The following information is provided by Eagle River Energy Advisors LLC. All inquiries on the following listings should be directed to Eagle River. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

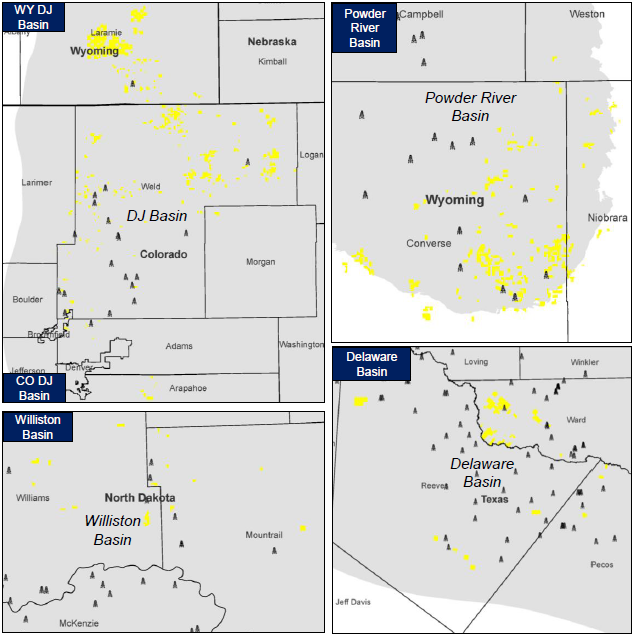

Lincoln Energy Partners retained Eagle River Energy Advisors LLC for the divestiture of mineral interests across the Denver-Julesburg (D-J), Powder River, Williston and the Permian's Delaware basins.

The offering includes assets in Colorado, North Dakota, Texas and Wyoming.

Highlights:

- About 24,650 net royalty acres diversified across five active plays (57% HBP)

- 945 producing wells provide low-risk and stable cash flow profile

- About 300 barrels of oil equivalent per day (boe/d) net production (57% Oil)

- About $182,800 monthly net cash flow (six-month average)

- Significant remaining reserves across all Basins with stacked pay potential

- More than 150 new wells drilled per year on Seller's assets since 2017 demonstrating significant activity

- Highly probable near-term development and associated cash flow uplift with 220 DUC and 1,516 Permitted Wells

- Active portfolio operators include Occidental Petroleum Corp., PDC Energy Inc., Extraction Oil and Gas Inc., Chesapeake Energy Inc., Noble Energy Inc. and others

- Portfolio operators actively permitting and drilling with 151 of 322 active drilling rigs in the Basins

Bids are due March 12. Virtual data room available starting Feb. 11. The transaction is expected to have a Jan. 1 effective date.

For information visit eagleriverholdingsllc.com or contact Austin McKee, managing director of Eagle River, at AMcKee@EagleRiverEA.com or 303-832-5128.

Recommended Reading

For Sale, Again: Oily Northern Midland’s HighPeak Energy

2024-03-08 - The E&P is looking to hitch a ride on heated, renewed Permian Basin M&A.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

Gibson, SOGDC to Develop Oil, Gas Facilities at Industrial Park in Malaysia

2024-02-14 - Sabah Oil & Gas Development Corp. says its collaboration with Gibson Shipbrokers will unlock energy availability for domestic and international markets.

E&P Highlights: Feb. 16, 2024

2024-02-19 - From the mobile offshore production unit arriving at the Nong Yao Field offshore Thailand to approval for the Castorone vessel to resume operations, below is a compilation of the latest headlines in the E&P space.

TotalEnergies Acquires Eagle Ford Interest, Ups Texas NatGas Production

2024-04-08 - TotalEnergies’ 20% interest in the Eagle Ford’s Dorado Field will increase its natural gas production in Texas by 50 MMcf/d in 2024.