The following information is provided by Energy Advisors Group Inc. (EAG), formerly PLS Divestment Services. All inquiries on the following listings should be directed to EAG. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

DXI Energy Inc. has retained Energy Advisors Group Inc. (EAG) to market a multizone NGL expansion project located in the Piceance Basin of Garfield County, Colo. DXI is also seeking a buyer for Dejour Energy (USA) Corp., a wholly owned subsidiary of DXI Energy, as part of a strategic exit of the U.S. market.

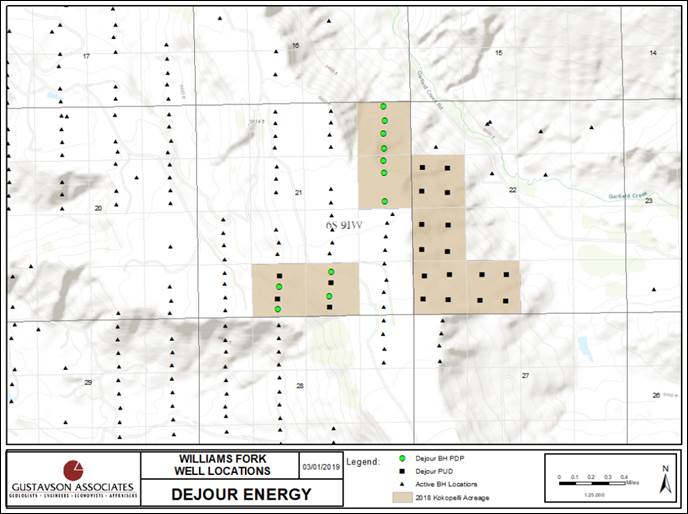

Kokopelli Multi-Zone NGL Expansion Project Overview:

The Kokopelli Project consists of two leases totaling 320 gross acres (68 net) in Garfield Co., Colorado. The project is part of a joint venture operated by Terra Energy Partners LLC. Dejour maintains a nonoperated working interest in the project of 25%-77% with 72%-77% lease net revenue interest between the two leases. Both leases contain a multiwell pad site with existing gross production of nine barrels per day (bbl/d) of oil and 1.316 million cubic feet per day of gas (Net: 1 bbl/d of oil and 187,000 cubic feet per day of gas) during August with a gas-weighted product mix of 74% gas, 21% condensate and 4% oil. Both leases have existing surface facilities and pipeline in place.

Between the two pad sites, there are a total of 13 wells (12 actively producing and one saltwater disposal) producing from the Williams Fork and 1-Mancos Discovery well. The acreage is contiguous and has significant running room for the development of 20 drilling locations engineering by Gustavson Associates. As of Jan. 1, 2019, total proved reserves are projected at about 4.6 billion cubic feet equivalent (Bcfe) with proved developed producing (PDP) net reserves of 981,000 million cubic feet equivalent (MMcfe).

Undeveloped Single Well Performance Metrics

20-Williams Fork Locations:

- EUR: 1,000 million cubic feet (after shrinkage)

- IP: about 1 billion cubic feet per day (Bcf/d)

- Capex: about $1,350,000 (drill, complete, tie-in)

Mancos (Niobrara) Locations:

- EUR: 5,000-7,500 million cubic feet (after shrinkage)

- IP: about 5 Bcf/d

- Capex: $5,500,000-$7,000,000 (drill, complete, tie-in)

Highlights:

- 13 Wells. 20 Locations. About 70 Net Acres

- Williams Fork and Mancos Discovery

- Contiguous Acreage For Horizontal Development

- Multizone NGL Expansion Possible

- Undeveloped IPs: about 1 Bcf/d

- 25%-77% Nonoperated Working Interest (72%-77% Net Revenue Interest)

- Gross Production: 9 bbl/d of Oil and 1.316 MMcf/d

- Net Production: 194,000 cubic feet equivalent per day (94% Gas)

- Existing Surface Facilities and Pipeline In Place

- Third-Party Engineering

- PDP Net Reserves of 981 MMcfe

- Total Proved Net Reserves of about 4.6 Bcfe

- Canadian Seller Exiting U.S. Market

Click here to view the online data room or visit energyadvisors.com/deals to view our other 30-plus assignments. For more information, contact Steve Henrich, director with EAG, at shenrich@energyadvisors.com or 713-600-0123.

Recommended Reading

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

Tech Trends: SLB's Autonomous Tech Used for Drilling Operations

2024-02-06 - SLB says autonomous drilling operations increased ROP at a deepwater field offshore Brazil by 60% over the course of a five-well program.

Seadrill Awarded $97.5 Million in Drillship Contracts

2024-01-30 - Seadrill will also resume management services for its West Auriga drillship earlier than anticipated.

Well Logging Could Get a Makeover

2024-02-27 - Aramco’s KASHF robot, expected to deploy in 2025, will be able to operate in both vertical and horizontal segments of wellbores.

Remotely Controlled Well Completion Carried Out at SNEPCo’s Bonga Field

2024-02-27 - Optime Subsea, which supplied the operation’s remotely operated controls system, says its technology reduces equipment from transportation lists and reduces operation time.