The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

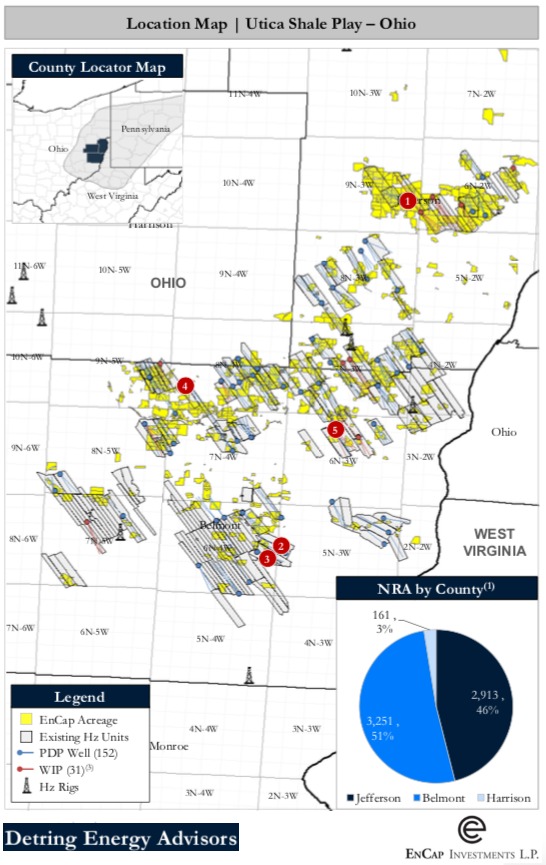

EnCap Investments LP has retained Detring Energy Advisors to market for sale certain of its oil and gas mineral and royalty interests located in Jefferson, Belmont, and Harrison counties, Ohio, within the core of the dry gas Utica Shale play.

The assets offer an attractive opportunity to acquire a concentrated, core position underneath premier Utica-focused operators generating world-class well results and superior economics, according to Detring.

Asset Highlights:

- About 6,325 Net Royalty Acres (at 1/8) | 93% HBP

- Overriding Royalty Interests (ORRI) located throughout the core of the prolific Utica Shale play

- Substantial OGIP across contiguous acreage position and under top operators including Ascent, Gulfport, Hess and XTO

- Significant near-term development potential with about 3,340 net royalty acres (more than 50%) contained within existing horizontal drilling units

- ORRI retained for any leases re-leased within 12 months of expiration

- About $6 million Cash Flow (last 12 months) | About 8 million cubic feet equivalent per day Net Production

- About 150 producing wells with average of about 0.7% Royalty Interest

- Strong on-lease activity averaging more than five wells completed per month (last 12 months), with three rigs currently running and 31 wells in-progress on-lease

- Gross production and revenue of more than 1.5 billion cubic feet per day (Bcf/d) and about $1.5 billion per year, respectively

- Prolific Well Results in Core Utica Dry Gas Window

- EnCap’s position is bracketed by superb well results averaging about 2.4 Bcf per thousand lateral feet (EUR) from the Utica/Point Pleasant Shale

Process Overview:

- Evaluation materials available via the virtual data room on Oct. 15

- Data room presentations available on request

- Proposals due on Nov. 14

For information visit detring.com or contact Melinda Faust at mel@detring.com or 713-595-1004.

Recommended Reading

Marketed: Paloma Natural Gas Eagle Ford Shale Opportunity in Frio County, Texas

2024-02-16 - Paloma Natural Gas has retained EnergyNet for the sale of a Eagle Ford/ Buda opportunity in Frio County, Texas.

Marketed: Onyx Resources 23 Well Package in Texas

2024-03-25 - Onyx Resources has retained EnergyNet for the sale of a 23 well package plus 1,082.81 net leasehold acres in Archer, Clay, Fisher, Jones, Kent, Stephens, Taylor and Young counties, Texas.

Marketed: Williston, Powder River Basins 247 Well Package

2024-03-11 - A private seller has retained EnergyNet for the sale of a Williston and Powder River basins 247 well package in Sheridan, Montana, Burke and McKenzie counties, North Dakota and Campbell County, Wyoming.

Marketed: Anschutz Exploration Six Asset Package in Wyoming

2024-02-26 - Anschutz Exploration Corp. has retained EnergyNet for the sale of six AFE asset packages in Campbell County, Wyoming.

Marketed: Sage Natural Resources 34 Well Package in Tarrant, Wise Counties, Texas

2024-02-02 - Sage Natural Resources retained EnergyNet for the sale of a 34 package (ORRI) in Tarrant and Wise counties, Texas.