The following information is provided by BMO Capital Markets Corp. All inquiries on the following listings should be directed to BMO Capital Markets. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

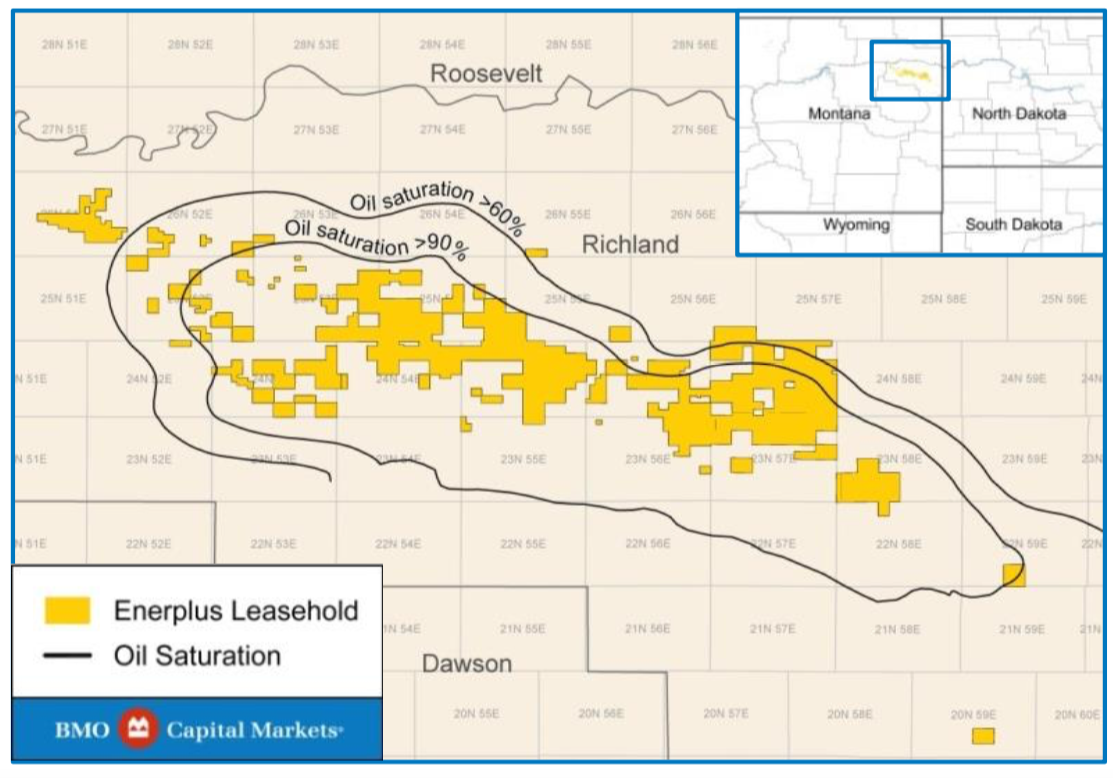

Enerplus Corp. retained BMO Capital Markets for the sale of a largely contiguous Bakken position within the Williston Basin in Montana.

The assets have not been a recent core focus area for Enerplus and the sale represents an area exit for the company, including all rights and depths, according to BMO.

Highlights:

- Opportunity to acquire a largely contiguous, roughly 54,000 net acre position in the heart of the prolific Elm Coulee Field in Montana’s Williston Basin (over 90% HBP)

- Proved developed producing (PDP) net production of 2,684 barrels of oil equivalent per day, 72% oil (June 2019E)

- Low decline rate of about 10%

- Strong PDP cash flow of about $30 million per year (June 2019E annualized) from 329 gross PDP wells not including saltwater disposal well

- Substantial original oil in place, with additional recovery potential from infill wells, refracs and EOR

- Proven potential for improvement in Bakken well performance driven by completion optimization and longer laterals

- Significant refrac potential with modern completion designs; wells historically completed with about 150 pounds per foot

- Cost reduction potential from additional field automation

- Company-owned saltwater disposal infrastructure helps reduce water disposal costs and can support additional volumes from future development or third parties

Data rooms open April 10. For information contact BMO’s Chelsea Neville at enerplus.montana@bmo.com or 713- 546-9703.

Recommended Reading

BP’s Kate Thomson Promoted to CFO, Joins Board

2024-02-05 - Before becoming BP’s interim CFO in September 2023, Kate Thomson served as senior vice president of finance for production and operations.

President: Financial Debt for Mexico's Pemex Totaled $106.8B End of 2023

2024-02-21 - President Andres Manuel Lopez Obrador revealed the debt data in a chart from a presentation on Pemex at a government press conference.

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.

M4E Lithium Closes Funding for Brazilian Lithium Exploration

2024-03-15 - M4E’s financing package includes an equity investment, a royalty purchase and an option for a strategic offtake agreement.