The following information is provided by Energy Advisors Group Inc. (EAG), formerly PLS Divestment Services. All inquiries on the following listings should be directed to EAG. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

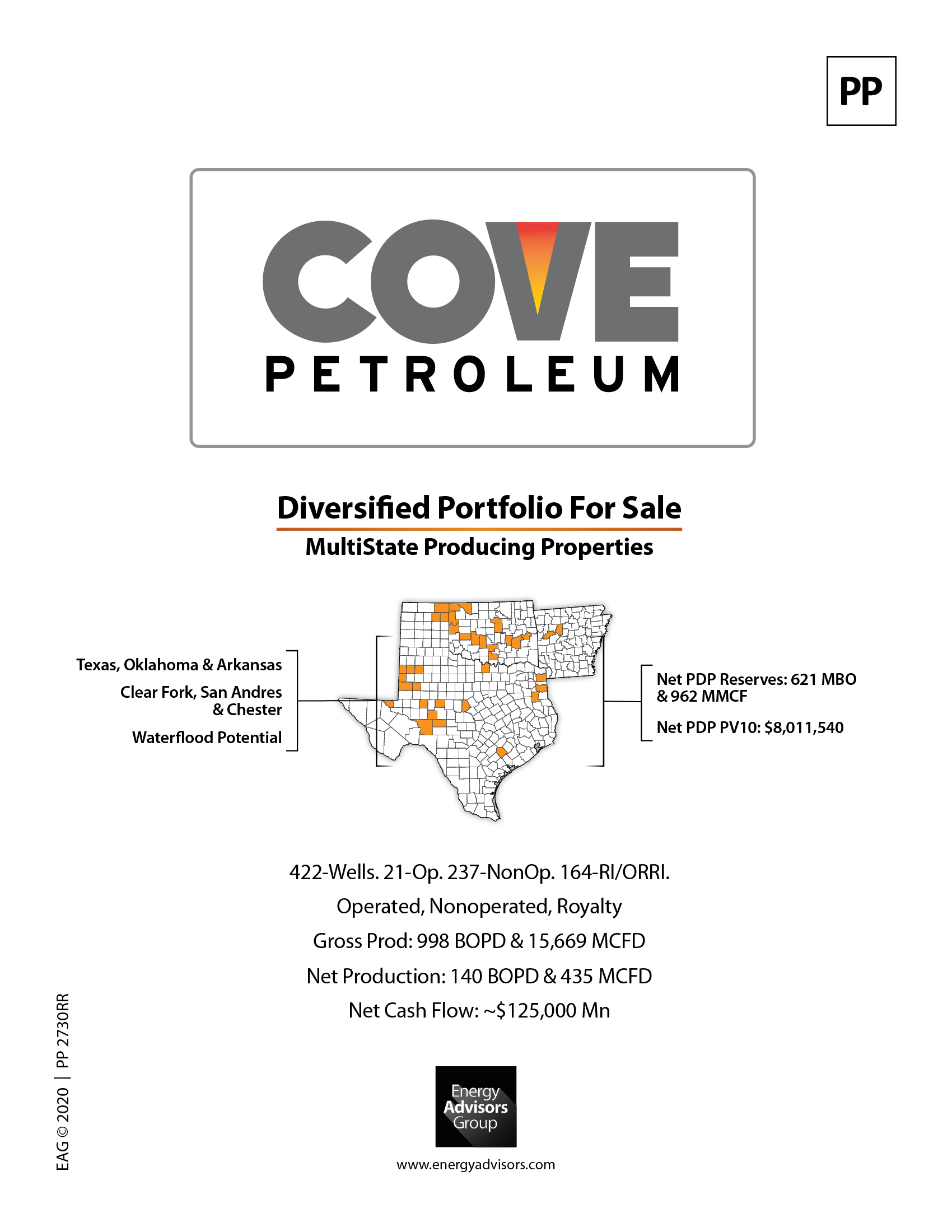

Energy Advisors Group Inc. (EAG) has been retained by Cove Petroleum Corp. to assist in marketing its entire portfolio of operated and nonoperated working interests plus royalty and overriding royalty interests in 422 wells, mainly in Texas and Oklahoma.

The portfolio encompasses 422 wells, consisting of 21 operated, 237 nonoperated and 164 royalty and override interest wells. The operated wells are concentrated in Hockley and Lubbock counties, Texas, and all produce from the Clear Fork Formation, a proven secondary recovery reservoir via waterflood. The upper or northern Permian Basin assets include both operated and nonoperated working interests and some with royalty and overriding royalty interests. In addition, some of the wells have both working and royalty interest ownership.

This package is a multistate producing portfolio which includes three major oil and gas states being Texas, Oklahoma and Arkansas. There are 76 different operators whose wells are producing with long life and shallow decline reservoirs.

Highlights:

- All Cove-operated properties have Waterflood Potential

- Various wells in the West Broadview Field potentially have some pressure support from the adjacent West Broadview Unit

- Deep potential may exist in the Smyer field assets (Seismic to be shot in first quarter)

- Overriding Royalty Interest in Ward County, Texas.

- One Horizontal well (UL Kerwin A 18-12 #7101H) recently drilled

- Thus Additional Wolfcamp Horizontal wells are expected

- Potential for Bone Springs Horizontal development as well

- Undeveloped Minerals

- Cove owns Mineral Interest in Sec 16-6N-9W; Caddo County, Okla.

- Multi-unit Horizontal application by Zarvona Energy LLC currently in OCC and continued to June 23, 2020.

- Cash flow of $1.5 million to $1.9 million annually

- Minimal number of inactive properties

Texas Producing Properties, (Operated, Nonoperated and Overrides/Royalty Interests)

- 22-Counties. More than 230 Wells

- Panhandle; Permian; North Texas; East Texas

- Operated Properties Have Proven Waterflood Potential

- Gross Production From The Texas Assets: 887 barrels per day (bbl/d) of Oil and 3.626 million cubic feet per day (MMcf/d) of Gas

- Net Production From Texas: 140 bbl/d of Oil and 216,000 cubic feet per day of Gas

- Key Texas Positions:

- Permian (Cochran, Dawson, Gaines, Dawson, Hockley and Lubbock counties)

- East Texas (Rusk, Harrison and Cass counties)

- Panhandle/North Texas (Coke and Ochiltree counties)

- South Texas (Lavaca County)

Oklahoma Producing Properties (Mostly Nonoperated Working Interest)

- 14 counties. More than 120 Wells

- Anadarko and Arkoma Basins

- Beaver, Carter, Pittsburgh and Roger Mills Counties

- Gross Production From Oklahoma: 109 bbl/d of Oil and 9.169 MMcf/d of Gas

- Net Production From The Oklahoma Assets: 3 bbl/d of Oil and 204,000 cubic feet per day of Gas

- Key Oklahoma Plays and Positions:

- Stack/Scoop Play

- Oklahoma Panhandle

The seller also owns small interests in Arkansas, Colorado and Louisiana.

Purchasers of operated working interest should note that this sales package will include some wells applicable for waterflood including interests around the West Broadview Unit.

Click here to view the online data room or visit energyadvisors.com to view our other assignments.

For more information, contact Blake Dornak, A&D director for EAG, at bdornak@energyadvisors.com or 713-600-0169.

Recommended Reading

What's Affecting Oil Prices This Week? (April 15, 2024)

2024-04-15 - While concerns about the stability of oil supply are increasing, Stratas Advisors does not expect oil supply to be disrupted – unless there is further escalation in the Middle East.

What's Affecting Oil Prices This Week? (Feb. 26, 2024)

2024-02-26 - Stratas Advisors forecast that global crude production will be essentially unchanged from 2023, which means that demand growth in 2024 will outpace supply growth.

Oil Dips as Demand Outlook Remains Uncertain

2024-02-20 - Oil prices fell on Feb. 20 with an uncertain outlook for global demand knocking value off crude futures contracts.

Oil Prices Edge Lower on False Report of Israeli Ceasefire, Sustained OPEC Cuts

2024-02-01 - Oil prices fell 2% on the false speculation that Israel and Hamas had tenatively agreed to a ceasefire, but losses were subsequently pared.

Oil Rises After OPEC+ Extends Output Cuts

2024-03-04 - Rising geopolitical tensions due to the Israel-Hamas conflict and Houthi attacks on Red Sea shipping have supported oil prices in 2024, although concern about economic growth has weighed.