The following information is provided by RedOaks Energy Advisors LLC. All inquiries on the following listings should be directed to RedOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Dale Operating Co. has retained RedOaks Energy Advisors as its exclusive adviser in connection with the sale of its Delaware Basin minerals position in New Mexico and West Texas.

Highlights

- 930 Net Royalty Acres (normalized to 1/8th)

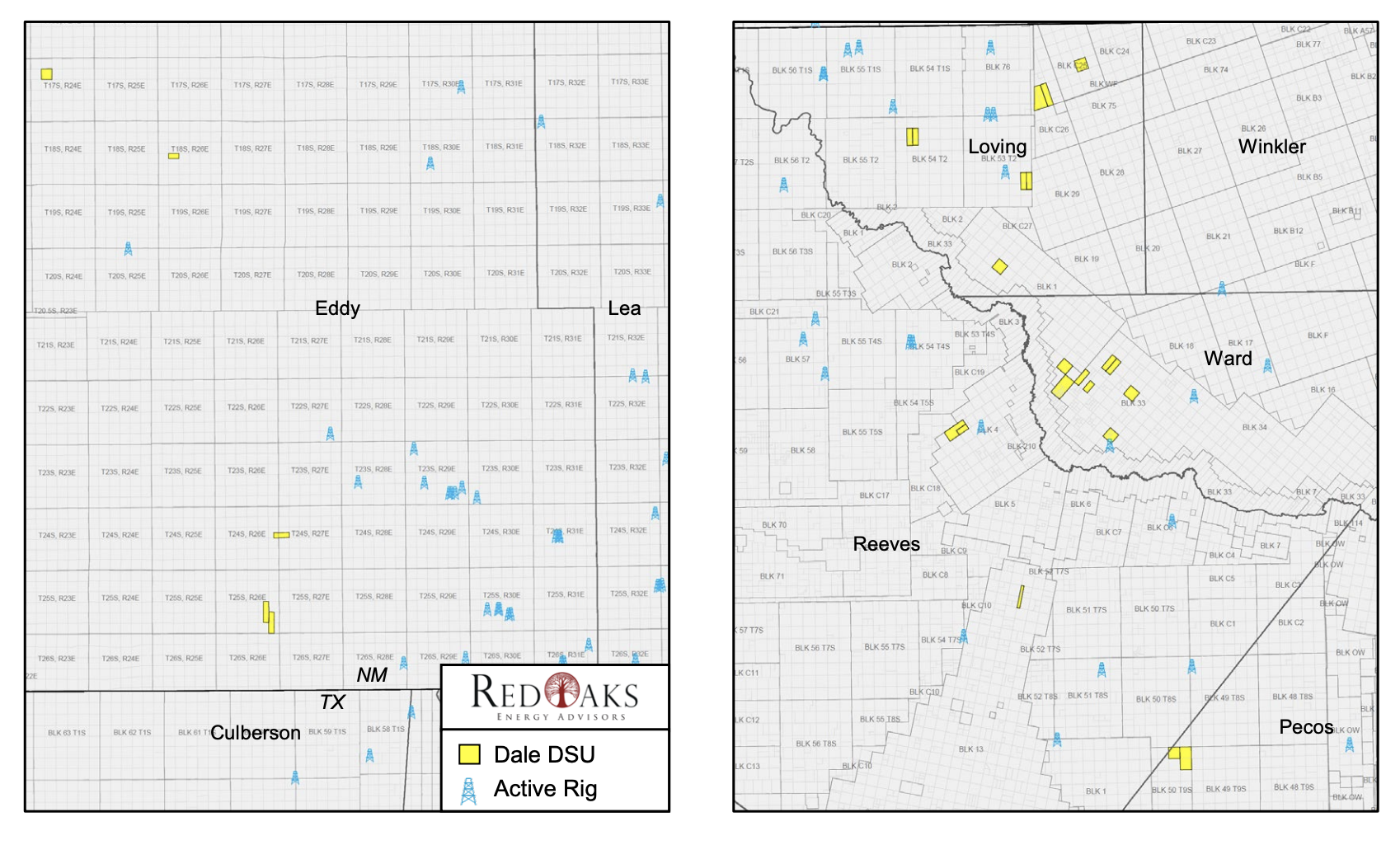

- Location: New Mexico's Eddy County and Loving, Ward, Reeves and Pecos counties, Texas

- Significant cash flow: $57,000 per month (2020 average)

- PDP PV-10: $2.5 million

- 50 producing horizontal wells | 21 DSUs

- Key Operators: EOG Resource Inc., Concho Resources Inc., Cimarex Energy Co. and Mewbourne Oil Co.

Bids are due Dec. 17. For information visit redoaksenergyadvisors.com or contact Will McDonald, associate of RedOaks, at Will.McDonald@redoaksadvisors.com or 214-420-2338.

Recommended Reading

US Drillers Add Most Oil, Gas Rigs in a Week Since September

2024-03-15 - The oil and gas rig count, an early indicator of future output, rose by seven to 629 in the week to March 15.

US Drillers Cut Oil, Gas Rigs for the First Time in Three Weeks

2024-03-08 - The oil and gas rig count, an early indicator of future output, fell by seven to 622 in the week to March 8, the lowest since Feb. 16.

US Drillers Add Oil, Gas Rigs for First Time in Five Weeks

2024-04-19 - The oil and gas rig count, an early indicator of future output, rose by two to 619 in the week to April 19.

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2024-02-02 - Baker Hughes said U.S. oil rigs held steady at 499 this week, while gas rigs fell by two to 117.

US Drillers Add Oil, Gas Rigs for Third Time in Four Weeks

2024-02-09 - Despite this week's rig increase, Baker Hughes said the total count was still down 138 rigs, or 18%, below this time last year.