The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

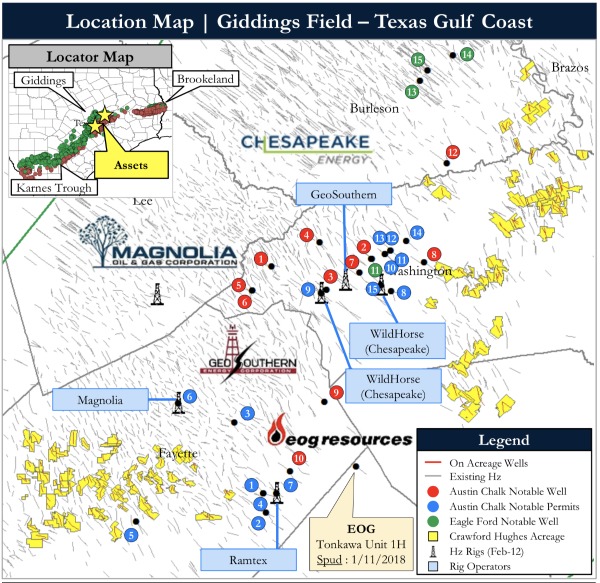

Crawford Hughes Operating Co. has retained Detring Energy Advisors to market for sale certain oil and gas producing, leasehold and related assets located in the Austin Chalk and Eagle Ford fairways of the established Giddings Field.

The assets offer an attractive opportunity to acquire a position on-trend with recent prolific well results by top regional operators, according to Detring.

Asset Highlights:

- 43,700 Net Acres – 100% HBP

- High average working interest (90%) and nets (75%) across majority of position

- Acreage contained entirely within the Austin Chalk fairway with activity pressing northeast and southwest toward the assets

- Contiguous and operated position ideal for extended laterals and pad development

- Roughly 18,000 net acres with Eagle Ford rights (50/50 joint development agreement with Apache Corp.)

- World-Class Austin Chalk Well Results

- Following success in the B interval, operators are now targeting the Austin Chalk A zone with multiple results more than 1,500 barrels of oil equivalent per day (boe/d) or more than 300 boe/d per Mft

- Multiple offset well results and permits by Magnolia Oil & Gas (EnerVest), Chesapeake Energy (WildHorse Resource Development), GeoSouthern Energy, EOG Resources and others

- Superb well control and log data provide a strong geologic understanding of regional development and well results

- Thermally mature, high total organic carbon (TOC)

- Localized Eagle Ford upside

- Giddings Field horizontal spuds and permits up about 15 to 20 times over a two-year period, including prolific results in both the Austin Chalk and Eagle Ford

- Following success in the B interval, operators are now targeting the Austin Chalk A zone with multiple results more than 1,500 barrels of oil equivalent per day (boe/d) or more than 300 boe/d per Mft

- About 2.8 million cubic feet equivalent per day Net Production – 6% Annual Decline

- Low-decline production base (26% liquids)

- $11 million Proved Developing Producing (PDP) PV-10 value

- $2.3 million next 12 months operating cash flow (PDP only)

Process Overview:

- Evaluation materials available via the Virtual Data Room on Feb. 25

- Proposals due March 27

For information visit detring.com or contact Melinda Faust at mel@detring.com or 713-595-1004.

Recommended Reading

Mexico Pacific Appoints New CEO Bairstow

2024-04-15 - Sarah Bairstow joined Mexico Pacific Ltd. in 2019 and is assuming the CEO role following Ivan Van der Walt’s resignation.

Global Partners Declares Cash Distribution for Series B Preferred Units

2024-04-15 - Global Partners LP announced a quarterly cash dividend on its 9.5% fixed-rate Series B preferred units

W&T Offshore Adds John D. Buchanan to Board

2024-04-12 - W&T Offshore’s appointment of John D. Buchanan brings the number of company directors to six.

73-year Wildcatter Herbert Hunt, 95, Passes Away

2024-04-12 - Industry leader Herbert Hunt was instrumental in dual-lateral development, opening the North Sea to oil and gas development and discovering Libya’s Sarir Field.

Riley Permian Announces Quarterly Dividend

2024-04-11 - Riley Exploration Permian’s dividend is payable May 9 to stockholders of record by April 25.