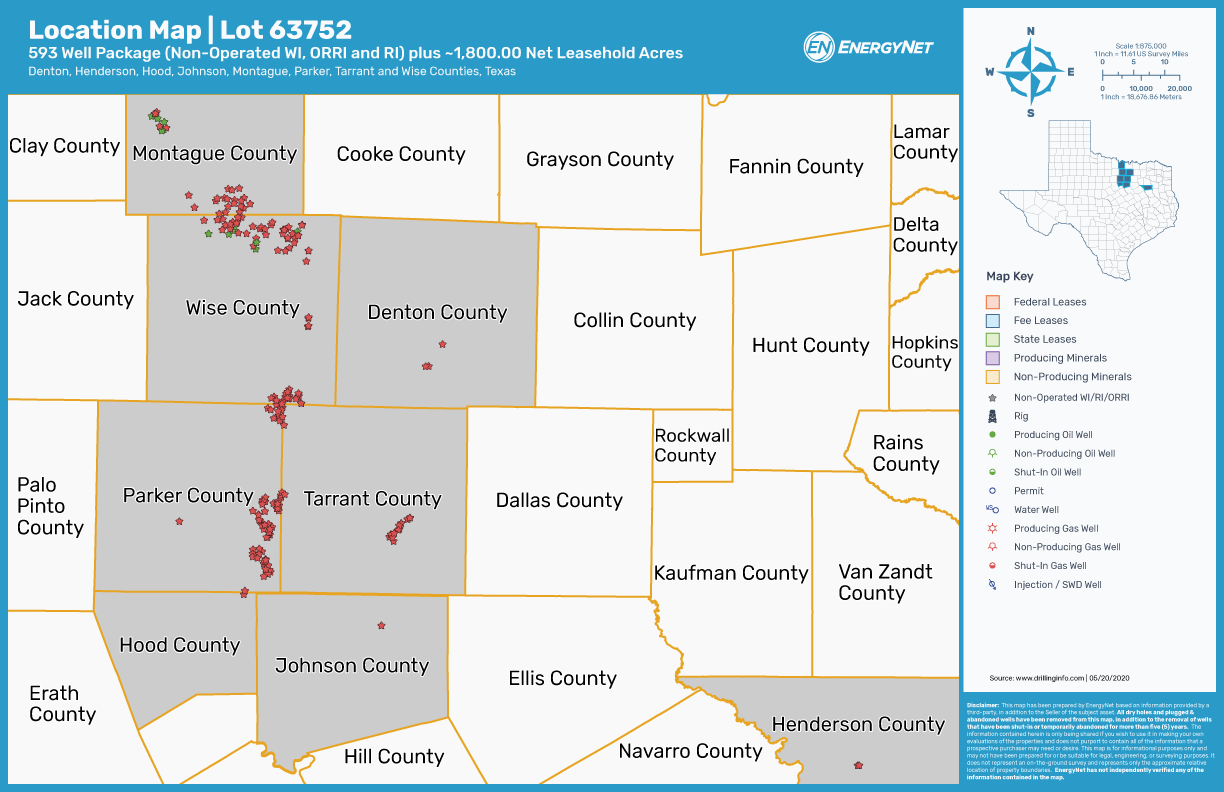

The offering includes nonoperated working interest, overriding royalty interest (ORRI) and royalty interest plus roughly 1,800 net leasehold acres located in Denton, Henderson, Hood, Johnson, Montague, Parker, Tarrant and Wise counties, Texas.

Highlights:

- Nonoperated Working Interest in 514 Wells:

- 12.947% to 0.26712% Working Interest / 10.980382% to 0.206902% Net Revenue Interest (After Payout)

- 415 Producing Wells | 95 Non-Producing Wells | Four Plugged and Abonded Wells

- 83 After Payout Only (Currently in Before Payout Status)

- An Additional ORRI in 43 Wells

- An Additional Royalty Interest in 15 Wells

- An Additional Unleased Mineral Interest in 15 Wells

- Select Operators include Bedrock Production LLC, Devon Energy Production Co. LP and EOG Resources Inc.

- ORRI in 79 Wells:

- 0.478787% to 0.002056% ORRI

- 56 Producing Wells | 23 Non-Producing Wells

- Select Operators including Blackbeard Operating LLC, Eagleridge Operating LLC and XTO Energy Inc.

- Six-Month Average 8/8ths Production: 98.098 MMcf/d of Gas and 172 bbl/d of Oil

- Nine-Month Average Net Cash Flow: $81,091 per Month

- About 1,800.00 Net Leasehold Acres

Bids are due by 1:45 p.m. CT June 10. For complete due diligence information visit energynet.com or email Heidi Epstein, manager of business development, at Heidi.Epstein@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

To Dawson: EOG, SM Energy, More Aim to Push Midland Heat Map North

2024-02-22 - SM Energy joined Birch Operations, EOG Resources and Callon Petroleum in applying the newest D&C intel to areas north of Midland and Martin counties.

Rystad: More Deepwater Wells to be Drilled in 2024

2024-02-29 - Upstream majors dive into deeper and frontier waters while exploration budgets for 2024 remain flat.

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

TotalEnergies Acquires Eagle Ford Interest, Ups Texas NatGas Production

2024-04-08 - TotalEnergies’ 20% interest in the Eagle Ford’s Dorado Field will increase its natural gas production in Texas by 50 MMcf/d in 2024.

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.